JD Wetherspoon earnings preview: sales recover but costs remain high

Upcoming earnings from JD Wetherspoon are likely to see strong sales growth, but the problem of rising costs remains.

Q3 earnings likely to see higher sales but rising costs

Pub chain JD Wetherspoon is set to report third-quarter (Q3) earnings this week against a backdrop of rising costs that are overshadowing a recent revival in sales. Despite seeing a jump in revenues, chairman Tim Martin has warned that elevated energy and labour expenses continue to weigh heavily on the business.

JD Wetherspoon shares struggle due to lack of dividend

Shares of the FTSE 250-listed company have fallen around 9% year-to-date as investors remain discouraged by slowing sales growth and Wetherspoon's lack of a dividend payment since 2019. The absence of capital returns has dampened sentiment despite the firm's efforts to bounce back from pandemic disruptions.

Cost pressures cloud outlook

While higher sales provide some relief, Martin has stressed that soaring utility bills and wage inflation are hampering profitability across Wetherspoon's nationwide pub network. The company continues to grapple with elevated operating costs that are disrupting earnings recovery.

All eyes will be on Wetherspoon's ability to pass through price increases to consumers when it reports Q3 results this week. However, persistent cost headwinds may limit near-term upside for the beleaguered pub operator's shares amid a still-challenging operating landscape.

Analyst ratings for JD Wetherspoon

LSEG Refinitiv data shows a consensus analyst rating of ‘hold’ for JD Wetherspoon with 2 strong buy, 3 buy and 7 hold – and a mean of estimates suggesting a long-term price target of 879.55 pence for the share, roughly 20% higher than the current price (as of 7 May 2024).

Technical outlook on the JD Wetherspoon share price

JD Wetherspoon’s share price has been oscillating between its 200-week simple moving average (SMA), now at 833.60 pence, and its 55-week SMA at 726.5p since the beginning of the year with the latter likely to be revisited for the eights consecutive week.

The major pub company’s share price has been hovering above its mid-March 712.0p low ever since, a fall through which would put the 2022-to-2024 uptrend line at 700.0p on the map.

JD Wetherspoon Weekly Candlestick Chart

For the JD Wetherspoon’s share price to break out of its near three-month sideways trading range and do so to the upside, a rise and daily chart close above the 12 April peak at 770.0p would need to occur. Only then would the February high at 862.5p be back in play. If then also overcome, the December 2020 low and the January 2022 high at 960.0p to 989.5p would be back in sight.

JD Wetherspoon Daily Candlestick Chart

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

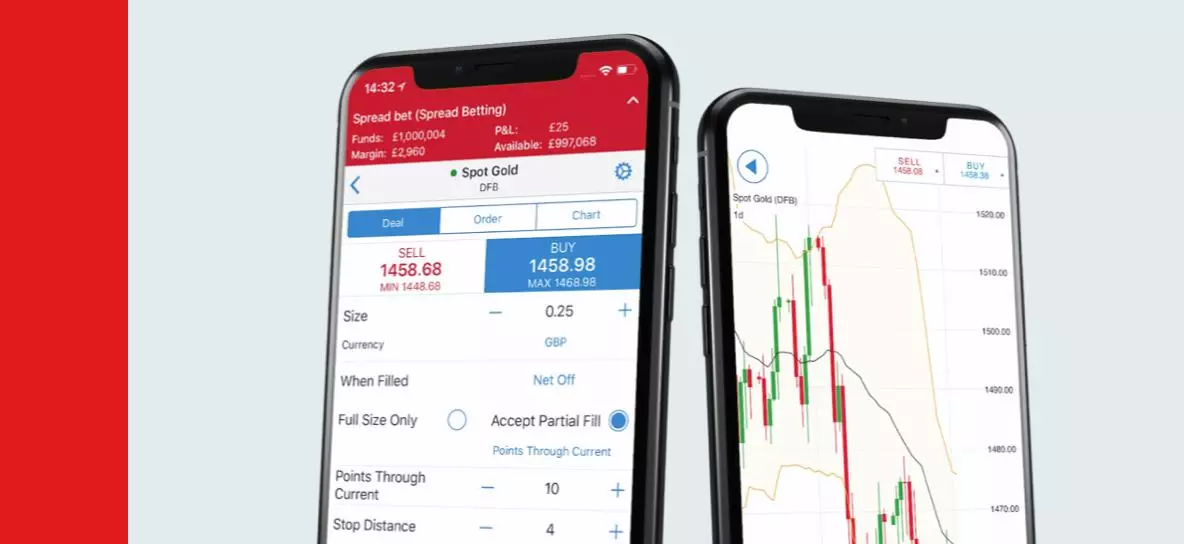

See your opportunity?

Seize it now. Trade over 15,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.