Take a closer look at everything you’ll need to know about forex, including what it is, how you trade it and how leverage in forex works. Interested in forex trading with us?

Written by Anzél Killian, Senior Financial Writer. Reviewed by Axel Rudolph, Senior Market Analyst.

What is forex trading?

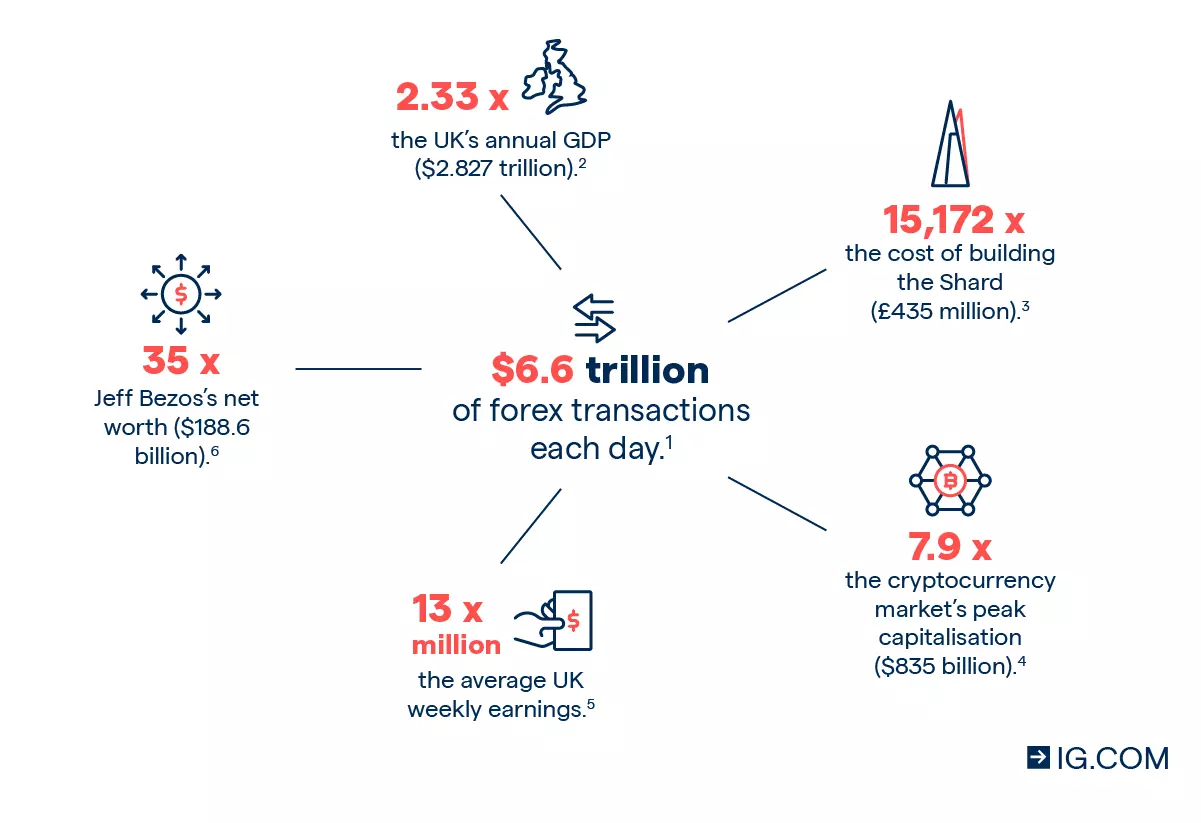

Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. FX is one of the most actively traded markets in the world, with individuals, companies and banks carrying out around $6.6 trillion worth of forex transactions every single day.

While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken by forex traders to earn a profit. The amount of currency converted every day can make price movements of some currencies extremely volatile – which is something to be aware of before you start forex trading.

We’re the UK’s number one retail forex provider7 – with a range of major, minor and exotic currency pairs for you to go long or short on.

Ready to start trading forex? Open an account to get started

Beginners’ guide to forex: learn currency trading in 6 steps

Forex trading essentials for beginners

- What is a forex pair?

- What are the base and quote currencies?

- What is a pip in forex?

- What is a lot in forex trading?

What is a forex pair?

