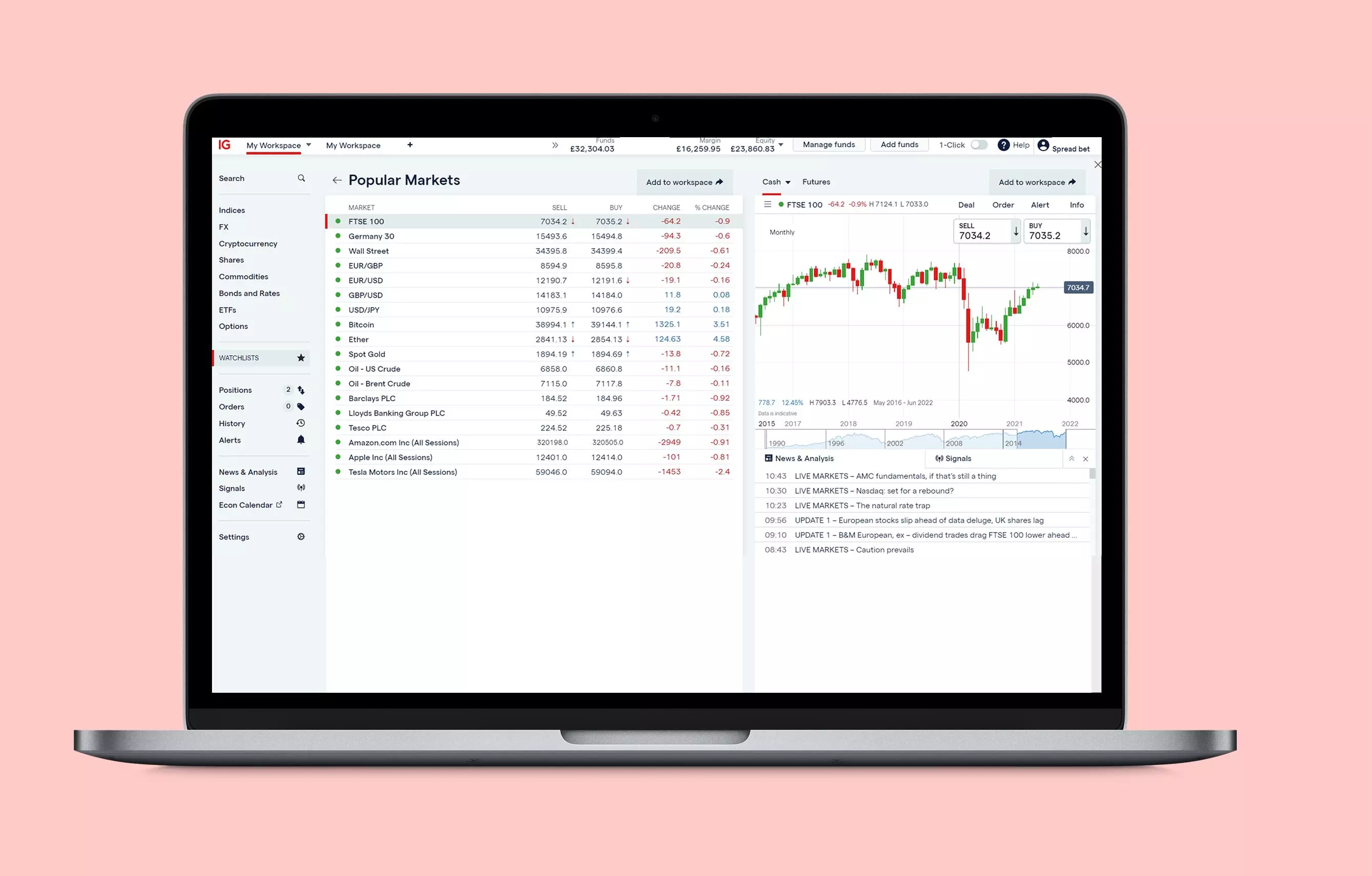

Learn how to trade online in the UK, and access key markets – like shares, indices, forex, commodities and more – with our award-winning platform.1 Ready to start trading?

