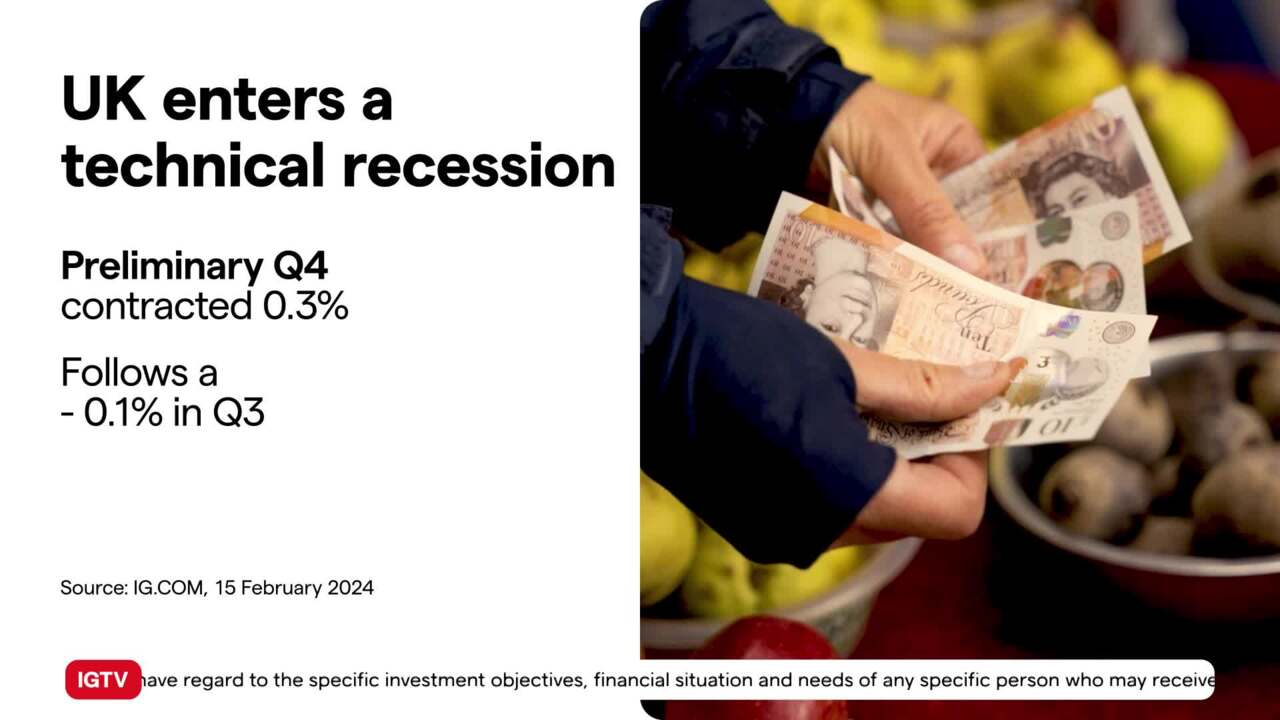

UK in a technical recession

GDP, in the UK, contracted 0.3 per cent in the final three months of last year compared with the previous quarter, following a 0.1 per cent decline between July and September.

In 2023, the economy largely stagnated as it grew only 0.1 per cent. This was well below the 2.5 per cent expansion registered in the US, and weaker than the 0.5 per cent growth of the eurozone. IGTV’s Jeremy Naylor looks at the reaction for sterling, under pressure across the board. However, some economists are confident that there are signs the UK economy is turning a corner. It’s assumed that growth will strengthen over the next few years, wages are rising faster than prices, mortgage rates are down and unemployment remains low.

(AI Video Summary)

The UK economy

The UK is in a tough spot economically. The country's economy has shrunk for two consecutive quarters, which means it is officially in a recession. In the last quarter of the year, the economy contracted by 0.3% and in the previous quarter, it had negative growth of 0.1%. This is not good news for the Chancellor's plans to boost the economy, and it could also affect the upcoming elections.

The UK's growth rate

While the UK's growth rate for the whole year was only 0.1%, the US grew by 2.5% and the euro zone by 0.5%. But there is some hope for the UK. There are signs that the economy is starting to improve, with wages rising, mortgage rates going down, and unemployment rates staying low. These positive factors suggest that the economy will get stronger in the future.

The British pound

However, investors in the market are not feeling very confident right now. The GBP has lost value against the euro and the USD. This decline in the pound's value has continued even after the recession data was announced.

GBP/USD

If we look at a chart of the GBP/USD we can see that it is hovering just above a level of support at 125.18. This means that the pound's value has been consistently going down, which shows that the market is worried about the UK economy.

So, while there is hope for the UK's economic recovery in the future, the confirmation of a recession has raised concerns about what lies ahead. The market's reaction has been negative, with the pound losing value against major currencies like the euro and the dollar. The situation is uncertain, and traders are keeping a close eye on the economy to see how it develops.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.