Oil price downward pressure continues

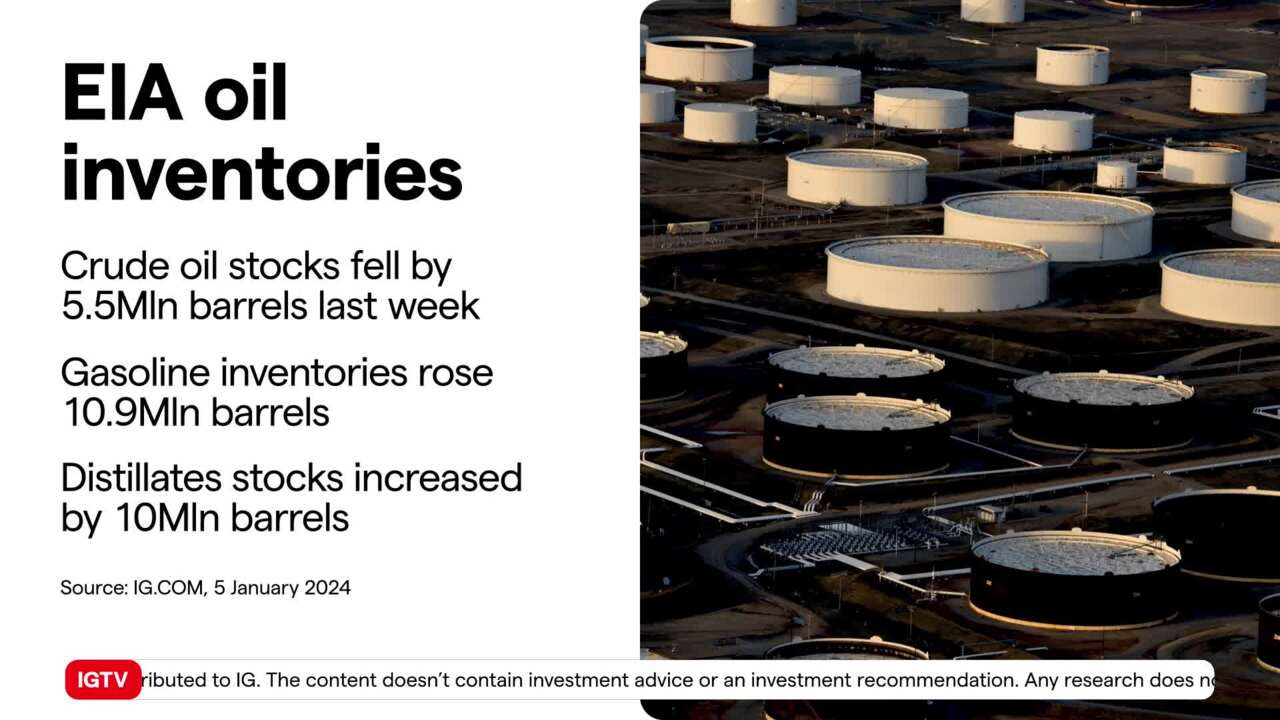

After Thursday’s volatility in the oil market the downward pressure continues. This time it was the turn of the EIA to show that stockpiles are building. Gasoline inventories saw the biggest weekly build in 30 years.

(AI Video Transcript)

Oil prices going down lately

This video dives into the recent ups and downs of oil prices and how they can affect inflation. It focuses on the WTI, the West Texas Intermediate. It shows that oil prices have been going down lately, but they've had some crazy swings too.

One of the reasons for the volatility is a big drop in crude oil inventories. Because of some issues in the Red Sea, refiners and oil buyers have been choosing to get their oil from the US instead of going around Africa. This unexpectedly reduced the amount of oil available, making the market go crazy.

Gasoline stocks

Another thing impacting oil prices is the huge increase in gasoline stocks. Last week, they went up by 10.9 million barrels, the biggest jump in over 30 years. This happened because refineries were working at full capacity, but people weren't using as much gas during the holiday season between Christmas and New Year. On the flip side, demand for distillates like heating oil went up because it's been unusually warm in the North East.

Baker Hughes rig count

The video also mentions the upcoming Baker Hughes rig count, which is a big deal. It tells us how many oil rigs are actively drilling and producing oil. Right now, there are 622 rigs in total, with 500 of them producing oil. This data will be released on Friday, and it could have an impact on the markets.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

React to volatility on commodity markets

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.1

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

1In the case of all DFBs, there is a fixed expiry at some point in the future.

See opportunity on a commodity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on a commodity?

Don’t miss your chance. Upgrade to a live account to take advantage.

- Analyse and deal seamlessly on fast, intuitive charts

- Get spreads from just 0.3 points on Spot Gold

- See and react to breaking news in-platform

See opportunity on a commodity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.