What can we expect for copper prices?

After surging close to 15% over the past weeks, can the rally for copper prices sustain?

What can we expect for copper prices?

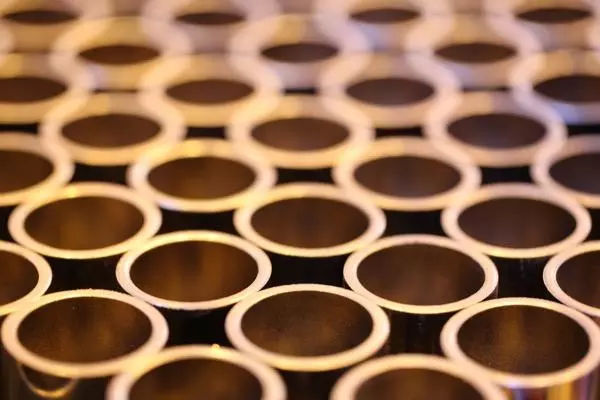

Near term, copper prices are riding on the energy shortage crisis. While the crisis prompted metal supply cuts from China to Europe, a rebound in economic activities due to improved vaccination rates have concurrently been driving demand. The supply-demand imbalance has been reflected in the near-record low for global copper stockpiles, along with copper contracts trading in steep backwardation on the London Metal Exchange.

A look at the copper net non-commercial positioning data from the Commodity Futures Trading Commission (CFTC) indicated an increase in net-long positions from the week before. However, as copper prices near its all-time closing high, one may note that non-commercial net-long positions widely trail behind its February 2021 high. This may suggest that some market participants continue to stay on the sidelines, over concerns of softening industrial production in China and further reserve sales putting a cap on further upside.

Recent moves by China’s government to rein in coal prices ahead of winter may spur some worries that authorities are increasingly concerned on surging commodity prices, which may flow through into industrial metals. Markets caught a glimpse of this back in June, when China released some industrial metals from its national reserves to curb surging prices, fuelling some expectations that price upside may be capped by government intervention.

Copper – technical analysis

After a recent surge above its previous consolidation zone, copper prices have come off a little from its three-month high and continues to hover above the key US$10,000 per metric ton mark. A recent retest of the US$10,000 level yesterday was met with a bullish rejection, suggesting that buyers are trying to keep in control. A break below this level may potentially bring further downside to the US$9,476 level next, where a previous resistance will now serve as support.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

React to volatility on commodity markets

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.1

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

1In the case of all DFBs, there is a fixed expiry at some point in the future.

See opportunity on a commodity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on a commodity?

Don’t miss your chance. Upgrade to a live account to take advantage.

- Analyse and deal seamlessly on fast, intuitive charts

- Get spreads from just 0.3 points on Spot Gold

- See and react to breaking news in-platform

See opportunity on a commodity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.