Meta Platforms’ 1Q earnings preview: Growth momentum to stay intact

Further recovery in ad market, improved product offerings and Meta’s latest AI chip to set the runway for growth.

When does Meta Platforms report earnings?

Meta Platforms (formerly Facebook) is set to release its quarter one (Q1) 2024 financial results on 24 April 2024 after the US market closes.

Meta Platforms’ 1Q 2024 results – what to expect

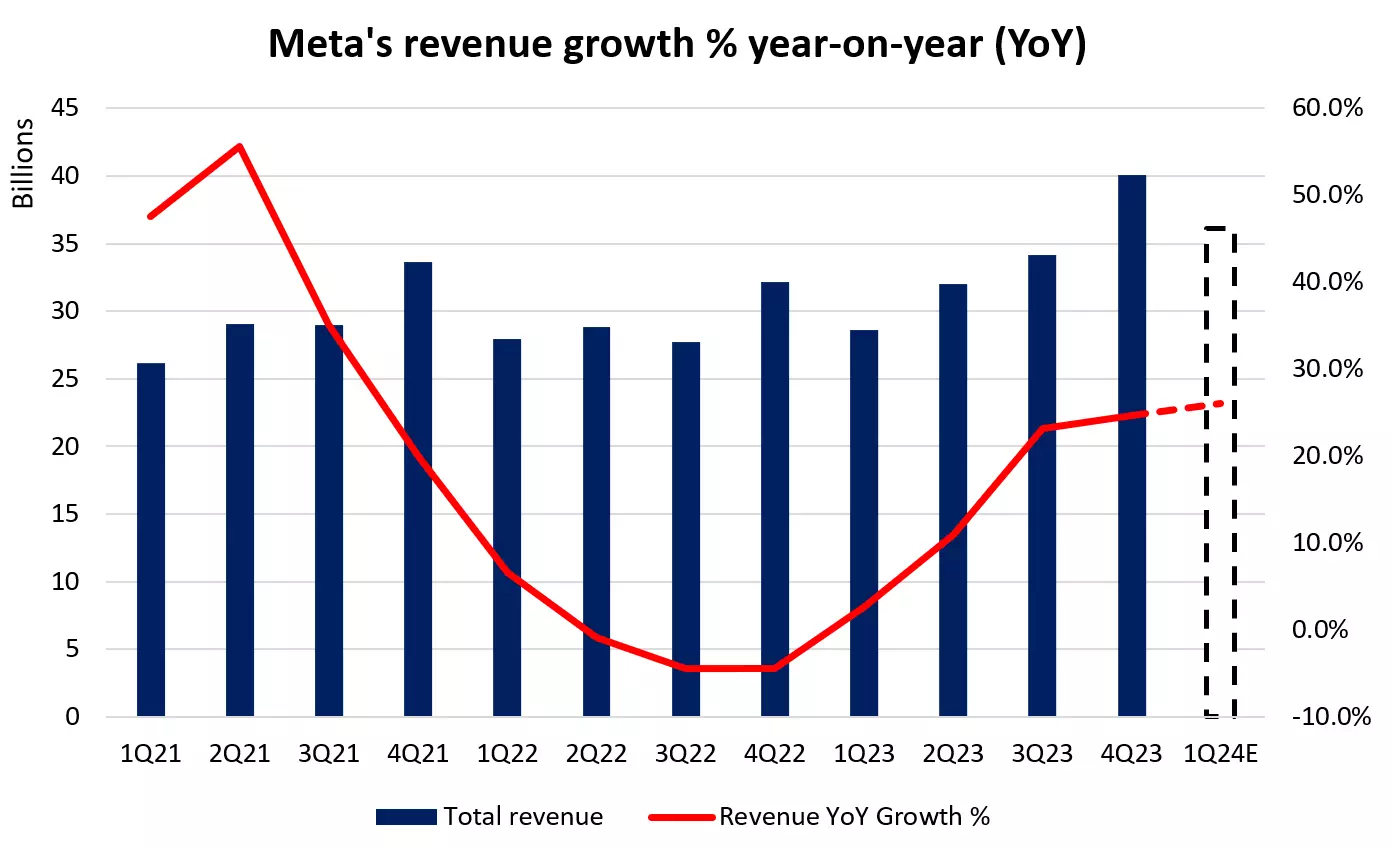

Expectations are for Meta’s Q1 revenue to register a 26% year-on-year (YoY) growth to US$36.1 billion, up from the US$28.6 billion a year ago. This will be the highest quarterly revenue growth since 3Q 2021. Earnings per share is expected to grow almost two-fold to US$4.29, versus the US$2.20 a year ago.