Access a world of markets through online trading

Here are the five steps you’ll need to follow to start trading online:

Learn more about online trading

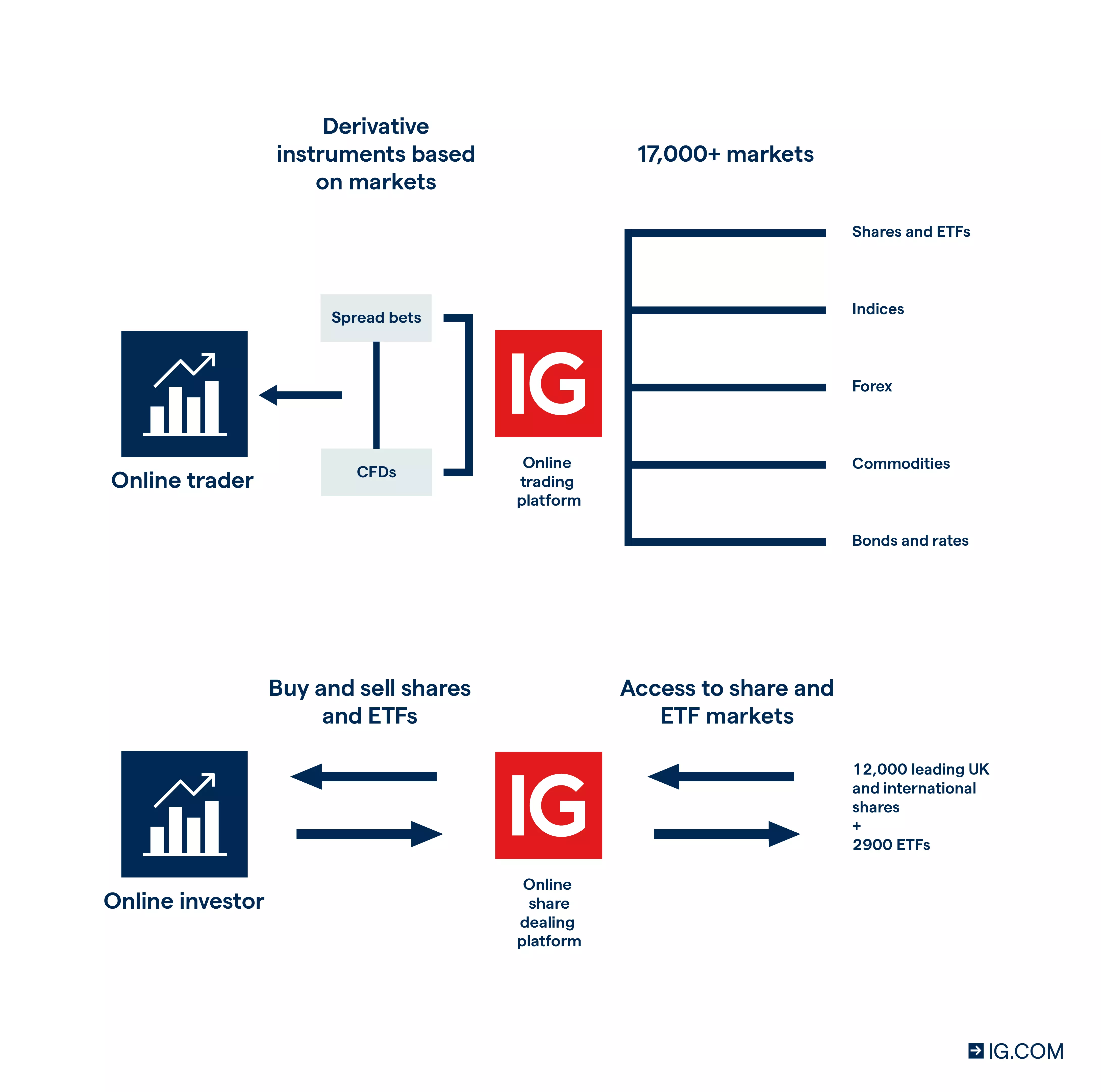

Online trading is a way for traders from a variety of backgrounds, and with diverse levels of experience, to access a wide range of the world’s most popular financial markets. When trading online, you’ll use derivative products to speculate on the price movements of underlying assets – without ever owning the asset itself.

This is because derivatives like spread bets and CFDs track the price of the asset on which they are based. Traders using derivatives never take delivery of the underlying, whether it be a physical commodity like gold or oil, foreign currency, or a security like company shares.

In comparison, if you invest, you’ll buy, own and sell an asset. For example, you can use our share dealing platform to buy and sell shares from over 14,900 leading companies and ETFs.

Online trading vs investing

Online trading is not the same as investing. When investing, you’ll actually buy and own the asset. In the case of shares, for example, this entitles you to voting rights and dividend payments if the company grants them. You can use our share dealing platform to invest in a wide selection of leading stocks and funds.