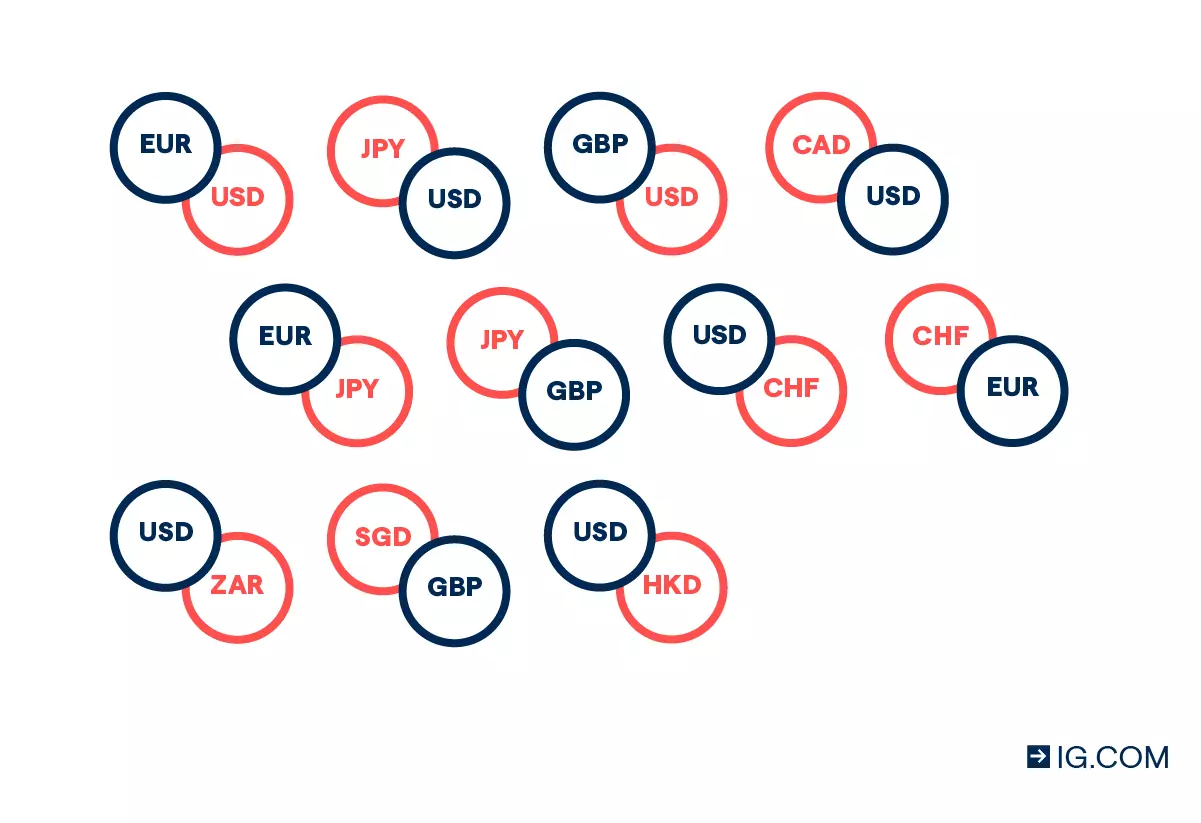

A forex pair is a combination of two currencies that are traded against each other. There are hundreds of different combinations to choose from, but some of the most popular include the euro against the US dollar (EUR/USD), the US dollar against the Japanese yen (USD/JPY) and the British pound against the US dollar (GBP/USD).

What are the base and quote currencies?

The base currency is always on the left of a currency pair, and the quote is always on the right. The base currency is always equal to one, and the quote currency is equal to the current quote price of the pair – which shows how many of the quote currency it’ll cost to buy one of the base. So, when you’re trading currency, you’re always selling one to buy another.

What is a pip in forex?

