Internal rate of return definition

What is IRR?

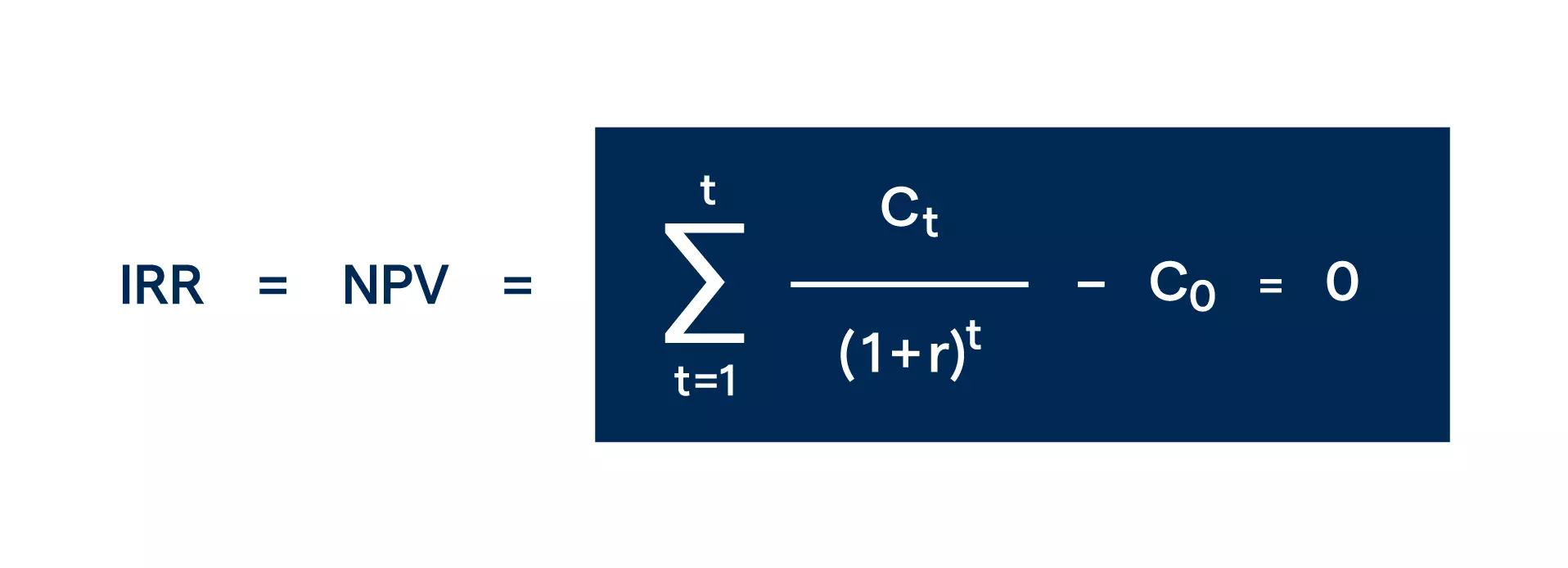

Internal rate of return (IRR) is a capital budgeting measurement used by companies to determine the profitability of a potential investment or project based on predicted cashflows. The IRR formula is complex and relies on a certain amount of trial and error to get correct.

Visit our news and trade ideas section

Get the latest news and market analysis from our in-house experts.

This is because IRR makes the net present value (NPV) of all cash flows equal to zero. The NPV is the difference between the present value of cash inflows (predicted profits) and the current value of cash outflows (predicted expenditure) over a period of time.

If this metric is made to equal zero, then it equates to identical cash inflows and outflows, which has led IRR to be criticised as overly simplistic.

IRR formula

With the NPV set to zero, the IRR formula then works out the discounted future cash flows from a project or investment. It does this from an estimate of the value of a future project, based on its predicted profits compared with predicted expenditure.

However, because of the complexity of the calculation, few traders calculate IRR manually, instead opting for specifically designed computer software.

Where:

Ct = net cash inflow during the period t

C0 = total initial investment cost

r = discount rate

t = number of time periods

What does IRR tell traders?

IRR tells traders the projected rate of growth that a company is likely to experience following a project. A high IRR means that a project is likely to be good for growth and a low IRR is an indicator of slow or minimal growth. However, IRR can sometimes be overly-optimistic and for that reason, some traders choose to use the modified internal rate of return (MIRR) instead.

A popular way that IRR is used in capital budgeting is for establishing whether new projects will be more profitable than expanding existing projects. Traders can use this information to make their own judgements about a company’s predicted growth, and whether to take a position on that company’s stock as a result.

Pros and cons of IRR

Pros of IRR

IRR can be useful for a business to determine the future growth and expansion it might experience as a result of a new project, compared to greater investment in its current operations.

As IRR is a uniform calculation for investments and projects of varying types, it can be used to rank different possible undertakings on an equal basis.

Cons of IRR

As previously mentioned, IRR tends to overestimate the potential returns of a project or future investment by making the NPV equal to zero. As a result, it is best used in conjunction with other capital budgeting measurements, such as MIRR.

IRR is also not an effective metric to use when comparing projects of different lengths, because shorter-duration projects often have a high IRR. Conversely, projects with a long duration often have a low IRR. This is not necessarily a true reflection of the potential returns of a project or investment.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.