Oracle shares tumble, all-sessions, on poor forecasts

Sticky inflation and high borrowing costs have forced many companies to cut back on expenditure and Oracle says this is impacting demand for its cloud offerings.

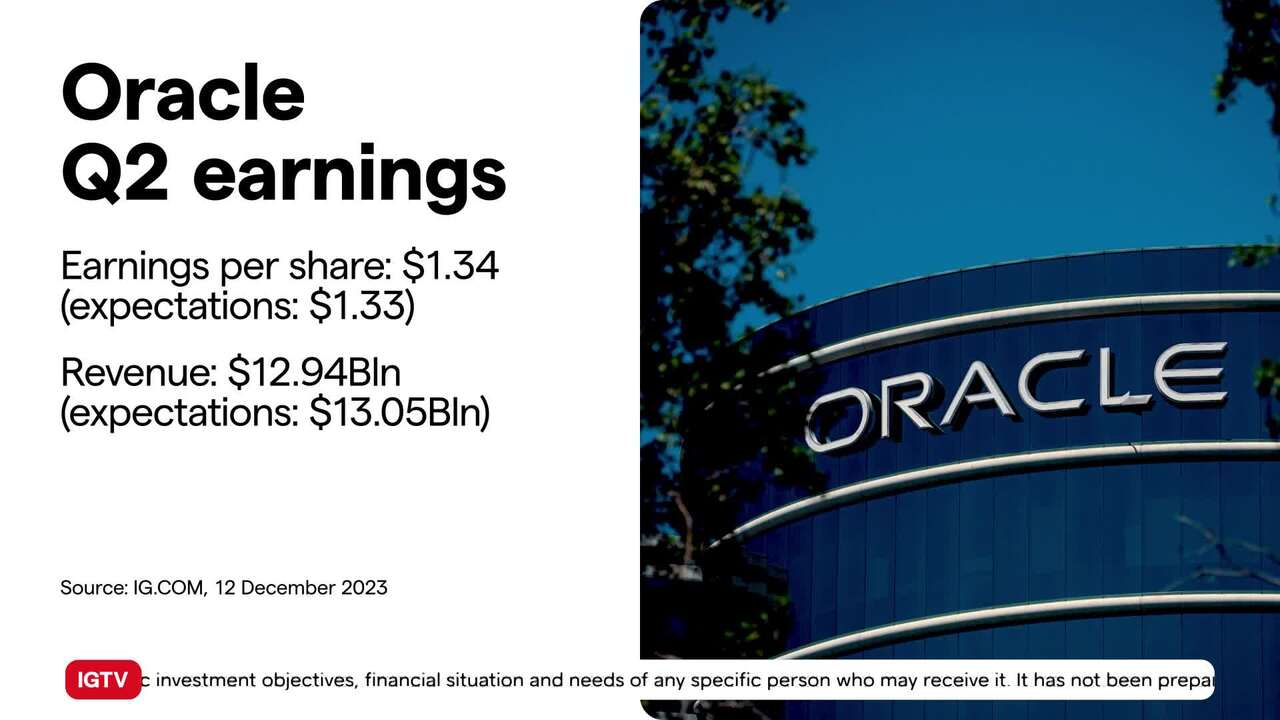

Oracle forecast total revenue growth to be in the range of 6%-8%, below analysts' average estimates for growth of about 7.6%. For its fourth quarter, Oracle reported adjusted earnings of $1.34 per share, marginally beating estimates. Quarterly revenue rose 4% to $12.94 billion, below analysts' average estimate of $13.05bn. Excluding Cerner, the health care business Oracle acquired last year, revenue rose 6%.

(AI Video Transcript)

Oracle

Shares of Oracle a technology company, had a big drop after the regular trading hours. This happened because people were worried about inflation and high borrowing costs affecting Oracle's spending. They were also concerned that this might reduce the demand for Oracle's cloud services. The company said that its total revenue growth would be 6 to 8% lower than what analysts predicted. In the fourth quarter, Oracle made a profit of $1.34 per share, which was a little better than expected.

Oracle's stock prices

However, their revenue for the second quarter was only 4% higher, reaching $12.94 billion. This was lower than the estimated $13.05 billion. When you don't include the revenue from a healthcare company Oracle bought the previous year, the revenue increase was 6%. There was a chart showing the movement of Oracle's stock prices after regular trading hours, and it showed a big decrease. Experts think this trend will continue when the stock market opens the next day.

Overall, Oracle's shares had been doing well in 2023, with a 27% increase. But this recent setback has probably affected Larry Ellison, one of the co-founders and the chairman of Oracle. To sum it up, Oracle's shares had a big drop in after-hours trading due to concerns about inflation and high borrowing costs. Analysts are worried that the demand for Oracle's cloud services may go down. Even though Oracle's profit in the fourth quarter was a bit better than expected, their revenue increase fell short of estimates. This caused a big drop in the company's stock value, which is expected to continue at the start of the trading day.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.