Are these the best cryptocurrency and blockchain stocks to buy?

Cryptocurrency stocks are a great way to tap into the rapidly growing digital currency market, without betting it all on bitcoin. Read on to learn how to trade or invest in blockchain stocks, crypto stocks, and more.

Top 5 cryptocurrency and blockchain stocks to watch

As crypto trading becomes more mainstream, investing in crypto shares and blockchain stocks can allow investors to access the potential upside of the crypto trend, without having to navigate the complicated world of digital wallets and crypto exchanges.

Our cryptocurrency stocks list offers a sense of the diversity of the crypto stocks and shares market.

Unlike pure cryptocurrency investments, these companies are publicly listed and therefore abide to the usual financial regulations. This significantly reduces the risks associated with crypto investing, and allows investors to access the sort of liquidity that is typical for stocks and shares investments.

Coinbase

Coinbase is the largest cryptocurrency exchange in the US, and a hugely influential player in the global crypto markets. Traders have spoken about ’the Coinbase effect’, which is the theory that digital tokens will see a quick price increase after they’ve been listed on the exchange.

In April 2021 – just nine years since the company was established – Coinbase went public with a direct listing on the Nasdaq exchange. By the end of the first day of trading, Coinbase shares were selling for more than $328 apiece, giving the company an initial market cap of $85.8 billion on a fully diluted basis.

Coinbase takes a small transaction fee every time someone places an order to buy or sell a crypto asset, which means that the more activity there is on the platform, the better the stock performance should be. This makes it a good option for investors and traders who want to benefit from the rising popularity of the cryptocurrency sector in general, without buying individual coins.

Riot Blockchain

Often named as one of the best blockchain stocks, Riot Blockchain is one of a handful of companies that engages in Bitcoin mining on an industrial scale.

Bitcoin is by far the most well-known and popular cryptocurrency, with valuations reaching a high of $64,829.14 (around £47,000) per coin in early 2021. Riot Blockchain is based in North America, and uses thousands of miners to find and secure new blocks of Bitcoin. The company is on an acquisition spree at the moment, buying up new mining machines and other hardware to increase its capabilities and reduce its energy costs.

Riot Blockchain’s share price is closely linked with the value of Bitcoin, and that relationship is set to become even closer as Riot’s miners increase their share of the Bitcoin market. This makes Riot Blockchain one of the more interesting crypto mining stocks on the market because – unlike other Bitcoin companies – Riot plans to maintain a permanent stake in the Bitcoin ecosystem.

Square

The original aim of cryptocurrencies was to create a digital currency that could be used to make digital payments. Along with PayPal, Square is one of the largest payment processing providers in the world, and it has been facilitating payments via bitcoin since 2017.

In recent years, Square has been working to make it easier for its business users to use bitcoin as a payment, paving the way for wider crypto integrations in the future. For investors who believe in the future of digital payments, Square stock could be a good starting point.

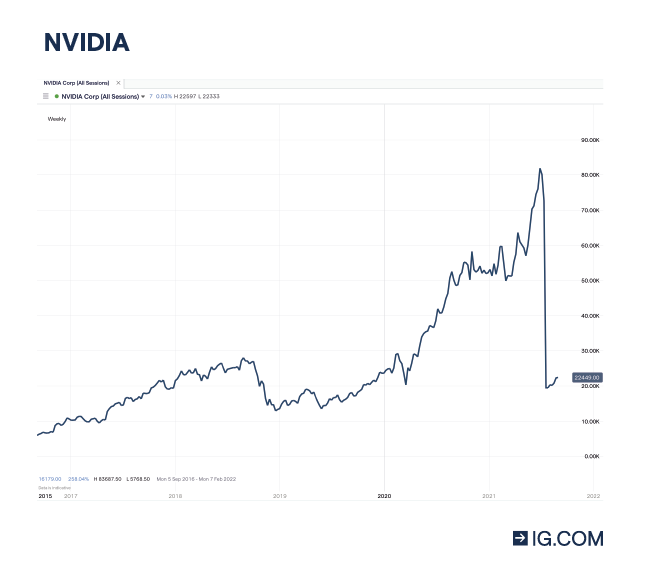

NVIDIA

Crypto mining requires an enormous amount of data, and all that data has to be stored on specialist graphics processing units (GPUs). NVIDIA’s GPUs are extremely sought-after by crypto miners, and the company’s stock has flourished as crypto mining has become more popular.

