Macro data to watch: UK unemployment rate, US CPI

In addition to central bank decisions, the market is also anticipating a set of macro-economic data throughout the week.

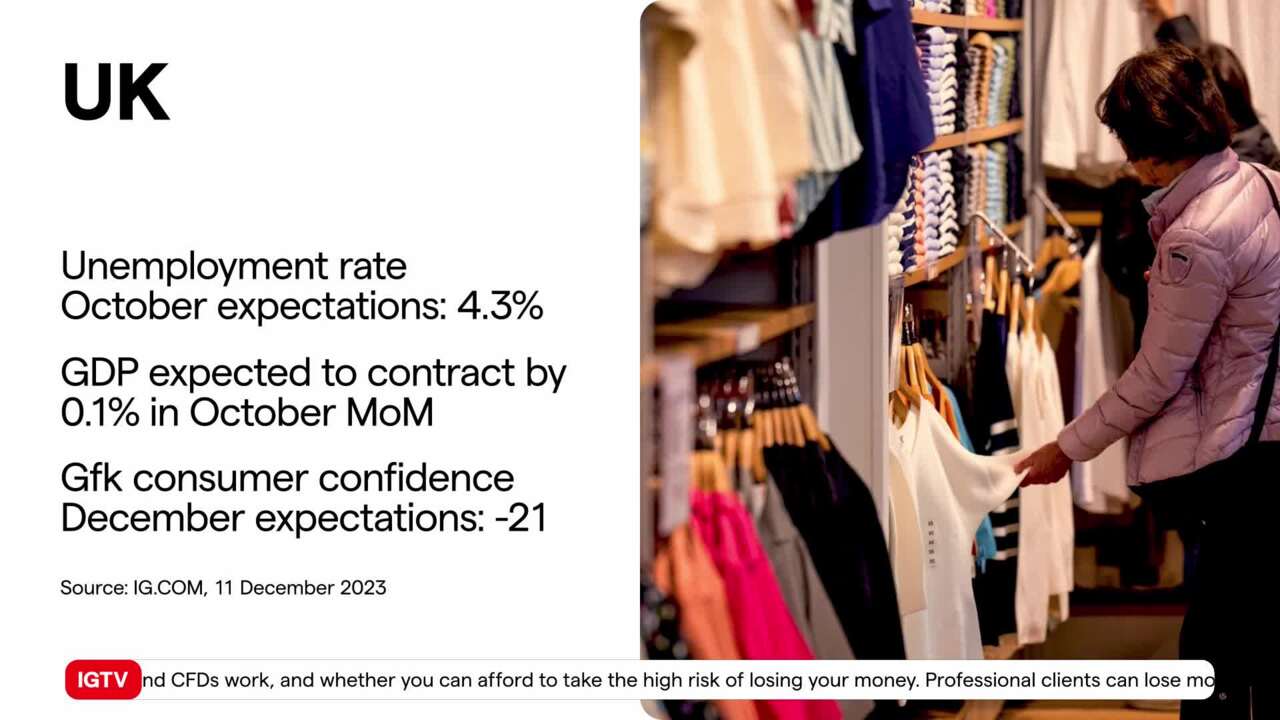

In the UK, the unemployment rate is anticipated to rise to 4.3% in October, which would set a new high since September 2021. UK monthly GDP should have contracted by 0.1% in October - and GfK Consumer Confidence figures are seen as rising to -21 in December. In the US, the Consumer Price Index (CPI) is expected to rise by 3.1% in November year-over-year, one notch lower than in October, while core CPI growth is expected to remain at 4%. IGTV’s Angela Barnes has this round-up.

(AI Video Transcript)

UK job market

This week in the UK, there are a few important things happening that could affect the country's economy. On Tuesday, the unemployment rate is expected to go up to 4.3% in October. This means that more people might be struggling to find jobs, which is not good news for the job market.

UK GDP

On Wednesday, the monthly gross domedtic product (GDP) (which measures how much money the country is making) will be released, and it's predicted that the economy shrunk by 0.1% in October. This could mean that the economy is slowing down or having a negative impact on growth. The three-month average is expected to stay the same, which is not ideal.

But it's not all bad news. Industrial production, which measures how much stuff is being made, is forecasted to go up by 1.1% in October compared to the same time last year. This shows that the industrial sector is doing well and producing more things. This is a positive sign for the country's economy.

The GFK consumer confidence

And on Friday, the GFK consumer confidence data will be published. It's expected to show a slight improvement, with a rating of minus 21 in December. This is better than the previous month's rating of minus 24. In fact, this rating would match the highest level in the past 22 months, which happened in September. This means that consumers are feeling more confident about spending money, which is good news for businesses.

So overall, it's a bit of a mixed bag for the UK's economy. Some things are not looking great, like the rising unemployment and shrinking GDP. But there are also positive signs, like the increase in industrial production and improving consumer confidence. It's important to keep an eye on these things to get a better understanding of how the UK's economy is doing.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.