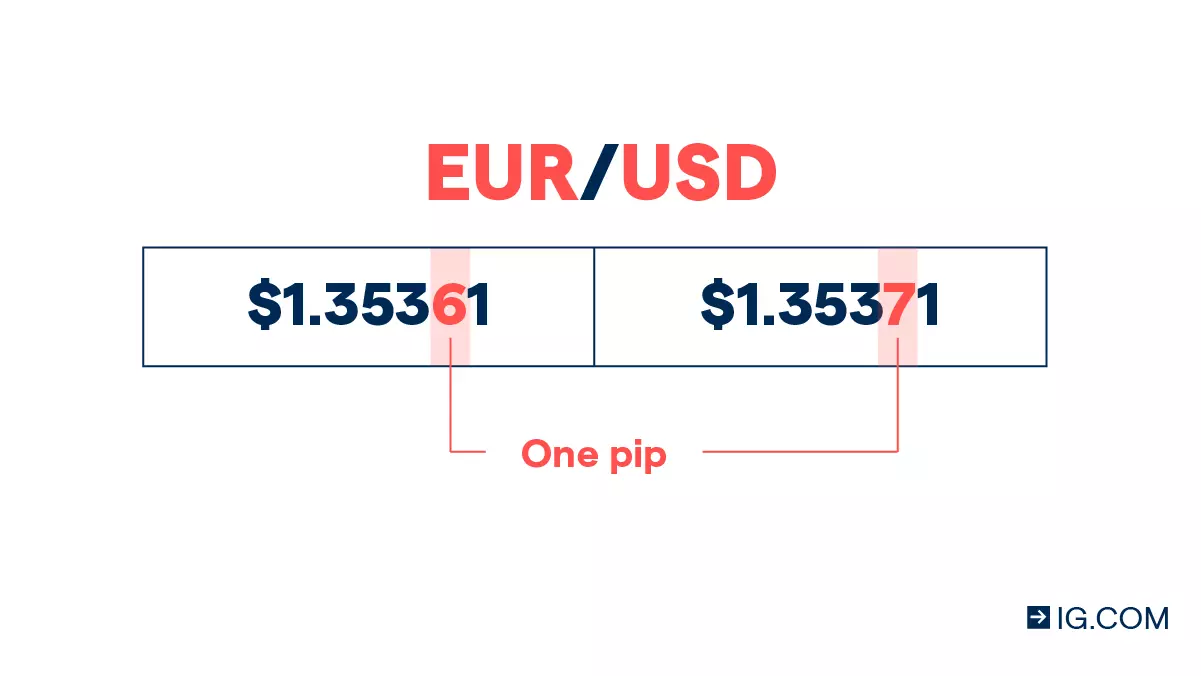

A pip in forex is usually a one-digit movement in the fourth decimal place of a currency pair. So, if GBP/USD moves from $1.35361 to $1.35371, then it has moved a single pip. But, if you’re trading JPY crosses, a pip is a change at the second decimal place. A price movement at the fifth decimal place in forex trading is known as a pipette.

What is a lot in forex trading?

