How to buy US shares in the UK

The US stock market is home to many mega-cap companies, including Apple, Google and Amazon. Learn more about buying and trading shares in a US-based company with our guide: how to buy and trade US shares in the UK.

Complete a W-8BEN form

No individual can buy US shares without a W-8BEN form – it is a requirement of the American Internal Revenue Service (IRS). Therefore, the second step to buying US shares in the UK is to fill out this form. You don’t have to download anything; it can be completed on our online platform.

The W-8BEN is to confirm that you are not a resident of the US. It enables us to process an individual tax benefit on your behalf – a reduction of up to 30% in the amount of US tax you’re charged on dividends from the US shares you buy.

Find out more about filling out a W-8BEN form on our platform

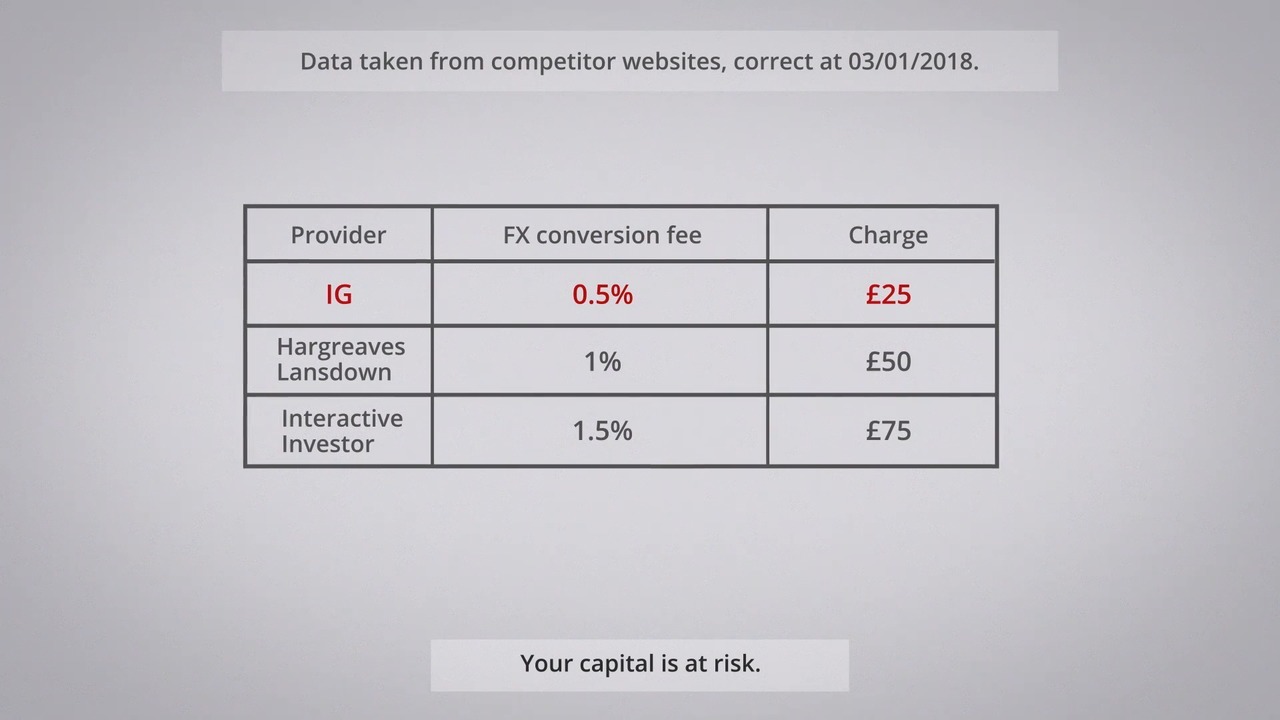

| US standard commission | US best commission | FX conversion fee | |

| IG | £10 | £0 | 0.5%* |

| Hargreaves Lansdown | £11.95 | £5.95 | 1.0% |

| AJ Bell | £9.95 | £9.95 | 1.0% |

*Increasing to 0.7% from 7 April 2025

You can only buy US shares in US dollars. IG will automatically convert your pounds into US dollars, charging a foreign exchange fee of just 0.5%. Remember, because you’re holding non-sterling assets, you’re exposed to foreign exchange risk and any currency fluctuations will affect the value of your international shareholding.

