Fixed costs definition

What is a fixed cost?

A fixed cost is a business expense which does not vary with production volumes. Fixed costs often include rent, contractual agreements or licences that are needed for the business to operate, which do not change in price if production increases or decreases. Instead, they are bound for the length of the contract or payment schedule.

Visit our news and trade ideas section

Get the latest news and market analysis from our in-house experts.

Fixed costs calculation

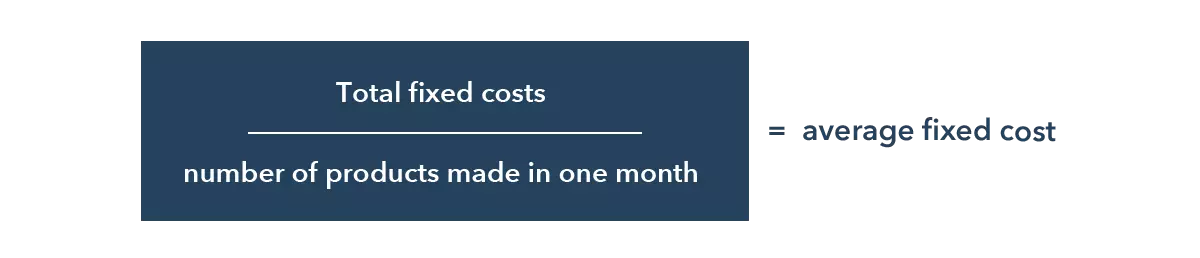

To calculate the average fixed cost of an asset over one month, you’ll first need to add up all of the fixed costs paid within that month. These will be payments such as the rent for office or factory space, utility bills, property tax or legal and administrative fees.

Once you have the total of all the fixed costs, you can divide that total by the number of products a company has made in one month for the average fixed cost.

Fixed cost example

As an example of fixed costs, let’s look at rent payments for a finance company. Suppose that the company pays £25,000,000 a year for its offices in central London. This equates to around £2,083,333.33 per month, which will be reported in the company’s fixed costs.

Regardless of whether demand for the company’s products has increased or decreased, rent will remain the same as it is not affected by consumer demand. However, fixed costs can still change over time – but not during the length of that current contractual agreement or rent schedule.

For example, they could increase if a company moves out of its current building and rent costs are more expensive than before; or they could decrease if any contractual or legal agreements change or expire. These changes are not due to shifts in production, but rather, a change in an established agreement or cost payment schedule.

Another example of a fixed cost would be a company’s utility bill, which may change according to the time of year but is generally not affected by supply of or demand for a company’s products. A company might pay £10,000 a month for heating and electricity in December, but only £2500 a month for the same in August.

Fixed and variable costs: what’s the difference?

Unlike fixed costs, variable costs are business expenses which do vary with production volumes. Variable costs include expenses such as materials and labour (salaries). For example, if a company is currently experiencing high demand for its products, it will need to buy in more materials and spend more on labour to meet output requirements.

Fixed costs and variable costs are reported separately by a business. Together, they account for the company’s total costs.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.