Amazon shares: outlook threatened by darkening economic picture

Amazon’s Q2 results look robust, with its e-commerce and cloud computing divisions faring well. But, can the online retail giant stick to its outlook? IGTV’s @AngelineOng investigates.

(Video Transcript)

Dark clouds on horizon

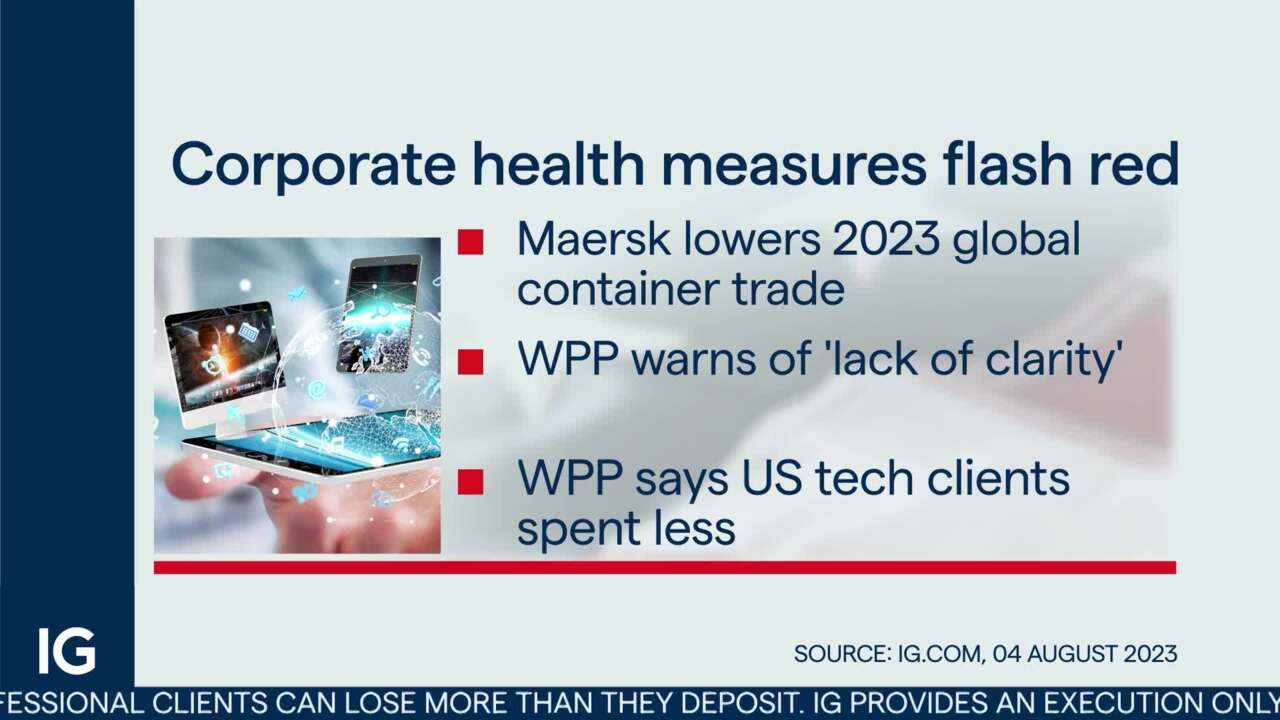

Amazon's second quarter sales growth and profit may have looked robust, and its growth engines, e-commerce and cloud computing also fared well. But the economic horizon is darkening. Credit and consumption markers are weakening, and some forward indicators are also flashing red.

Maersk, the shipping giant, is warning of a steeper decline in global demand for shipping containers by sea this year, prompted by muted economic growth and customers reducing inventories.

Tech clients spending less

WPP , meanwhile, said lower spending from tech clients caused its revenues in North America to fall in the quarter. Amazon's shares, don't forget, are also coming off very lofty levels. They've risen some 50% year-to-date, so all in all, a really tough hill to climb if economic indicators and data point towards a weakening economy.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.