Australia's march job dip: economic challenges ahead, RBA rate decision looms

With Australia's unexpected employment downturn in March and an eye on key economic indicators, all eyes are on the RBA's response and future rate paths amidst ongoing labour market pressures.

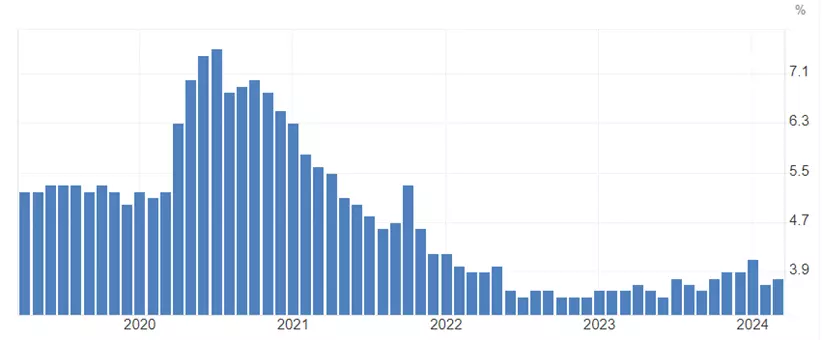

The Australian economy shed 6.6k jobs in March, contrasting sharply with the significant 116.5k job increase in February. Unemployment ticked up to 3.8% from the previous 3.7%, as the participation rate slightly declined to 66.6% from 66.7%.

The underutilisation rate, encompassing both unemployment and underemployment, held steady at 10.3%. This figure represents a modest 0.5 percentage point rise from March 2023, yet it stands 3.6 percentage points below the March 2020 level.

The Australian Bureau of Statistics (ABS) noted that "the flows into employment had returned to a more usual pattern," referring to the seasonal holiday distortions that have hampered the ABS's labour force data in recent months.

Labour market tightness and RBA rate speculation

Although today's figures are unlikely to influence the upcoming RBA meeting—where it's widely anticipated that rates will be maintained—the persistently tight labour market may cause reconsideration among those advocating for RBA rate cuts before the latter half of the year.

The market will seek further insights into the economy's trajectory and the path of RBA interest rates from the following key data ahead of the next RBA meeting on May 7th.

- Q1 inflation (Wednesday, the 24th of April

- Retail sales (Tuesday, the 30th of April)

We reiterate our call for the RBA to cut rates by 25 basis points (bp) in August before a second cut in November, which will see the cash rate end the year at 3.85%. However, we may push back the expected timing of rate cuts if next week's Q1 inflation data is hotter than expected.

Australian unemployment rate

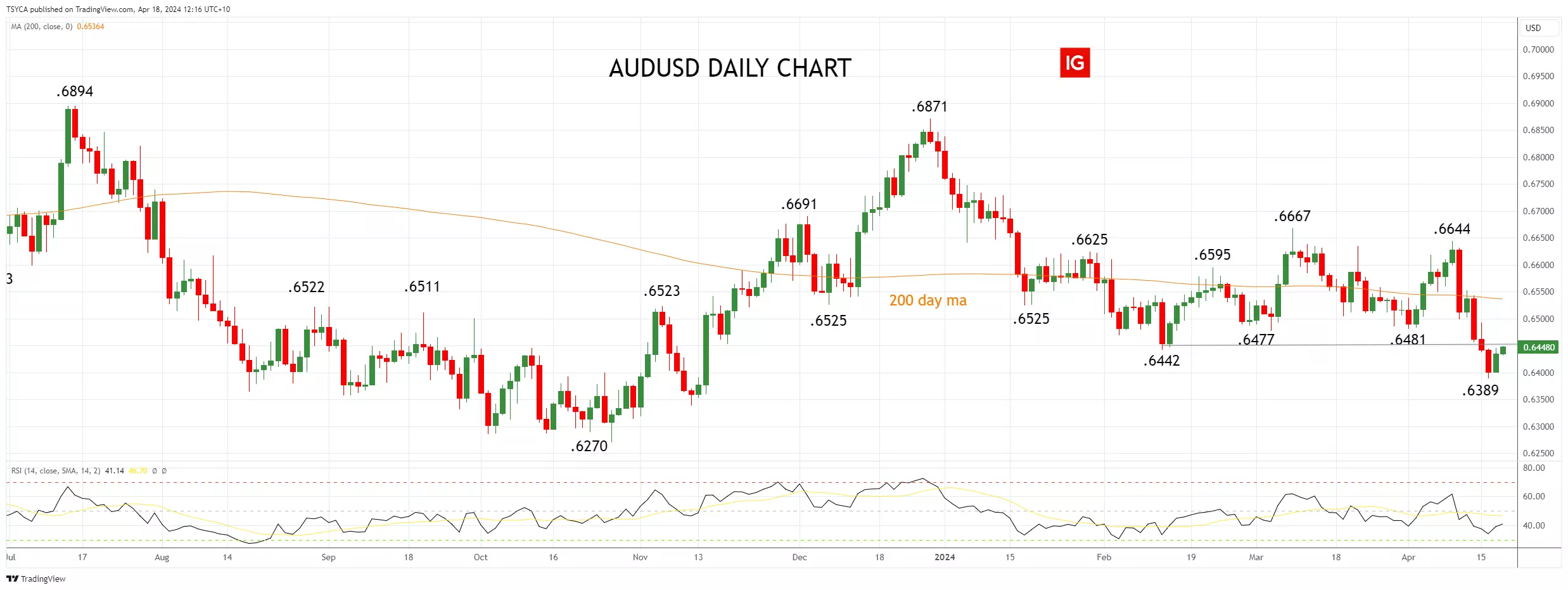

AUD/USD technical analysis

Last week's reversal lower from Tuesday's .6644 high saw the AUD/USD cascade through several important support levels, including the 200 days moving average at .6540.

As a follow-up to the main act, the AUD/USD broke below its year-to-date low of .6442 this week, trading to a fresh five-month low of .6389.

While the AUD/USD is now oversold, it needs to clear short-term resistance at .6450 to alleviate short-term downside pressures and avoid another step lower towards weekly support at .6330.

AUD/USD daily chart

- Source TradingView. The figures stated are as of 18 April 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.