Having undergone a series of cost-cutting measures in 2023, along with a rebound in the digital advertising (ad) space, net profit margin is expected to stay around the 30% range at 31.1% for the reporting quarter, up from 19.9% a year ago but slightly lower than 4Q 2023 (35.0%).

Recovery momentum in advertising spend to continue through 2024

More than 96% of Meta’s revenue revolves around ad spend, with significant exposure to the US and Canada (40%), Asia Pacific (26%) and Europe (23%).

Forecasts from Interpublic Group (IPG)’s Magna unit suggests that ad spend will continue to accelerate in 2024, with the US ad market expected to grow 9% to reach $369 billion. The recent run in stronger-than-expected US economic conditions seems to validate this view. Not to forget that this year is a US presidential election year, which will likely offer a boost in political ad spending.

The 2020 US election was the most expensive campaign year in history, with an estimated US$9.6 billion in political ad spending. Estimates from eMarketer suggest that political ad spending in the upcoming 2024 election may be 30% higher than the prior election, with a potential 156% spike in digital ad. That may aid to underpin growth momentum for key digital ad players, like Meta and Google, through 2024.

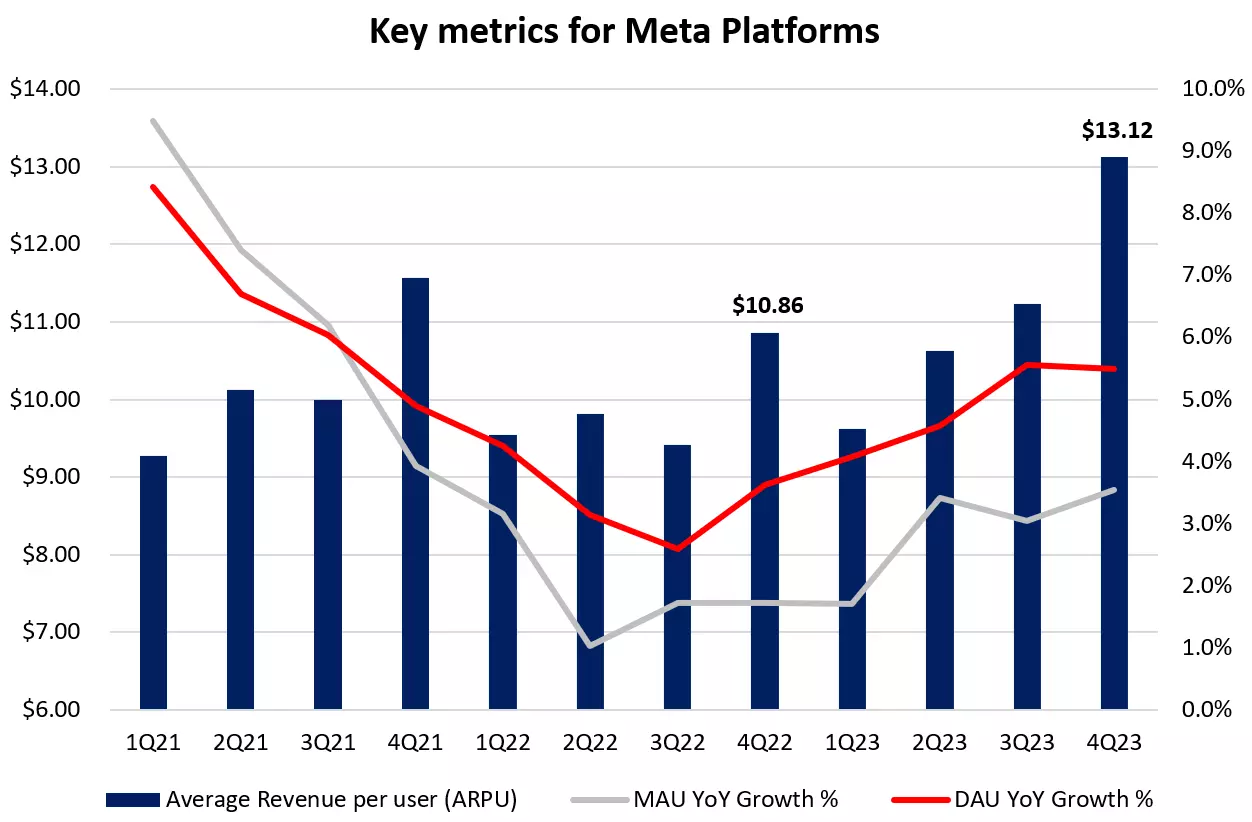

Further improvement in metrics expected

The past year has seen a turnaround in active users and improvement to its average revenue per user (ARPU). In 4Q, the total number of ad impressions served across Meta’s services jumped 21% and the average price per ad increased 2%, which served as validation for its strategy in improving on-platform ad experiences, while investing in models to accurately predict and serve relevant ads to consumers, and improved performance for advertisers.

The management earlier guided that it saw a trend of ‘strong, broad-based advertising demand across verticals, particularly within online commerce and gaming’, which set the tone for the recovery momentum to continue. Having an additional day in the reporting quarter (29 February) may offer some slight benefit as well.

Latest Meta AI chip, product enhancement to be in focus

In a bid to reduce costs and dependence on external suppliers, US big tech firms have turned to developing their own in-house chips in recent years. Meta is no exception and has recently found much success in its chip development efforts.

It recently unveiled its next-gen Meta Training and Inference Accelerator (MTIA) in-house artificial intelligence (AI) chip, which is set to be the successor to last year's MTIA v1. The next-gen MTIA is built on a 5nm process node (versus previous 7nm), boasts more internal memory and runs at a higher average clock speed than its predecessor.

