BAE shares drop despite optimistic investor's update

The defence and aerospace giant BAE Systems released its full-year guidance for investors yesterday, detailing a positive outlook amid increased defence spending and reduced deficits. So why is the BAE share price falling?

- Billions of pounds worth of contracts awarded in the past year

- £230 million contract from the US Pentagon, announced yesterday

- BAE is on track to meet annual earning targets, with 10% annualized growth projected

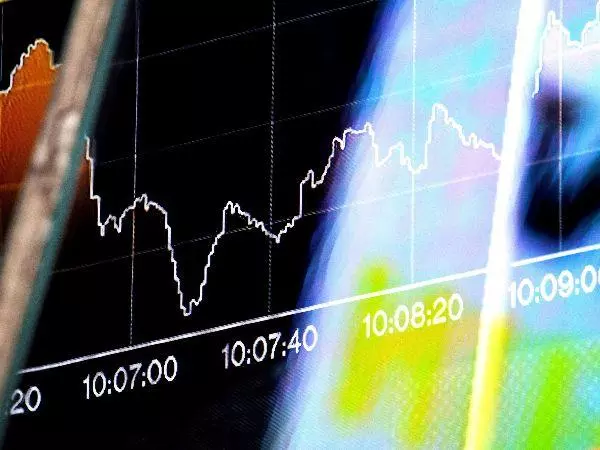

- Despite this, BAE share price dropped this week and is down 2.5% from Monday.

- Ready to trade the BAE share price? Open an account today

BAE remain confident in their full year ambitions

The UK defence giant BAE Systems latest trading statement has reaffirmed its confidence in reaching its top-line growth and margin expansion as detailed in its full-year guidance. Along with this, the update details billions of pounds worth of recent contracts, including a just-announced £230 million contract from the Pentagon to supply GPS missile tracking modules.

BAE also announced that it was making moves to reduce its pension deficit and that it is on track to surpass its annual earnings targets, due to a revised upwards projection of 10% earnings growth for the financial year. BAE Systems Chief Executive, Charles Woodburn, stated 'our good operational performance underlines our confidence in the full year guidance for top line growth and margin expansion and our three-year cash targets.'

Dividends also remain on track for mid-year payout, at 14.3 pence per share. Despite this, the BAE share price took a tumble yesterday and continued to do so as markets opened on Thursday, 20 May, dropping 2% within the first hour of trading.

Why does uncertainty remain around the BAE share price?

One area of concern is the US Defense budget for 2022. Although US President Joe Biden suggested that the budget will remain relatively flat, at $715 billion, compared to $704 billion for the previous fiscal year, this has not been enough to soothe the markets.

The revised budget is unlikely to contain projections for the next five years, translating to more uncertainty for a company that is already in a beleaguered industry. Other issues facing the defence industry are also weighing against the BAE share price, with the rise of environmental, social and governance investing meaning that managers are increasingly excluding companies like BAE from ethical funds.

Trade BAE stocks today

Take your position on UK shares for just a small initial deposit with spread bets or CFDs. Spread bets are completely tax-free, while CFDs are free from stamp duty.1 You can also buy and take ownership of UK shares for just £3 with us.2

Open an account to start trading or investing in UK shares.

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 Deal three times or more in the previous month to qualify for our best rate.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.