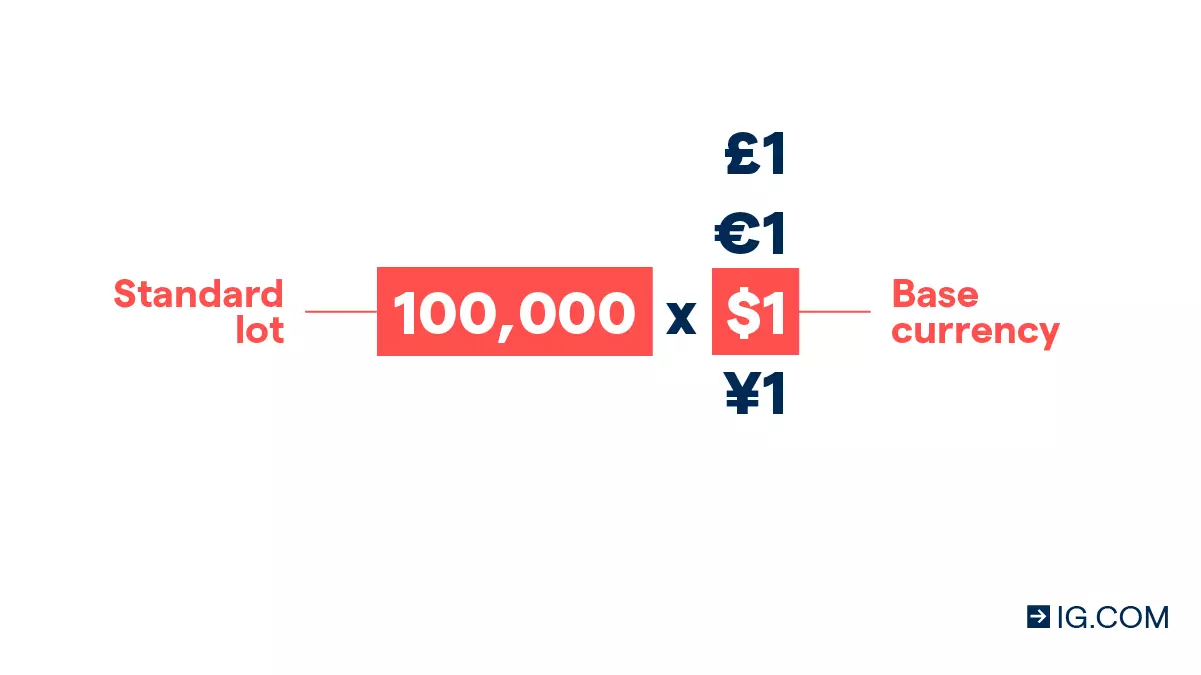

Currencies are traded in lots, which are batches of currency used to standardise forex trades. As forex price movements are usually small, lots tend to be very large. For example, a standard lot is 100,000 units of the base currency.

How does forex trading work?

Forex trading works like any other transaction where you are buying one asset using a currency. In the case of forex, the market price tells a trader how much of one currency is required to purchase another. For example, the current market price of the GBP/USD currency pair shows how many US dollars it would take to buy one pound.

Each currency has its own code – which lets traders quickly identify it as part of a pair. We’ve included codes for some of the most popular currencies below.

What does it mean to buy or sell a currency pair?

To buy a currency pair means that you expect the price to rise, indicating that the base currency is strengthening relative to the quote currency. To sell a currency pair means that you expect the price to fall, which would happen if the base currency weakened against the quote.

For example, you’d ‘buy’ the GBP/USD pair if you think that the pound will strengthen against the dollar – meaning you’ll need more dollars to buy a single pound. Or, you’d ‘sell’ this pair if you think that the pound will weaken against the dollar – meaning you’ll need fewer dollars to buy a single pound.What is the spread in forex trading?

The spread in forex trading is the difference between the buy and sell prices. For example, the buy price might be 1.3428 and the sell price might be 1.3424. For your position to be profitable, you’ll need the market price to either rise above the buy price or fall below the sell price – depending on whether you’ve gone long or short.

What are margin and leverage in FX trading?

Margin refers to the initial deposit you need to commit in order to open and maintain a leveraged position. So, a trade on EUR/GBP might only require a 3.33% margin in order for it to be opened. As a result, instead of needing £100,000 to open a position, you’d only need to deposit £3300.

Why do people trade forex?

Speculating on currencies strengthening or weakening

Traders speculate on forex pairs to profit from one currency strengthening or weakening against another. When the price of a pair is rising, it means that the base is strengthening against the quote and when it’s falling, the base is weakening against the quote.

That’s because a rising price means that more of the quote are needed to buy a single unit of the base, and a falling price means that fewer of the quote are needed to buy one of the base. So, traders would likely go long if the base is strengthening relative to the quote currency, or short if the base is weakening.

