Boeing shares rise on reports it's to deliver first Dreamliner to China since 2021

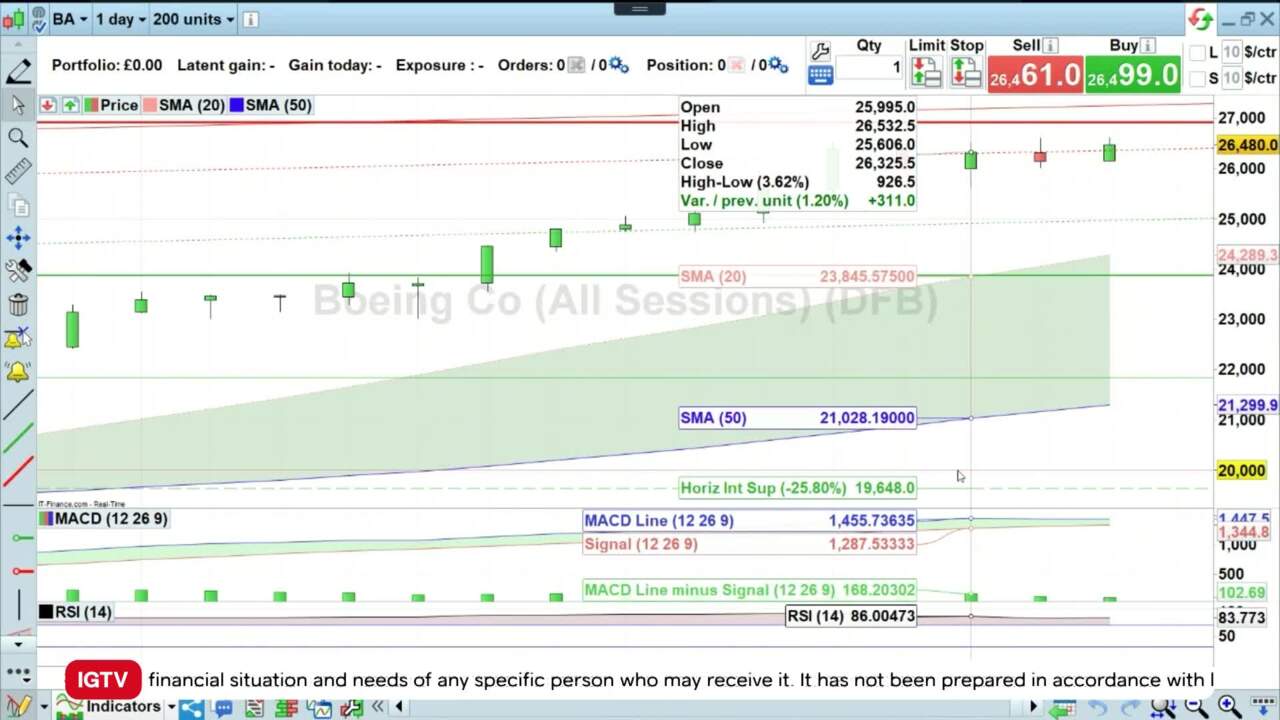

Boeing, all-sessions, is tracking higher on reports that it will get the green light from China to resume deliveries of its 787 Dreamliner after two years. IGTV's Angeline Ong investigates why the news is lifting the stock.

(AI Video Summary)

Boeing shares taking flight thanks to new deal with China

Boeing, the aircraft manufacturing company, is experiencing a rise in its stock prices. According to the IG trading platform, these stocks have increased by 1.3%. This growth is attributed to reports that Boeing is about to recommence delivering its Dreamliner planes to China after a pause of more than four years. This is a significant development for Boeing as it could also mean the end of the freeze on deliveries of its profitable 737 MAX aircraft. In the past, Boeing focused on making smaller, more fuel-efficient planes for shorter flights, while Airbus concentrated on larger, long-haul planes. Nonetheless, Boeing's decision seems to be paying off as it appears ready to take advantage of its chosen target market.

Growing confidence in Boeing's safety and reliability

Despite some troubles with its planes in the past, the potential revival of Dreamliner deliveries to China is a positive turning point for Boeing. It indicates growing confidence in the safety and reliability of the aircraft. This is particularly crucial for Boeing's 737 MAX, which has been grounded since 2019 following fatal crashes. Boeing's decision to prioritise shorter-haul planes that consume less fuel aligns with the global trend of sustainable aviation. Airlines and regulators are actively seeking ways to reduce carbon emissions, making planes that use less fuel for shorter flights increasingly appealing. By resuming Dreamliner deliveries to China, Boeing is showing that its strategy is paying off and strengthening its position in the market.

Overall, the prospect of Boeing restarting Dreamliner deliveries to China is good news for the company. It suggests that the halt on 737 MAX deliveries may come to an end, which could significantly impact Boeing's profitability. Moreover, this move reinforces Boeing's commitment to smaller, more fuel-efficient aircraft, placing it in a favorable position amidst the growing demand for sustainable aviation. Investors and industry observers will now closely monitor Boeing's upcoming actions following this positive development.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.