Can Micron deliver an upside surprise for fiscal Q1?

Micron Technology is set to report yet another quarter of losses for its fiscal Q1 2024, after reporting losses every quarter in fiscal 2023.

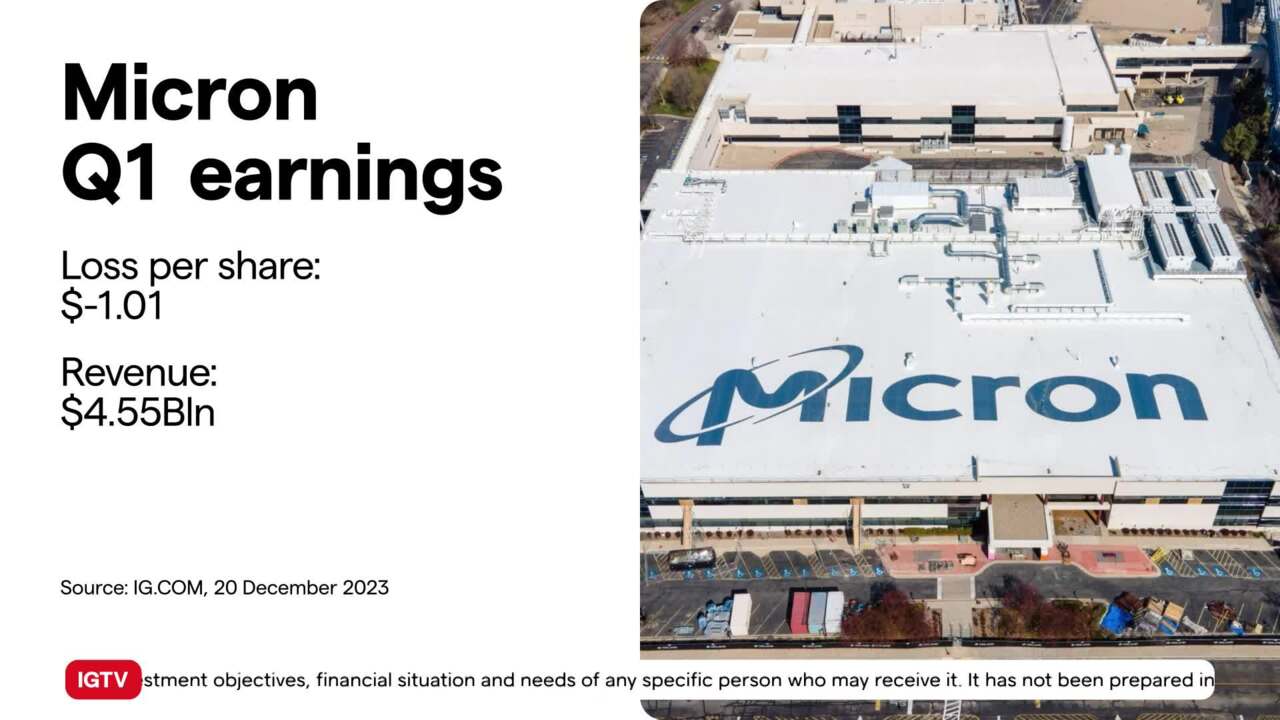

On top of an industry-wide slowdown, Micron is facing a ban of its products on the Chinese market. The memory chip maker is expected to post a loss of $1.01 per share, on revenue of $4.55bln, however analysts remain confident that the group can make strong gains in 2024. Q2 2023, Micron recorded a loss of $1.91 per share, then a loss of $1.43 in Q3, and then a $1.07 loss three months ago. This suggests a slow but steady recovery is underway in the memory market. Investors will want to know more about the level of stocks and of any improvement in the supply chain.

(AI Video Transcript)

Micron Technology

Micron Technology, a company that makes memory chips, is about to announce its financial results for the first quarter of 2024. In the past year, the company has been facing difficulties, such as losses and the possibility of being banned from selling its products in China. However, analysts believe that things are looking up for Micron in 2024.

Memory chip makers are expected to report a loss of $1.01 per share on revenues of $4.55 billion. While this may sound disappointing, there is hope for a slow but steady improvement in the memory market. Investors are specifically interested in the company's stock levels and any improvements in its supply chain.

Micron's upcoming financial results

Overall, there is a lot of anticipation surrounding Micron's upcoming financial results. Analysts believe that the company might be able to overcome its recent challenges and make significant gains in 2024. However, there is also some risk involved in investing in this stock, as the outcome of the earnings report is still uncertain.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.