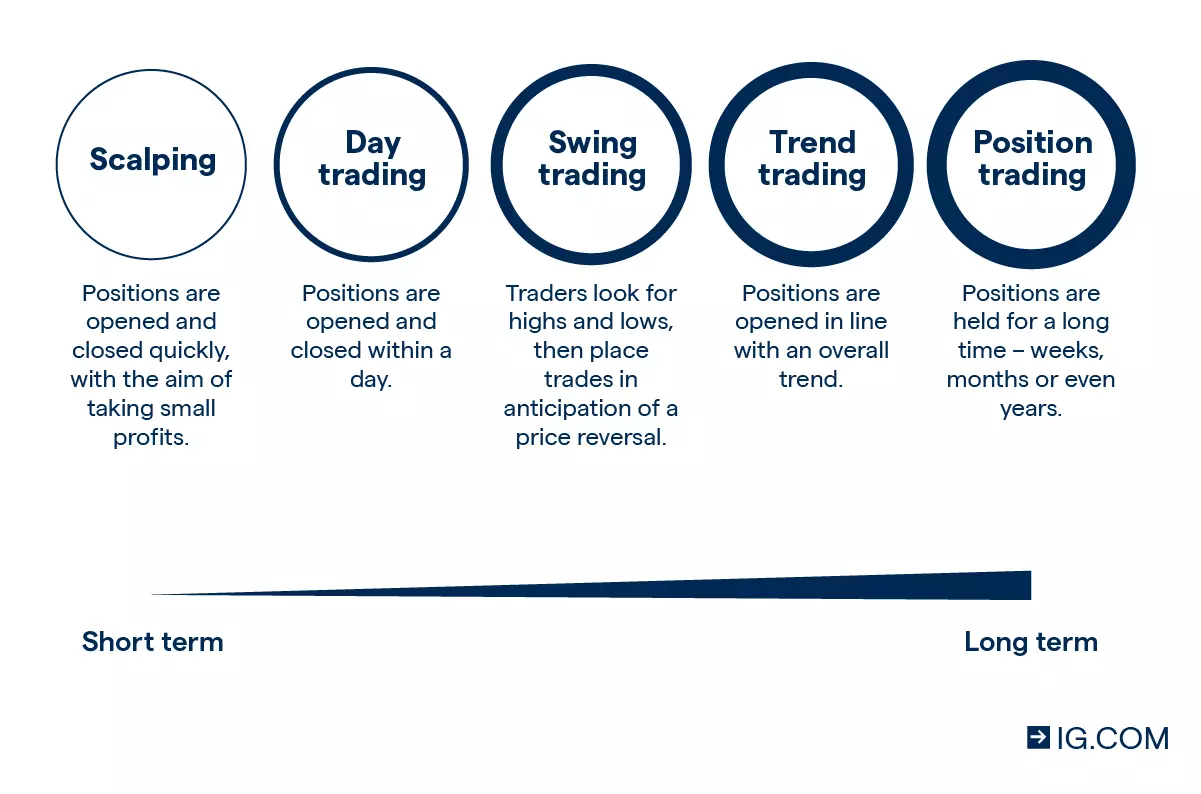

Some of the most popular forex trading styles are scalping, day trading, swing trading and position trading. You might choose a different style depending on whether you have a short- or long-term outlook.

Hedging with forex

Hedging is a way to mitigate your exposure to risk. It’s achieved by opening positions that will stand to profit if some of your other positions decline in value – with the gains hopefully offsetting at least a portion of the losses. Currency correlations are effective ways to hedge forex exposure. An example would be EUR/USD and GBP/USD, which are positively correlated because they tend to move in the same direction. So, you could go short on GBP/USD if you had a long EUR/USD position to hedge against potential market declines.

