What time do the pre-market and post-market open and close?

Discover when you can buy and sell shares, indices and forex in the pre and post-market.

Stocks after hours times: what time can stocks be traded in the pre-market and post-market?

Pre and post-market trading hours are extensions of the regular trading hours of a specific stock exchange, enabling traders to react to moving markets in real time.

Instead of going through a centralised exchange, after-hours trading occurs via an electronic market such as an electric communication network (ECN) or an alternative trading system (ATS). They work like a secondary market where any orders not filled during this timeframe are void and do not transfer onto the stock exchange when it re-opens.

Although there’s some misconception that out-of-hours trading is illegal, this is far from true. The pre and post-markets are available to anyone via a broker, enabling you to react to significant market news or updates as they occur.

Is the pre-market price a good indicator?

Whilst the pre-market can be an effective way to gauge market sentiment and indicate a stock’s opening price, it’s not always accurate. Due to low liquidity in the out of hours markets, stock consensus can rapidly change once the market re-opens and trading volume increases.

It is therefore worth considering other factors such as earnings reports, price history and world events when trying to accurately determine market sentiment.

It’s also worth noting that the pre-market stock price doesn’t explicitly influence it’s opening price. Instead, this is decided by a short auction which occurs just before the market re-opens, and the most frequently traded figure becomes the opening price for that day.

After hours stock price

Much like trading on a centralised exchange, the stock price throughout this period is determined by supply and demand. The more people who wish to buy a certain stock, the more it goes up and vice versa.

With out-of-hours-trading however, comes an increased risk. As there are often fewer participants than there are during normal market hours, there is less liquidity and markets are more volatile as a result.

US stock exchange opening hours

|

NYSE1 | NASDAQ2 |

| Normal trading hours (UK time) | 2.30 to 9pm Monday to Friday | 2.30 to 9pm Monday to Friday |

| Pre-market trading hours (UK time) | 9am to 2:30pm Monday to Friday | 9am to 2:30pm Monday to Friday |

| Post-market trading hours (UK time) | 9pm to 1am Monday to Friday | 9pm to 1am Monday to Friday |

| IG extended hours | 12pm to 10.30pm Monday to Thursday 12pm to 10pm Friday |

12pm to 10.30pm Monday to Thursday 12pm to 10pm Friday |

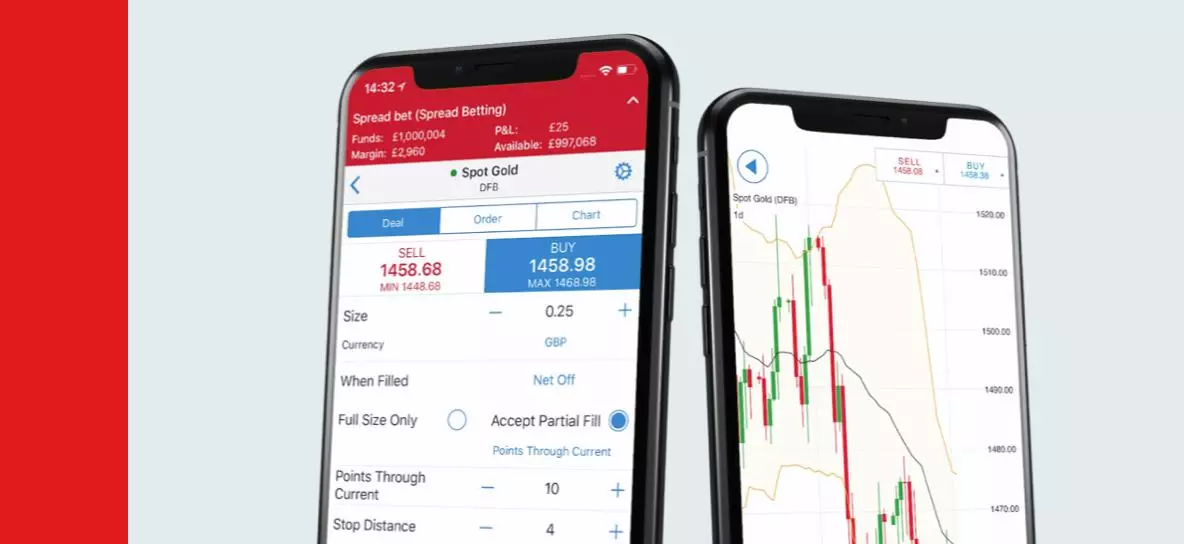

With us, you can buy and sell shares in both pre and post-market trading hours. We also offer the ability to trade shares with derivatives out of hours - using spread betting and CFD trading.