IG is the only provider in the UK that offers extended hours on dealing US shares. Because US companies release reports before and after the market closes, extended trading hours enable you to trade any subsequent price action.

There may be other charges and taxes including additional services and physical share certificate costs. We may also charge you a fee if we are required to perform a service on your behalf that is not set out in our product details.

If you buy shares, you can also earn dividends if the US company pays them to shareholders. Dividends may be charged a ‘withholding tax’, which is equivalent to your UK basic rate income tax liability but exempts you from paying any further tax on your foreign dividends. Plus, if you already have investments in US shares, you can transfer your existing holdings to IG quickly and easily.

Buy US shares

You can buy US shares through our share dealing platform. First, open your share dealing account online or on our trading app and deposit your funds. Next, log in and go to the share dealing platform or app and search for the stocks you want to buy.

Finally, choose whether you want to buy the shares at the current market price or if you want to set an order to buy the shares at a specified price. A limit order, for example, sets the price you are happy to pay and executes automatically when the price level is hit.

One of the features of share dealing is dividend payments. If you are due to receive dividend payments from the shares you own, we will pay them straight into your IG account once received.

Why buy US shares with us?

- Low costs and best possible prices

- Wide range of shares to choose from

- Dedicated support line, 24 hours a day (8am Sunday to 10pm Friday)

- Ease of access with a mobile app to manage your investments

Tax benefits

An IG share dealing portfolio can be placed in an Individual Savings Account (ISA), shielding your profits and income from capital gains tax. Likewise, investing in an IG self-invested personal pension (SIPP), you’ll receive tax relief on your contributions and pay no capital gains tax or income tax on your investments. Most foreign countries don’t charge stamp duty on your international share purchases, but if they do, it’s normally quite low.1

Trading derivatives on US shares in the UK

Trading US shares in the UK is an alternative if you do not want to buy the shares outright.

Trading is different to share dealing in that you don’t own the underlying asset, so you can go long or short on the shares. When you decide to trade US shares, you can trade using leverage, which means you put down a small deposit to gain full market exposure.

However, leverage magnifies your exposure because your profit or loss will be based on the full size of your position. If you want to open a leveraged position, you can do so via a CFD trading or spread betting account.

CFD trading and spread betting on US shares

A CFD is a contract in which you agree to exchange the difference in the price of shares from when you open your position to when you close it. You can buy CFDs to go long or sell them to go short. When you trade shares via spread betting, you are placing a bet on whether its price is headed up or down. As the share price moves in your chosen direction, you make a profit. If it moves against you, you make a loss.

Find out more about CFD trading and spread betting, and learn more about buying shares with us, or how to get started investing in stocks

Benefits of trading US shares with IG

- You can go long or short – speculating on rising or falling prices

- Since you don’t own the underlying asset, you don’t have to pay stamp duty

- When you trade CFDs, you can offset your losses against profits for capital gains tax liabilities

- With spread betting, your profits are exempt from capital gains tax (UK only)

- You can use spread betting or CFDs as a hedging tool

- No commission payable when spread betting – only a spread, and overnight funding charges if your position stays open

Extended hours trading on US shares

The US stock market opens from 2:30pm to 9pm (UK time), so you can trade US shares trade up until 9pm. Extended hours are also available to share dealing clients, from 12pm to 10.30pm Monday to Thursday and until 10pm on a Friday.

CFD and spread bet clients can trade up until 1am Monday to Thursday and 10pm on a Friday (UK time).

Please note that the hours mentioned here depend on stock exchange opening hours, and may vary or change as countries shift to and from daylight savings time.

Learn about out of hours shares trading

1Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.