Wall Street remain stuck in its ranging moves: Gold, NZD/USD, Brent crude

It was another flat session in Wall Street overnight, as earnings releases thus far still failed to provide the catalyst for a break to a new higher high for the S&P 500 and Nasdaq.

Market Recap

It was another flat session in Wall Street overnight, as earnings releases thus far still failed to provide the catalyst for a break to a new higher high for the S&P 500 and Nasdaq, keeping the indices stuck on its ranging moves. Morgan Stanley was the latest bank to report earnings, with higher costs and the sluggish environment for deal-making dampening some optimism around its top and bottom line beat. Nevertheless, its share price managed to pare initial losses to eke out a 0.7% gain by the close.

More action seems to come after-market, with Tesla’s results not providing much to cheer. Slashing prices to support growth in the US and China translated to its lowest quarterly gross margin in two years and a miss in 1Q profits. On a broader scale, what it reflects is the tough environment for corporates to sustain demand and downside risks to earnings over coming quarters remains. Particularly for Tesla, further price cuts announced suggests that earnings and margins may continue to take further hit ahead. Its share price is down 6% after-market.

On the economic front, more persistent pricing pressures in the UK seem to put a 25 basis-point (BP) rate hike back on the table for the next Bank of England (BoE) meeting in May. While rate expectations for the Federal Reserve (Fed), remains well-anchored, Treasury yields continue their creep higher, keeping the US dollar afloat above its key 101.30 level.

A stronger US dollar may not be positive news for gold prices, but the strong defending of its lower channel trendline with volume build-up yesterday has been noteworthy. Lower highs in moving average convergence/divergence (MACD) still suggest abating upward momentum for now, but a breakdown of the near-term channel pattern will have to take place for greater conviction of a wider retracement in place.

Asia Open

Asian stocks look set for a slight negative open, with Nikkei -0.19%, ASX -0.21% and KOSPI -0.21% at the time of writing. The Asian session will leave investors to digest the fresh Tesla’s results, while US futures are still trending within its relatively lower-volatility state with some slight losses.

A no-change in the one-year medium-term lending facility from the People's Bank of China (PBOC) earlier this week suggests that an inaction may play out for the one-year and five-year loan prime rate today as well. On another front, lower-than-expected New Zealand’s inflation rate (6.7% versus 7.1% forecast) helped to provide some justification for the central bank to consider a rate pause ahead, with tighter policies feeding through to lower prices.

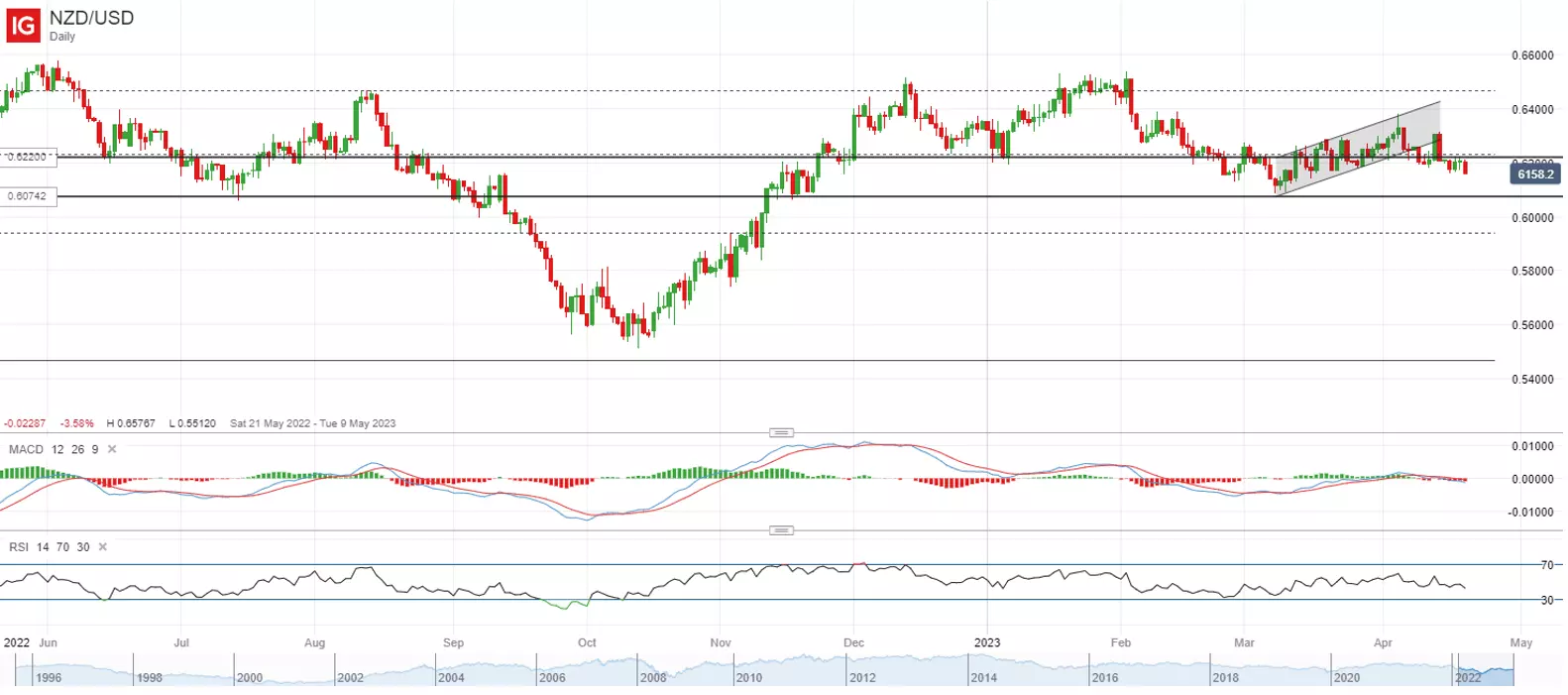

Less hawkish expectations have not been well-received by the NZD/USD, which continues to drift lower from the 0.622 support-turned-resistance level. The formation of near-term lower highs and lower lows seem to instil an overall downward bias for now. Further downside may leave its March 2023 low on watch at the 0.607 level.

On the watchlist: Potential gap-filling for Brent crude prices in place

Brent crude prices have shrugged off the larger-than-expected decline in US crude oil inventories yesterday, with a firmer US dollar and the subdued risk environment having a greater say in keeping prices down. This comes upon a retest of technical resistance at the US$86.90 level, which has established a track record of weighing on prices on at least four occasions thus far – a crucial level that the bulls will have to overcome.

With a break below a trendline support, Brent prices seem to be looking to fill the gap, leaving the US$80.00 level on watch next. A bearish crossover on MACD may also support a reversal in momentum to the downside for now.

Wednesday: DJIA -0.23%; S&P 500 -0.01%; Nasdaq +0.03%, DAX +0.08%, FTSE -0.13%

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.