Seize opportunity 24 hours a day

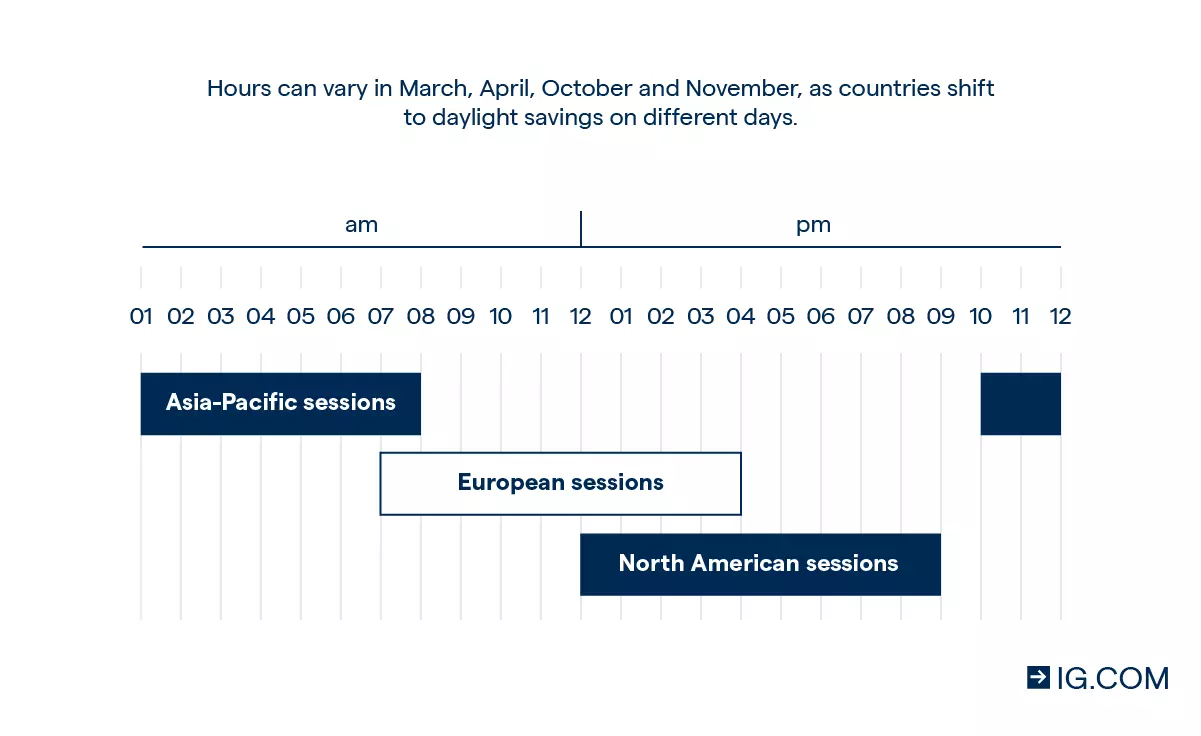

The forex market is open 24 hours a day thanks to the global network of banks and market makers that are constantly exchanging currency. The main sessions are the US, Europe and Asia, and it’s the time differences between these locations that enables the forex market to be open 24 hours a day.

The forex trading market hours are incredibly attractive, offering you the ability to seize opportunity around the clock. We are also the only provider to offer weekend trading on certain currency pairs, including weekend GBP/USD, EUR/USD and USD/JPY. That means you can trade these combinations when others can’t.

Learn how currency markets work

What moves the forex market?

The forex market is made up of currencies from all over the world, which can make exchange rate predictions difficult as there are many forces that can contribute to price movements. That said, the following factors can all have an effect on the forex market.

Supply and demand

Exchange rates for forex pairs are based on the supply and demand of one currency versus another. In basic terms, if demand for one currency is greater than another then the price of the first currency will rise against the second.

The below factors all feed into what influences supply and demand.

Central banks

A currency’s supply is controlled by central banks, who can announce measures that will have a significant effect on that currency’s price.

Central banks choose whether to increase or decrease interest rates. Typically when a country chooses to raise interest rates, the country's currency may increase in value. This is because it attracts foreign investors who want to benefit from the higher interest rates.

Quantitative easing, meanwhile, involves injecting more money into an economy, and can cause a currency’s price to fall in line with an increased supply.

Interest rates and carry trades

One of the more popular investments among institutional investors is called a carry trade - based on interest rate differentials between countries.

This involves selling a currency with a low interest rate, with the goal of using the proceeds to buy a currency with a higher interest rate. This aims to capture the difference between the rates.

Fiscal policy

This is how governments influence the levels and allocations of taxes and public spending. The currency of a country with, for example, a high debt ratio and low growth is likely to be sold off. FX traders may instead prefer to buy a currency of a country with lower debt and higher growth.

International trade

Both anticipated and actual international trade between countries also influences FX prices. For example, a currency from a country with a trade deficit could be worth less than one with a trade surplus.

This is because a country with a trade deficit imports more goods and services than it exports - and therefore needs to buy the currencies of its trading partners to pay for these imports.

News reports and market sentiment

Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. If negative news hits, then demand might be expected to fall. This is why currencies tend to reflect the reported economic health of the region they represent.

Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand.

How to become a forex trader

Learn the ways to trade forex

There are several ways to trade forex, including trading spot forex, forex forwards and currency options. When you trade with us, you’ll be speculating on the price of spot forex, forwards and options either rising or falling with a spread betting or CFD account.

- Spot forex trading lets you trade forex pairs at their current market price with no fixed expiries

- Forex or currency forwards enable you to trade forex pairs at a specified price to be settled at a set date in the future or within a range of future dates

- Forex or currency options let you trade contracts that give the holder the right, but not the obligation, to buy or sell a currency pair at a set price, if it moves beyond that price within a set time frame

All of these – spot, forwards and options – can be traded with FX spread bets and FX CFDs. These are financial derivatives which let you speculate on whether prices will rise or fall without having to own the underlying asset.

What is a forex broker?

