“Saudi is key to mid-east politics and oil prices”

Oil is broadly holding the gains that came through after the weekend attacks on Israel. Bill Blain from Shard Capital says Saudi Arabia is key to the region and so to oil market pricing.

The recent attacks by Hamas on Israel

The recent attacks by Hamas on Israel have caused the price of oil to go up. This is because people are worried that the conflict could disrupt the supply of oil. However, the increase in price is mainly because of the risk of more violence, not because there is actually less oil available. This is important because it could affect the relationship between Saudi Arabia and Israel.

Saudi Arabia

Saudi Arabia is a big player in the oil market. They have to decide if they want to keep supporting Russia's effort to raise oil prices or if they should bring them down to avoid more conflict. This decision is crucial because Saudi Arabia is seen as the leader of the Arab world. If they make the wrong choice, they could upset other Arab countries. This is especially important because some people think Iran was behind the attack.

Oil prices

The market has been reacting to the situation. Oil prices went up a lot on Friday, but they went down a little bit today. Despite this, the prices are still higher than they were before the attacks. There are also concerns that the supply of oil could get tighter because of the situation. As people watch what happens next, the focus is on the people who are suffering because of the attacks. Families and individuals are experiencing losses and it is a tragic situation.

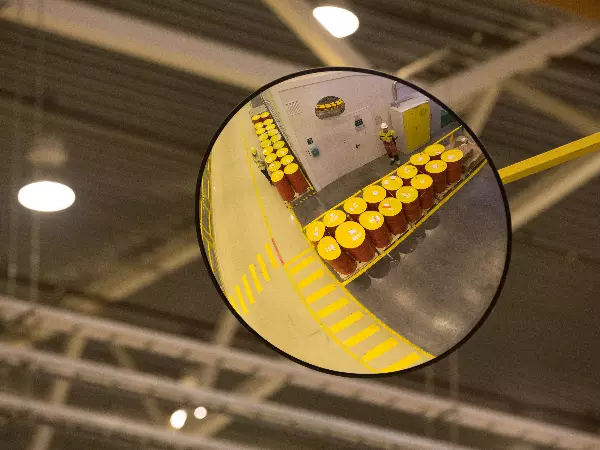

The supply of oil

Overall, the recent attacks in the Middle East have caused oil prices to go up. The main reason for this is the fear that the conflict could disrupt the supply of oil. Saudi Arabia, as a key player in the oil market, has a difficult decision to make about whether to support Russia's effort to raise prices or bring them down to avoid more conflict. The market has reacted to the situation, with prices going up and then slightly down, but still higher than before the attacks. The focus now is on the people who are suffering because of the attacks.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

React to volatility on commodity markets

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.1

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

1In the case of all DFBs, there is a fixed expiry at some point in the future.

See opportunity on a commodity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on a commodity?

Don’t miss your chance. Upgrade to a live account to take advantage.

- Analyse and deal seamlessly on fast, intuitive charts

- Get spreads from just 0.3 points on Spot Gold

- See and react to breaking news in-platform

See opportunity on a commodity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.