Oracle preview: Will the software company exceed earnings again?

US computer software company Oracle is due to report its latest earnings after the US close later, and again, its cloud computing area is seen as being a key driver of growth for the company.

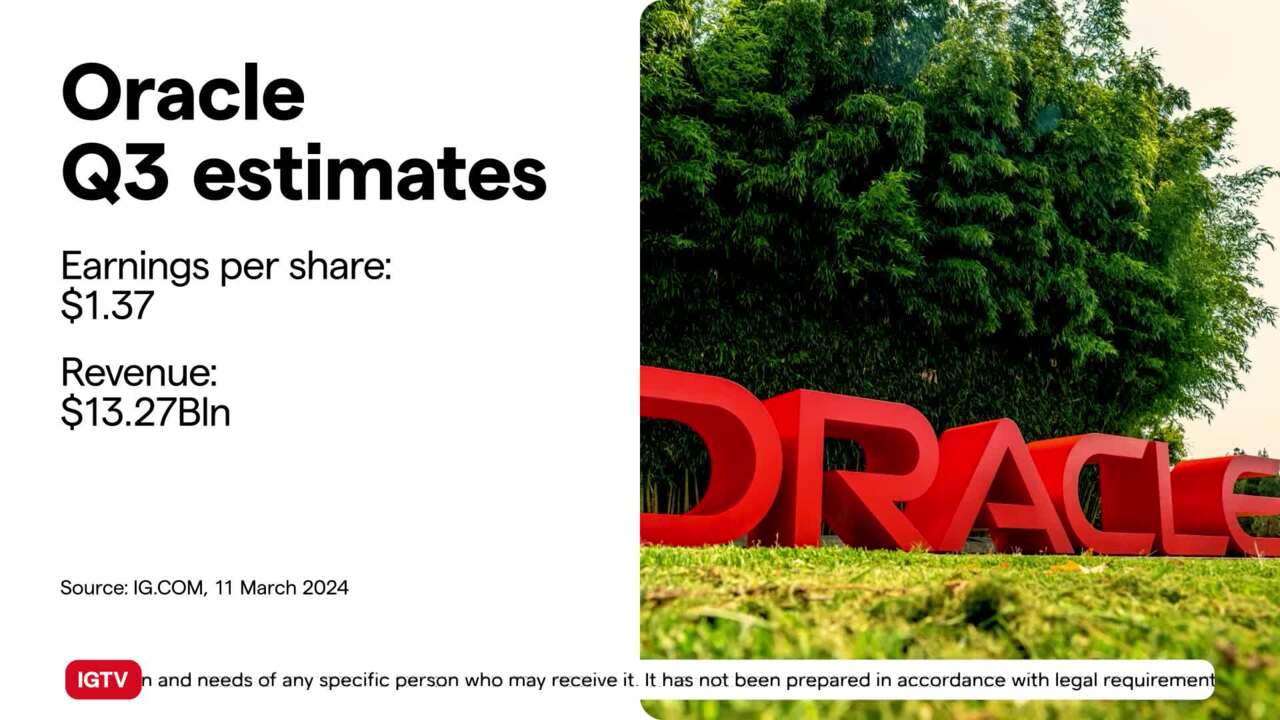

Current estimates call for Q3 earnings of $1.37 per share, reflecting a 12.3% improvement relative to the same quarter last year. Oracle has exceeded the earnings mark in each of the past four quarters, delivering an average earnings surprise of 3.32% over that timeframe. Sales are anticipated to have risen 7.07% to $13.27 billion. IGTV’s Angela Barnes has more.

(AI Video Summary)

Oracle's earnings

Oracle, a leading computer software company in the US, is about to release its earnings report. One area that has been driving the company's growth is its cloud computing sector. Experts predict that Oracle's earnings for Q3 will be around $1.37 per share, showing a 12.3% increase compared to the same quarter last year. This consistent growth has had a positive impact on market sentiment, with Oracle beating earnings expectations in the past four quarters and even exceeding the average estimate by 3.32%.

Oracle share price

In terms of sales, Oracle is projected to have experienced a 7.07% increase to $13.27 billion. However, when we look at the stock chart, we see that the price of Oracle shares has been quite volatile on the tastylive platform. For instance, after the last quarterly report in December, where the company fell short of revenue estimates, the stock price dropped. But despite this dip, Oracle's stock has still managed to gain almost 9% since the beginning of the year.

Oracle's Q3

One of the key factors expected to contribute to Oracle's Q3 growth is its cloud computing sector. The company's ability to consistently exceed earnings expectations has garnered positive market sentiment and confidence in its potential for sustained growth. Analysts predict a 12.3% improvement in earnings per share compared to the previous year, along with a 7.07% increase in revenues. These optimistic projections underline the market's trust in Oracle's ability to leverage its cloud computing sector for continued success.

Although Oracle's stock has experienced fluctuations on the tastylive platform, particularly following its last quarterly report, where revenue estimates were missed, the stock has still managed to show a positive year-to-date performance, with nearly 9% gains. This suggests that while the company may face short-term setbacks, investors remain hopeful and confident in Oracle's long-term prospects.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.