It's worth noting however, that CFDs and spread bets are leveraged products where you're exposed to the whole position no matter the size of your initial margin. Whilst this may result in increased earnings, there's a greater risk involved and it's possible you could lose money faster than expected.

Whilst the majority of listed stocks are available to trade on the pre and post-market, companies with fewer than 20 million shares may not deem this a financially viable option. So it’s worth checking with your broker to see which stocks you can trade.

US shares opening hours

| CFD and Spreadbet | Share Dealing | |

| Normal trading hours (UK time) | 2.30pm to 9.30pm Monday to Friday | 2.30pm to 9.30pm Monday to Friday |

| Pre-market trading hours (UK time) | 9am to 2.30pm Monday to Friday | 9am to 2.30pm Monday to Friday |

| Post-market trading hours (UK time) | 9pm to 1am Monday to Friday | 9pm to 1am Monday to Friday |

| IG extended hours | 12pm to 10.30pm Monday to Thursday 12pm to 10pm Friday |

12pm to 10.30pm Monday to Thursday 12pm to 10pm Friday |

Stock market indices: when can you trade indices out of hours?

Index trading is a way to take a position on the price performance of a group of stocks from a specific exchange, sector, or country. For example, the S&P 500 tracks the daily price movement of 500 large American companies listed on the NYSE or the NASDAQ.

Trading indices is conducted via derivatives such as spread bets and CFDs where you can speculate on the price direction of the index and take advantage of rising and falling markets.

Whilst most index trading occurs during the opening times of the relative stock market, with us, you can also trade outside of these hours.

Index trading hours

| FTSEE 1003 | S&P 5004 | Dow Jones5 | NASDAQ | Hang Seng6 | DAX7 | |

| Normal index hours | 8am to 4.30pm Monday to Friday | 2.30 to 9pm Monday to Friday | 2.30 to 9pm Monday to Friday | 2.30 to 9pm Monday to Friday | 1.30am to 9am Monday to Friday | 8am to 4.30pm Monday to Friday |

| IG extended hours | 24/7 except for 10pm Friday to 8am Saturday | 24/7 except 7am Saturday to 8am Monday | 24/7 except 7am Saturday to 8am Monday | 24/7 except 7am Saturday to 8am Monday | 24/7 except 7am Saturday to 6.02am Monday | 24/7 except for 10pm Friday to 8am Saturday |

Forex: when can you trade currencies in extended hours?

As forex trading operates across multiple time zones and doesn’t take place on a centralised exchange with set opening hours, on weekdays you can trade forex 24 hours a day.

There is however a weekend break where forex trading becomes more difficult. Thankfully, we are the only trading platform to offer extended weekend trading hours, so you can react to moving markets and trade forex as you see fit.

Forex trading hours

| GPD/USD | EUR/USD | USD/JPY | |

| Normal trading hours | 24 hours Monday to Friday | 24 hours Monday to Friday | 24 hours Monday to Friday |

| IG extended hours | 8am Saturday to 8.40pm Sunday | 8am Saturday to 8.40pm Sunday | 8am Saturday to 8.40pm Sunday |

There are also many more forex pairs available to exchange and whilst on weekdays the market is open 24/7, some currencies in emerging markets are not. It is therefore worth checking the available trading hours for your desired forex pair before you begin trading.

How to start trading out of hours

- Research the market you want to trade

- Open an account (link to the app form)

- Find your market in our platform

- Place your trade

Forex: when can you trade currencies in extended hours?

- During weekdays forex is available to be traded 24 hours a day

- The weekend break making forex trading more difficult on Saturday and Sunday

- We are the only trading platform to offer forex trading on the weekend

Footnotes:

1According to the NYSE

2According to the NASDAQ

3Based on trading hours of the LSE

4Based on trading hours of NASDAQ and NYSE

5Based on trading hours of NASDAQ and NYSE

6Based on the trading hours of the HKEX

7Based on the trading hours of the FSE

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

See your opportunity?

Seize it now. Trade over 15,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.