Ahead, market participants will be seeking for more clarity on how the new chips will support Meta’s new generative AI products and services, and its capabilities in boosting the effectiveness of its ads, such as its ranking and recommendation algorithm models.

Meta also confirmed plans for the release of Llama 3 next month, which is the next generation of its large language model used to power generative AI assistants. This product launch is a response to catching up with OpenAI’s ChatGPT and an improvement from its predecessors, Llama 1 and Llama 2, which were previously criticised for being too limited.

While management has previously guided that it does not expect GenAI products to be a meaningful 2024 driver of revenue, it is expected to carry a longer-term impact. Better ad engagement may also underpin user growth and allow Meta to increase ad pricing, which will contribute meaningfully to the company’s growth.

Quarterly dividend announced in February 2024 to be maintained

Market participants can look forward to upcoming shareholder returns from Meta, with the company announcing its first-ever dividend (US$0.50) back in February 2024, to be paid quarterly. The US$0.50 dividend is likely to be maintained in the upcoming results, with its annual dividend projected at US$2.00.

While this translates to a dividend yield of a mere 0.4%, the move offers some validation to its strong cash flow. In the previous quarter, the company also authorized an expanded US$50 billion share buyback program.

Meta Platforms share price – technical analysis

Year-to-date, Meta has been one of the top-performing ‘Magnificent Seven’ stocks with a 41% return (as of 16 April 2024), trailing just behind Nvidia’s 74%. Following a gap-up from its previous earnings release, Meta’s share price continues to trade on a series of higher highs and higher lows within an ascending wedge pattern.

Given the wider market retracement, its daily relative strength index (RSI) is back to retest its key 50 level, which has not been broken down since December last year. Any failure for the mid-line to hold may suggest sellers in greater control, at least for now.

In the event of further de-risking, a support confluence at the US$480-US$490 range will be on watch, where the lower wedge trendline coincides with the upper edge of its daily Ichimoku cloud support and its 50-day moving average (MA). A dip below the US$480 level may leave the US$450 level on watch next.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.