Sainsbury's: Confident Outlook with Strategies for Growth

Expanding Consumer Spending in Key Categories.

Sainsbury's: Confident Outlook with Strategies for Growth

Sainsbury's is gearing up for its next earnings update on the 25 of April with a confident tone set by its recent capital markets day in February. The company is poised to report continued sales growth, driven by its strategic initiatives and ongoing cost-reduction efforts.

Expanding Consumer Spending in Key Categories

One of Sainsbury's primary focuses is to build consumer spending in the frozen food and household chemicals categories, where it currently underperforms compared to its competitors. The company recognises the growth potential in these areas and aims to leverage its strengths to gain market share.

Fresh Food: Capitalising on Existing Strength

While expanding its presence in frozen foods and household chemicals, Sainsbury's will also continue to build upon its strength in the fresh food category. The company has established a reputation for offering high-quality fresh produce, meat, and bakery items, and it plans to further enhance its offerings in this domain.

Leveraging the Nectar Loyalty Program

Sainsbury's has been effectively utilising its Nectar loyalty program to drive customer engagement and build market share. Through targeted promotions and personalised offers, the Nectar program has proven to be a powerful tool in attracting and retaining customers.

New Store Construction and Expansion

To further bolster its presence across the United Kingdom, Sainsbury's is embarking on a new wave of store construction. The company has identified areas where it has a low market share and aims to establish a stronger foothold by opening new stores in these regions.

Cost Reductions and Operational Efficiency

Alongside its growth strategies, Sainsbury's remains committed to ongoing cost reductions and operational efficiency. The company recognises the importance of streamlining processes and optimising its supply chain to maintain a competitive edge in the highly competitive grocery market.

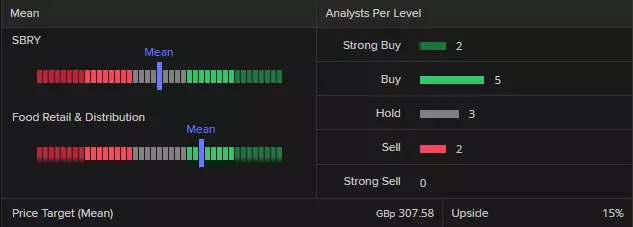

Analysts recommendations and IG sentiment

Fundamental analysts are rating Sainsbury’s as a ‘buy’ with Refinitiv data showing 2 strong buy, 5 buy, 3 hold and 2 sell - with the mean of estimates suggesting a long-term price target of 307.58 pence for the share, roughly 15% above the share’s current price (as of 22 April 2024).

IG sentiment data shows that 90% of clients with open positions on the Sainsbury’s share expect the price to rise over the near term while 10% of clients expect it to fall. This week saw 50% of IG clients (sample size of between 251 and 500) buy the Sainsbury’s share but over the course of this month 64% sold it.

Technical analysis on Sainsbury’s share price

The Sainsbury’s share price, down around 10% year-to-date, compared to the FTSE 100’s near 4% gains, trades back around the lower end of its 2023-to-2024 sideways trading band.

Sainsbury’s Weekly Chart

At the beginning of March the Sainsbury’s share price revisited its October 2023 low at 243.8p which, together with the 200-week simple moving average (SMA) at 249.1p, acted as support and held.

The early-March to early-April advance ran out of steam along the 55-week SMA though, when the share topped out at 274.2p before slipping to last week’s low at 254.8p amid general risk-off sentiment due to heightened tensions in the Middle East.

Sainsbury’s Daily Chart

For the Sainsbury’s share price to resume its March-to-April bounce, not only the 200-day SMA at 269.4p but also the late-March peak at 274.2p will need to be exceeded on a daily chart closing basis. Only then would the May and July 2023 highs at 290.2p to 291.0p be back in the picture. Further up sits the January peak at 309.0p.

Were last week’s low at 254.8p to give way, the March and October 2023 and March 2024 lows at 245.2p to 243.8p would be back in the frame. This area represents significant long-term support for the Sainsbury’s share price and isn’t expected to be fallen through.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.