FedEx shares up pre-market as it blasts forecasts for FY targets

Federal Express delivered some good earnings after the market closed on Thursday, but everything was blown out of the water by its outlook for the current year.

FedEx issued an adjusted profit forecast of between $14.60 to $15.20 per share for the full year, up from its previous projection of $13 to $14, and well above analysts' average estimate of $13.56.

(Video Transcript)

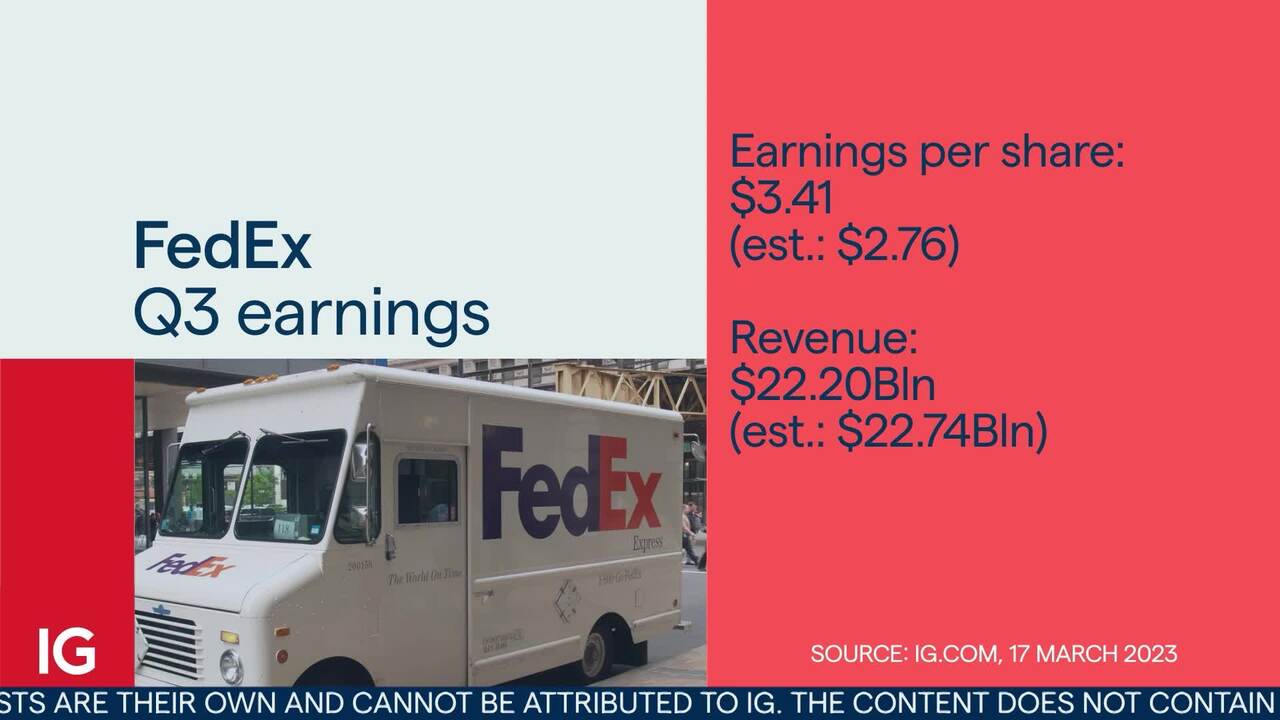

FedEx numbers

FedEx has raised its fiscal 2023 profit forecast. It came out with numbers after the bell last night in the States, citing progress in its plan to shave some $3.7 billion off in costs with the global delivery business really pumping up shares late in yesterday's session, up 11% in extended trade yesterday.

FedEx is not an all-session stock on the IG platform, so watch out at 1:30 pm today UK time when the shares start trading on Wall Street.

Adjusted earnings came in at 3.41 per share in the third quarter (Q3). That's down 1.18 on the third quarter last year, $0.65 higher than analysts' average estimates, so better than expected. Revenue fell 6% to $22.2 billion, missing Wall Street's forecasts.

Share price chart

Now, despite weak market conditions, FedEx now forecasts adjusted profit of between 14.60 to 15.20. And this is really what helped shares late in yesterday's session. That was well above previous projections of $13 to $14 and well above the average analyst estimate of 1356.

Now, as I said, it's not all sessions on the platform, but what I can tell you is on Reuters, they are looking at something like an 11% increase, some shares late in the session yesterday.

So that would take us up then to levels not seen since the 26th of August last year. So watching potentially for a good start today when the cash session gets underway for Federal Express on Wall Street.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.