Wall Street: market dive amid rate cut doubts, bank woes, & middle east strife

Wall Street faces a tough week amid Fed rate cut doubts, bank earnings misses, and geopolitical tensions, with attention turning to major earnings and pivotal retail sales data as rates outlook shifts.

US equity markets dived on Friday — in a week that saw the pathway toward Fed rate cuts became less certain — earnings reports from major banks disappoint, topped off by a sharp rise in Middle Eastern geopolitical tensions.

Arguably, the effects of the latter will continue to be reversed today after an Iranian missile and drone attack on Israel on Sunday morning, appears sufficient in size to revenge the killing of Iranian military personnel in Syria without being damaging enough to trigger a further escalation at this point.

This will leave traders to focus on Q1 2024 earnings this week from companies including Goldman Sachs, Johnson and Johnson, Bank of America, Morgan Stanley, Netflix (previewed here), Procter and Gamble, and American Express. As well as retail sales data for March and Fed speak from Logan, Daly, Mester, Williams, Bostic, and Goolsbee.

After a third consecutive month of firm CPI data, the rates market has repriced the probability of interest rates in the US remaining higher for longer. Current market pricing shows a first full 25 basis point (bp) rate cut priced for September and a second priced for December.

What is expected from US retail sales (Monday, 15 April at 10.30pm)

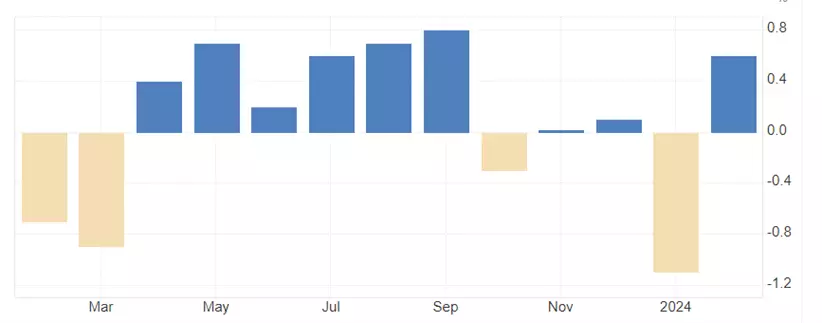

In February, retail sales increased by 0.6%, below market expectations, looking for a rise of 0.8%, following a steep 1.1% fall in January. The all-important retail sales control group, which feeds into GDP, was flat in February at 0.0%.

The softer-than-expected rebound in February following January's soft number suggests consumers are pulling back on spending as higher interest rates and stubborn inflation bite into household budgets.

This month, headline retail sales are expected to rise by 0.3% Month over month. The retail control group is expected to also increase by 0.3%. Should the retail sales numbers come in softer than expected, it will increase hopes of a Fed rate cut before September.

US headline retail sales chart

S&P 500 technical analysis

Last week, the S&P 500 closed lower for its largest two-week fall since mid-October.

To signal that the correction is complete and reignite the upside towards 5400, the S&P 500 cash needs to hold above support at 5055/5040 and clear resistance at 5265, coming from previous highs.

Aware that if the S&P 500 cash were to see a sustained break of support at 5055/5040, it would warn that a short-term high is likely in place at 5264 and that a deeper pullback towards 4800 is underway.

S&P 500 daily chart

Nasdaq technical analysis

Over the past seven weeks, there has been a noticeable flattening out in the Nasdaq's uptrend, well-illustrated by Friday's close of 18,003, within 1 point of the Nasdaq's close of 18,004 on February 22nd.

To signal that the correction is complete and reignite the upside towards 18,750, the Nasdaq cash needs to hold above support at 17,750/00 and clear resistance at 18,400/18,464, coming from previous highs.

Aware that if the Nasdaq were to see a sustained break of support at 17,750/700, it would warn that a short-term high is likely in place at 18,464 and that a deeper pullback towards 17,000 is underway.

Nasdaq daily chart

- Source TradingView. The figures stated are as of 15 April 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.