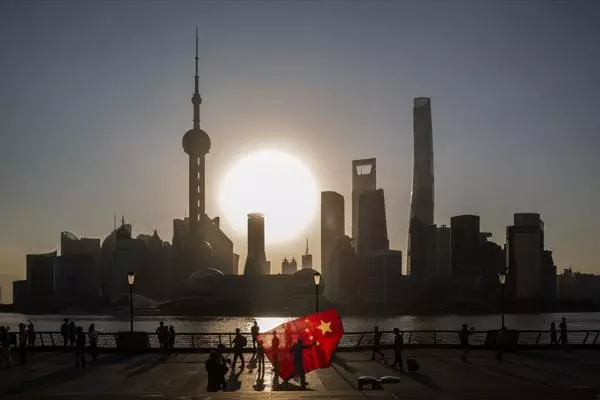

CNY: China cuts 1-year loan prime rate as recovery drags

The People's Bank of China cut the 1-year Loan Prime Rate (LPR) on Monday by 10 basis points to 3.45% while keeping the 5-year LPR at 4.2%.

IGTV’s Angela Barnes looks at how the decision highlights the economic conundrum Chinese authorities are facing.

(Video Transcript)

The People's Bank of China

In other news, let's move on to China, because after a reduction of the one-year loan facility rate by 15 basis points last week, the market expected the People's Bank of China to do the same with loan prime rates this Monday. It indeed cut the one-year LPR but by 10 basis points to 3.45%. As for the five-year Loan Prime Rate (LPR), the People's Bank of China (PBOC) decides to keep it at 4.2%. Well, this decision highlights the economic conundrum that Chinese authorities are facing. On one hand, it needs to do something about its declining growth trend and stimulate weakened demand in the country.

The Yuan

But on the other, the yuan is on a downward trend since the start of the year, and any further easing would trigger further sell-offs. Well, the yuan is currently trading near its all-time low against the US dollar. Let me see if I can try and bring up that chart for you. Yes, the yuan is currently trading near its all-time low against the dollar. And as we've now had several months of disappointing economic data from China, well, the country's post-COVID economy has been flagging across many sectors with youth unemployment at a record level and weak retail sales as consumers reign in their spending.

Country Garden

Additionally, missed bond payments by real estate giant Country Garden has weighed on the minds of investors. Well, China's securities regulator announced measures on Friday to boost confidence in the country's stock market. China's Shanghai Composite has fallen by 2% in the past month, while Hong Kong's Hang Seng has fallen more than 12% this month, setting a new 2023 low.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.