A forex broker provides access to trading platforms that can be used to buy and sell currencies. For example, when you trade forex with us, you’ll be able to use our award-winning platform8, MT4 or TradeView – all of which have their own unique benefits.

Forex brokers charge a fee, usually in the form of a spread. This is the difference between the buy (offer) and sell (bid) prices, which are wrapped around the underlying market price. The costs for a trade are factored into these two prices, so you’ll always buy slightly higher than the market price and sell slightly below it.

Traditionally, a forex broker would buy and sell currencies on behalf of their clients or retail traders. But, with the rise of online trading, you can buy and sell currencies yourself with financial derivatives like spread bets and CFDs, so long as you have access to a trading platform. This is because all forex trades are conducted over-the-counter (OTC), rather than on exchange like stocks.

Discover the risks and rewards of trading forex

- Forex is the most-traded financial market in the world, which means that forex prices are constantly moving, creating more opportunities to trade

- Some forex pairs are more volatile than others. Those with low liquidity are often more volatile, including many ‘minor’ pairs

- Pairs that include USD are often more liquid because as the world’s reserve currency, USD is often in high demand

- Slippage is sometimes an issue in forex trading, given how volatile the market can be. To help mitigate the effects of slippage on your forex trades, you should add stops and limits

- But, if you are aware of the risks and take appropriate steps to mitigate your exposure, then the forex market can be the source of your next opportunity

Free forex trading courses and webinars

To succeed when trading forex, you’ll need to take advantage of educational resources and platforms to help you build your confidence. We offer both: IG Academy and our demo account.

IG Academy has a wealth of information to get you acquainted with the markets and learn the skills needed for boosting your chances of trading forex successfully. Alternatively, you can use an IG demo account to build your trading confidence in a risk-free environment, complete with £10,000 in virtual funds to plan, place and monitor your trades.

We also offer trading strategy and news articles for all experience levels. This includes ‘novice’, like how to be a successful day trader, up to ‘expert’ – looking at technical indicators that you’ve perhaps never heard of.

Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. You’ll get access to award-winning platforms,8 expert support around the clock and spreads from just 0.6 points.

Determine your risk per trade

The risk-per-trade method is a basic money management strategy in trading. It involves deciding how much of your trading account you're willing to risk on any single trade. In general, it's best not to risk more than 2-3% of your account on a trade.

This ensures you have enough money to handle a series of losses. It's better to risk small amounts and gradually increase your account, rather than risk too much and deplete your trading funds.

Don't overtrade

There's no need to make a trade every hour or even every day. Wait for a good trade setup and avoid chasing the market for trading opportunities. Patience and discipline are key to successful trading. Overtrading won't help, even with the best money management plan.

Cut your losses and let your profits run

Successful traders follow the rule of cutting losses quickly and letting profits run. They close losing positions early, but let winning positions continue. Beginners often do the opposite, holding onto losing positions hoping they will turn around, and closing profitable positions too early for fear of missing out. It's important to adopt the mindset of cutting losses and maximising profits.

Always use stop loss orders

Stop loss orders are vital for risk and money management and should be part of any trading money management plan. A stop loss order automatically closes your position when the price reaches a certain level, limiting potential losses. All trading money management strategies should include stop loss orders.

Aim for trades with a reward-to-risk ratio of at least 1

Studies have shown that traders who enter trades with a reward-to-risk ratio of 1 or higher tend to be more profitable. The ratio refers to the potential profits and losses of a trade. By only taking trades with a ratio higher than 1, you need fewer winning trades to break even.

Calculate your position size correctly

Many traders struggle with calculating their position size to maintain their defined risk-per-trade. Position sizes are crucial in money management as they determine a trade's potential profit. To calculate your position size accurately, take the total risk per position and divide it by the risk-per-trade. The result gives you the maximum value you can take to maintain your defined risk-per-trade.

For example, if your total risk is 1% of a £10,000 account, your risk-per-trade is £100. If you trade with a 10 pip stop loss, let's say buying GBP/USD at $1.2000 with a stop loss at $1.1990, your position size (how much you can buy or sell) is then £10 per pip ($1.2000-$1.1990 = $0.0010 or 10 pip risk; multiplied by £10 per pip spread bet = £100 risk-per-trade).

