EUR/USD, EUR/GBP and GBP/USD drop despite rising UK consumer confidence

Outlook on EUR/USD, EUR/GBP and GBP/USD ahead of Jackson Hole Fed and ECB speeches.

EUR/USD drops further still

EUR/USD's decline from its $1.1275 July peak has taken it to below the 200-day simple moving average (SMA) at $1.0805 to the March-to-August tentative uptrend line at $1.077 ahead of Jerome Powell and Christine Lagarde’s key speeches at Jackson Hole today.

Were the tentative uptrend line not to hold, the May trough at $1.0636 would be back in the frame as the greenback continues to appreciate to new 2 /12 month highs.

Minor resistance above the 200-day SMA at $1.0805 can be found at the $1.0834 July low.

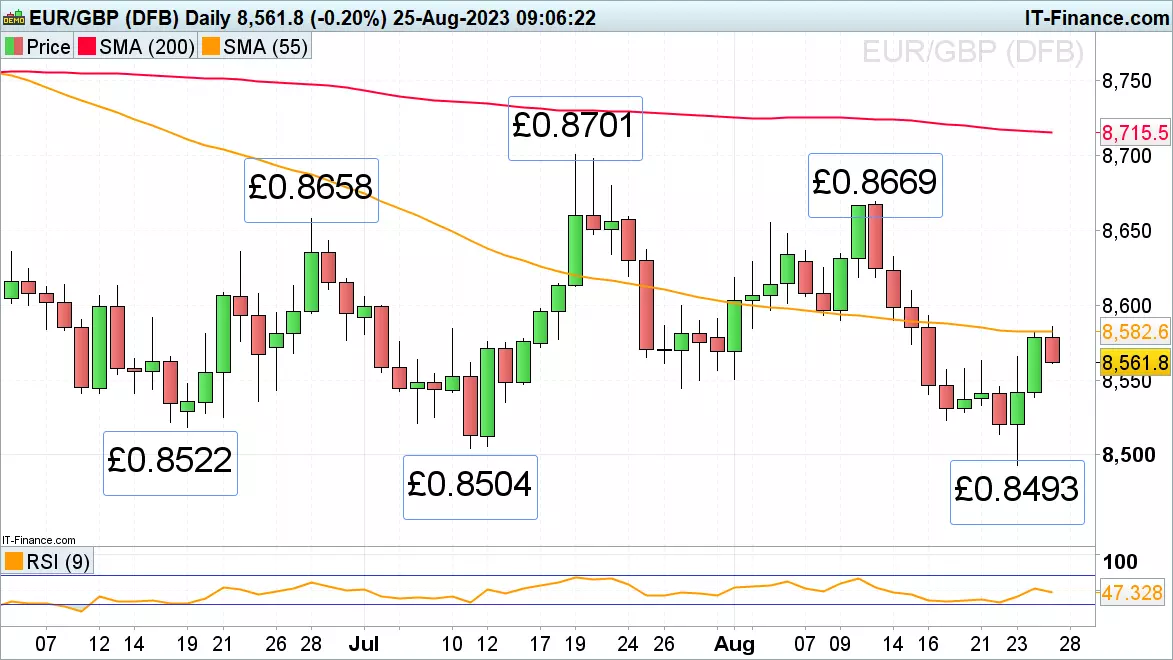

EUR/GBP recovery off one-year low runs out of steam

EUR/GBP's recovery from this week’s one-year low at £0.8493 on weak Eurozone and not much stronger UK flash purchasing managers index (PMI) data for August, has taken it to the 55-day SMA at £0.8582 which capped it earlier today, though.

The cross is seen falling once more as UK consumer confidence came in better-than-expected and as investors sell the euro ahead of the European Central Bank (ECB) Christine Lagarde’s speech at Jackson Hole.

Minor support may be found around the mid-August low at £0.8524 ahead of key support at the £0.8522 to £0.8504 June and July lows.

GBP/USD drops to two-month low despite rising UK consumer confidence

GBP/USD's decline from its $1.3142 July peak is accelerating to the downside despite a marked improvement in UK consumer confidence in August when it hit -25 versus -30 in July and a forecast of -29.

The strength in the US dollar ahead of Jerome Powell’s speech at the Jackson Hole symposium today thwarts any recovery attempt by the British pound with GBP/USD dropping to two-month lows. The early June high at $1.2544 has practically been hit, a fall through which would engage the minor psychological $1.25 mark. Below it meanders the 200-day SMA at $1.2401.

Minor resistance is seen at previous support, namely between the early- and mid-August lows at $1.2617 to $1.2621. Further up sits the $1.2679 May peak.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.