In early 2021, NVIDIA showed its commitment to the sector by launching a new line-up of chips specifically for crypto mining.

PayPal

PayPal is one of the largest payment providers in the world, and earlier this year it announced plans to allow its users to buy, sell and hold cryptocurrencies through its platform for the first time. In the US, PayPal customers can already use bitcoin, ethereum, litecoin and bitcoin cash to pay for items from participating retailers; a move that could bring crypto payments further into the mainstream, and forge a long-term connection between the listed payments provider and the unlisted crypto market.

How to trade or invest in cryptocurrency and blockchain stocks

Trading cryptocurrencies requires a very different skillset to trading stocks and shares. Many experienced investors are more comfortable wrapping crypto exposure into their investment portfolio indirectly via some key stocks and shares.

For example, investors can opt to buy into a growing crypto exchange such as Coinbase; a semiconductor firm such as NVIDIA, which produces graphics cards essential for crypto mining; or an industrial mining company such as Riot Blockchain.

With us, you can trade or invest in certain crypto-related stocks (like NVIDIA) using spread bets or CFDs.* When trading, you can speculate on both rising and falling market prices. Alternatively, you can via our share dealing service. Follow these steps to get started:

- Choose whether you want to trade or invest

- Create or log in to your account

- Identify your opportunity

- Carry out your own analysis and research

- Open and monitor your position

When trading with us, you’ll use leverage to open a position. While this lowers the cost of entry by means of margin, it magnifies both profits and losses. When investing, however, you’ll need to commit the full value of the position upfront and you can never lose more than the initial outlay. Always be sure to take the appropriate risk management steps.

One of the main risks of cryptocurrency trading is that the crypto sector is still largely unregulated, and so there are no protections in place for investors who fall victim to hacks or scams. By contrast, all stocks and shares are regulated in their home jurisdiction, which reduces this risk while also offering some exposure to the crypto markets.

What you need to know about the cryptocurrency industry

The cryptocurrency industry is incredibly diverse. Cryptocurrencies are not just used for trades, but some fulfil specific purposes – such as file sharing, Internet of Things (IoT) sector support, ‘bridging’ between different blockchains and more

As of January 2021, there are more than 4000 cryptocurrencies in the market each with their own development history, unique purpose, audience, and risk profile. Most crypto analysts split these currencies into three generations, with Bitcoin-inspired blockchain technology underpinning Gen 1, smart contracts and digital innovation representing Gen 2, and Gen 3 cryptos addressing ongoing issues around scaling, bottlenecking, and sustainability.

The main risk of crypto trading is the lack of financial standards and protection. Cryptocurrencies hackings are all too common, and there is increasing risk of market manipulation by big-money backers such as Elon Musk.

There is also immense volatility in crypto trading, which means that investors have to learn to hold their nerve. It is not uncommon to see 10% 20% price fluctuations in a 24-hour window. A combination of digital reporting, technical innovation, and social media means that cryptocurrency requires a very different trading mindset compared to conventional investing.

Best cryptocurrency stocks summed up

- There are several ways to access the crypto sector without actually buying or mining crypto coins directly

- Cryptocurrency shares are closely linked to the performance of the cryptocurrency market

- Blockchain stocks offer access to the technology which underpins bitcoin and other crypto assets

- Crypto currencies are not currently regulated, which makes them vulnerable to hacks and market manipulation

- However, crypto stocks are regulated in the same way as other stocks and shares

* We do not offer cryptocurrency trading in the UK, but you can get exposure to related stocks using the methods explained here.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.