Boohoo revenue warning takes shares down to 2015 levels

There’s been a near 10% drop in the stock of the Internet clothing retailer Boohoo as it warned that revenue in the second half will be below prior forecasts.

Both revenue and EBITDA were down in H1 and the environment is not favouring the business just yet. The board says it’s moving towards its new strategy, but at the moment things are still tough. Shares have hit levels not seen in eight years.

Boohoo sales in the UK

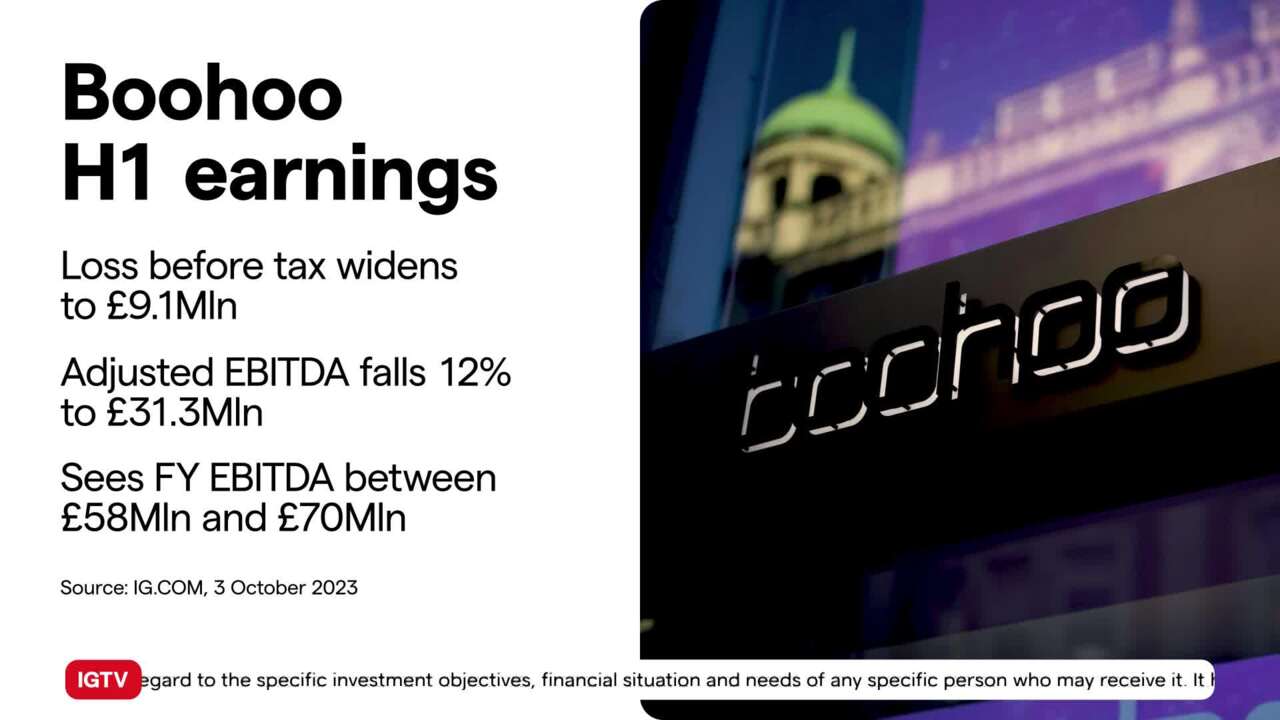

The online clothing store Boohoo has given a warning that its sales for the rest of the year may not be good. In the first half of the year, the company's sales dropped by 17% to £729.1 million. Sales in the UK went down by 19% and international sales went down by 15%. The company's profits also dropped by 12% to £31.3 million. Even though there was a small positive note where the profit margin increased by a bit, it was overshadowed by other bad news.

For example, the debt of the company increased from £10.4 million to £35 million. However, they did manage to reduce their inventory by £94 million, which could be seen as a good thing. But overall, they are expecting even worse sales for the rest of the year.

Boohoo stock price

As soon as this bad news was made public, the stock price of the company dropped by as much as 10% in early trading. Within 25 minutes, the stock price had reached 29 pence, which was the lowest it has been since October 2015. There have been worries about Boohoo's future, and this news has only made the situation worse. As a result, many investors decided to sell their shares, which caused the stock price to drop even more.

Boohoo financial results

In conclusion, Boohoo's warning about its sales, along with the disappointing financial results, caused the stock price to decline significantly. While there were a few positive things, like an increase in profit margin and a decrease in inventory, the overall outlook for the rest of the year is uncertain. Because of these concerns, investors have been selling off their shares, which has led to a negative story for Boohoo's stock.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.