UK general election - outlook for FTSE 100, FTSE 250 and sterling as Labour takes office

What challenges and opportunities lie ahead for the UK economy, currency and stock market, as new government takes office?

UK wakes up to a new government

The UK general election in 2024 resulted in a landslide victory for the Labour Party, led by Keir Starmer. In a dramatic shift from the previous election, Labour secured 410 seats, while the Conservative Party experienced a substantial loss, reducing their representation to just 119 seats. This outcome marks a significant change in the UK's political landscape, ending the Conservatives' 14-year tenure in government.

Result much as expected – market reaction muted

Financial markets had largely anticipated this result, leading to relatively subdued initial reactions. The British pound saw a slight increase against the dollar, continuing its recent upward trend. Gilt yields experienced a small decline, with both short-term and long-term rates easing.

The FTSE 100 index opened higher, with notable gains in construction-related stocks, suggesting some optimism about the potential impact of Labour's policies on the housing sector.

Challenges lie ahead

While the new government faces significant fiscal challenges, there may be opportunities to generate extra funding in the short term through tweaks to the tax system.

The UK economy may see slightly stronger near-term growth and higher inflation under a Labour majority. The mid-cap FTSE 250, more focused on the UK economy than its bigger peer the FTSE 100, may do better in this environment.

In the short-term, a rate cut from the Bank of England (BoE) may deliver a weaker pound, although an August cut is widely-expected. Longer-term, the pound’s fate lies more in the hands of central bank officials in London and Washington than it does in Whitehall.

Overall, while the election result represents a significant political shift, the immediate market reaction has been relatively muted. Markets are now focusing on the economic challenges and opportunities that lie ahead for the new Labour government, including how they will address fiscal issues, stimulate growth, and navigate the complex economic landscape they've inherited.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

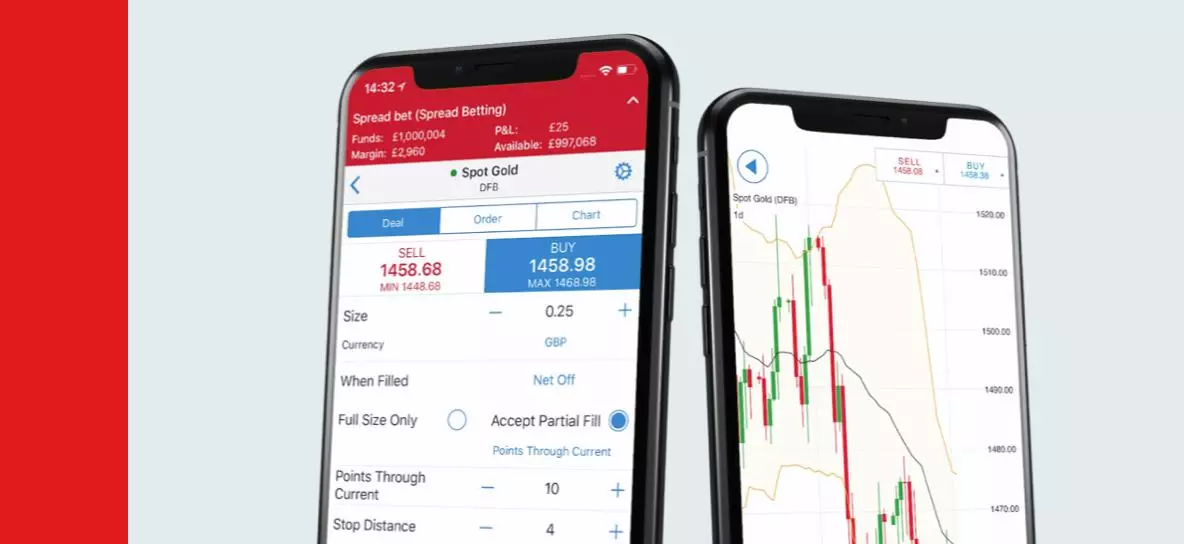

See your opportunity?

Seize it now. Trade over 15,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.