DAX40 index price forecast: breakout into overbought territory

The DAX40 (Germany 40) Index has now confirmed an upside breakout in line with the longer term trend, although the move sees the price trading in overbought territory.

DAX40 – Indicator analysis

Marked with the black arrow we see that the 20-day simple moving average (20MA) (red line) has now crossed above the 50-day simple moving average (50MA) (green line). This is a suggestion that the short to medium trend is once again aligned with the longer-term uptrend. The long-term trend is gauged by the price trading firmly above the 200-day simple moving average (200MA) (blue line).

The 20MA trading above the 50MA which in turn trades above the 200MA is what is considered proper order in technical analysis confirming that the short-, medium- and long-term trends are aligned.

The stochastic does however trade in overbought territory. This is a suggestion that perhaps the DAX40’s short term gains have become overheated, although this signal is considered to carry less precedence than the underlying trend bias. Also, counter trend indications from oscillators such as the stochastic are considered less reliable than signals aligned with the trend.

DAX40 – Price analysis

The DAX40 has now broken through resistance at the 15715 level. The upside breakout sees little in the way of resistance until the historical high at 16300. This in turn becomes the upside target favoured from the breakout. Traders who find long entry into the initial breakout might consider using a close below either a one or two day low (depending on threshold for risk), as a stop loss indication for the trade.

While the initial breakout is valid, our preferred approach to finding long entry is to look for the first pullback from each new high. This approach does find further favour from the fact that the price trades in overbought territory currently. Should a pullback occur we would look for the price to find support at either the 15485 level or at the black trend line on our chart before entering new long positions on the index.

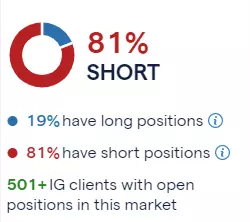

DAX40 – IG client sentiment

As of the morning of the 14th of April 2023, the majority (81%) of IG clients with open positions on the DAX40 Index expect the price to fall in the near term, while 19% of IG clients with open positions on the index expect the price to rise in the short term.

In summary

- The short medium- and long-term trends (as gauged by the moving averages) are considered up

- The DAX40 is however also looking overbought at current levels

- The trend bias is considered to take precedence over the overbought signal

- The DAX40 break of resistance suggests 16300 as a possible target

- The majority of IG clients with open positions expect the price to fall in the near term

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.