If your stop loss is at $1.1900, you'd be risking 100 pips and your position size would drop to £1 per pip ($1.2000-$1.1900 = $0.0100 or 100 pip risk; multiplied by £1 per pip spread bet = £100 risk-per-trade).

Be cautious with leverage

Trading with leverage can attract new traders to financial markets. However, leverage is a double-edged sword. It can increase profits, but it can also magnify losses. Be cautious and understand the risks when trading with leverage.

Avoid greed

Greed and fear can harm your trading decisions. With experience, you'll learn to manage your emotions so they don't affect your trading. It's important to be realistic about your goals. Avoid overtrading and setting unrealistic profit targets. A trade with a high risk and a low profit target is likely to result in a loss.

Use trailing stops to secure profit

An effective trading money management plan should include different types of stop loss orders for different market conditions. When a market is trending strongly, it might be wise to use a trailing stop set at the average height of the correction wave.

This allows you to secure profits as the trend continues, as the trailing stop will automatically adjust your stop loss.

Remember, successful trading requires discipline, patience, and a solid money management plan.

Page last updated: 20 October 2023

Latest forex trading news

FAQs

What does forex (FX) trading mean?

Forex trading means exchanging one currency for another. Forex is always traded in pairs which means that you’re selling one to buy another.

Is there a difference between forex trading and currency trading?

There is no difference between forex trading and currency trading, as both mean that you’re exchanging one currency for another. When forex trading or currency trading, you’re attempting to earn a profit by speculating on whether the price of a currency pair will rise or fall.

How can I make money from forex trading?

You can make money from forex trading by correctly predicting a currency pair’s price movements and opening a position that stands to profit. For example, if you think that a pair will decline in value, you could go short and profit from a market falling.

Alternatively, if you think a pair will increase in value, you can go long and profit from an increasing market.

How can I get started trading FX?

You can get started trading FX with a forex trading account. Plus, you’ll also need to be familiar with what moves the forex market – like central bank announcements, news reports and market sentiment – and take steps to manage your risk accordingly.

What costs and fees do you have to pay when currency trading?

The costs and fees you pay when trading currency will vary from broker to broker. But, you should bear in mind that you’ll often be trading currency with leverage, which will reduce the initial amount of money that you’ll need to open a position. Be aware though that leverage can increase both your profits and your losses.

How much money is traded on the forex market daily?

Approximately $6.6 trillion worth of forex transactions take place daily, which is an average of $250 billion per hour. The market is largely made up of institutions, corporations, governments and currency speculators – speculation makes up roughly 90% of trading volume and a large majority of this is concentrated on the US dollar, euro and yen.

Is forex trading income taxable?

The tax on forex positions does depend on which financial product you are using to trade the markets.

When you trade via a forex broker or through CFDs, any gains to your forex positions are taxable. However, your losses are tax-deductible, and depending on your circumstances can also be used to offset gains made elsewhere.

Alternatively, spread bets are a tax-free way to speculate on the forex market.9

How is the forex market regulated?

Despite the enormous size of the forex market, there is very little regulation because there is no governing body to police it 24/7. Instead, there are several national trading bodies around the world who supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards. For example, in the UK the regulatory body is the Financial Conduct Authority (FCA).

What are gaps in forex trading?

Gaps are points in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘gap’ in the normal price pattern. Gaps do occur in the forex market, but they are significantly less common than in other markets because it is traded 24 hours a day, five days a week.

However, gapping can occur when economic data is released that comes as a surprise to markets, or when trading resumes after the weekend or a holiday. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organisations. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap.

Try these next

Take a look at our list of financial terms that can help you understand trading and the markets

Be aware of the risks associated with forex trading and understand how IG supports you in managing them

Discover the different platforms that you can trade forex with IG

1 Bank of International Settlements Triannual Survey, 2019

2 Calculated using figures from the IMF, 2019

3 Calculated using the initial contract value for 15 October 2008

4 Calculated using data from Coin Market Cap

5 Calculated using Office of National Statistics average weekly earnings from Q3 2020

6 Calculated using a Forbes estimate of Jeff Bezos’s net worth, October 2020

7 By number of primary relationships with FX traders (Investment Trends UK Leveraged Trading Report released July 2024).

8 Awarded UK’s best trading platform at the ADVFN International Financial Awards 2020 and Professional Trader Awards 2019.

9 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.