Watching Ford shares as it cuts EV investment after poor Q3

A poor third quarter set of earnings from Ford Motor has led it to examine how it does a number of things.

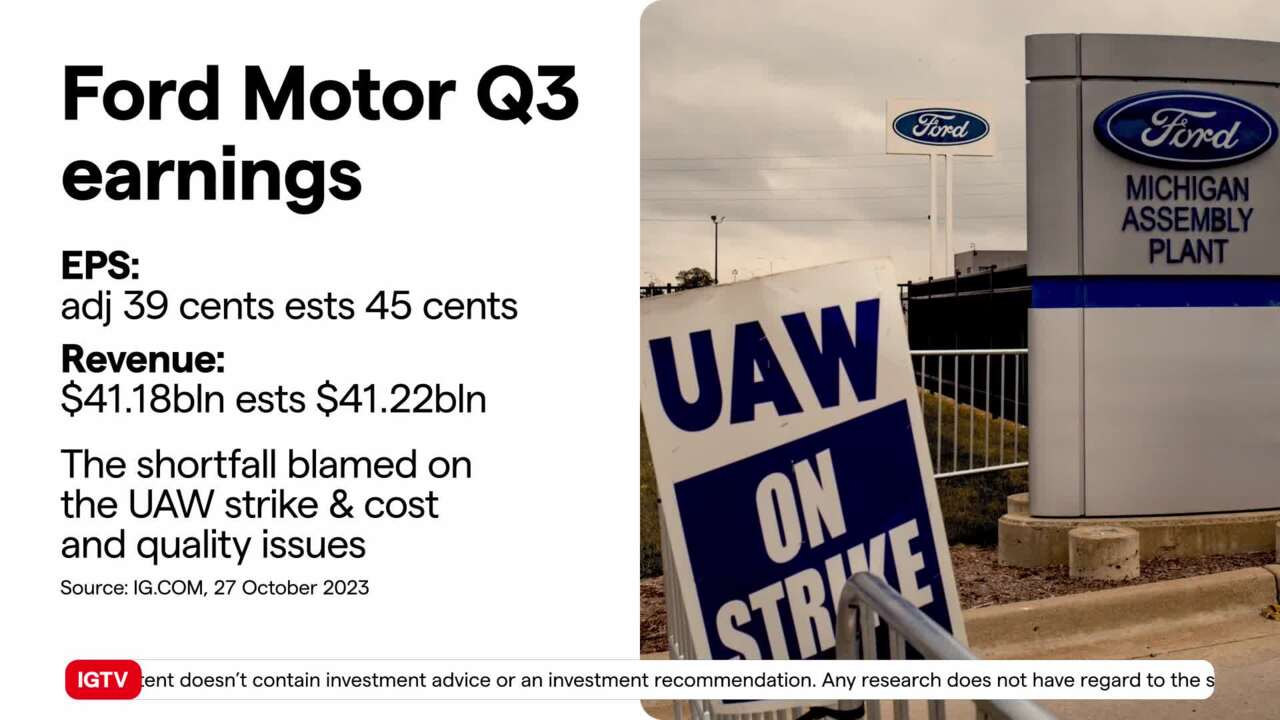

The drop in earnings was mostly due to the strike by UAW workers, which saw negotiations this week come to a possible conclusion, although the vote is still to be done. However, after the release of the Q3 numbers, Ford also said it is now delaying about $12 billion in planned investments on EVs, including construction of a second battery plant with joint venture partner SK On due to softening demand for higher priced premium electric vehicles.

(AI Video Transcript)

Ford Motors

Ford Motors has had a tough time lately, partly because of a strike by the Auto Workers Union. This strike lasted almost six weeks and cost the company a whopping $1.3 billion. As a result, Ford fell short of the expectations of Wall Street, earning only 39 cents per share instead of the expected 45 cents. The company's revenue currently stands at $41.18 billion, with $41.22 billion of that being due to the worker strike. Thankfully, the strike is now over, as a tentative deal has been reached.

Ford's stock price

Ford's troubles don't end there, though. They have also decided to delay $12 billion in planned investments on electric vehicles, including the construction of a new battery plant. This decision is due to a decrease in demand for the more expensive electric cars. As a result of all these challenges, Ford's stock price took a hit and reached its lowest point since July 1st. At the end of trading, the stock was worth $10.96 per share, and it continued to decline in extended trade later that night. It's clear that these financial struggles have had a significant impact on the company's stock performance.

The Auto Workers Union strike

In summary, Ford Motors has faced difficulties in the past quarter, with the Auto Workers Union strike and the decision to delay investments in electric vehicles. These challenges have caused the company to fall short of expectations and have led to a decline in stock price. However, with the strike now over and a tentative deal in place, Ford has an opportunity to regroup and make necessary changes to improve their financial situation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.