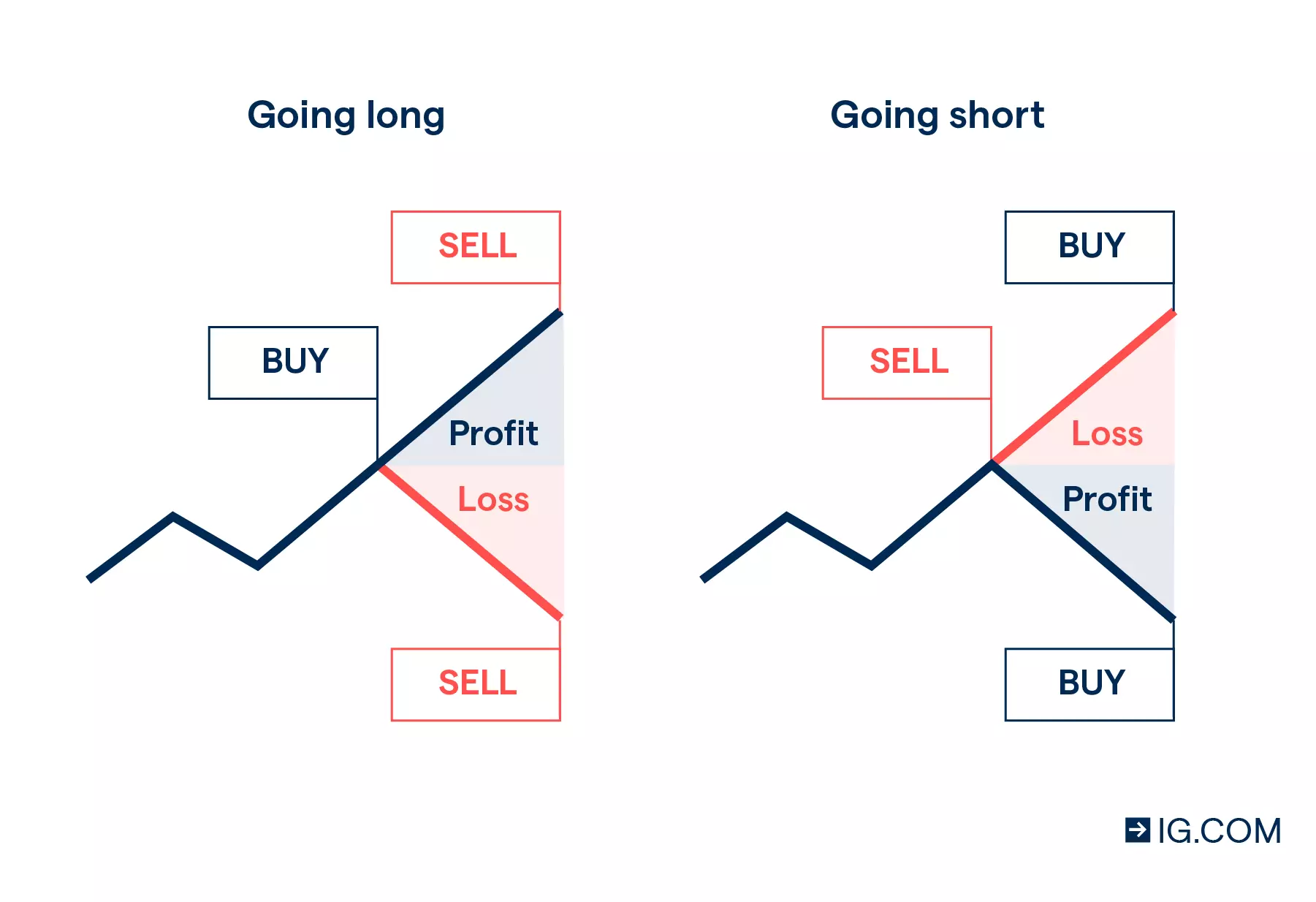

But, investing also means that you can only profit from price movements if you sell the asset for more than you paid for it. Because the price of your investment asset must appreciate in value, you are restricted to ‘going long’.

When ‘going long’, you believe that the price of an asset will rise over a certain timeframe, so you buy it with the intention of selling it later to earn a profit – ‘buy low, sell high’.

If you’re trading online using spread bets and CFDs, however, you can speculate on both rising and falling asset prices (go long or short). ‘Going short’ is the reverse of going long, enabling you to profit if you correctly predict the depreciation of an asset price.

When ‘going short’, you’ll open a trade by selling the derivative instrument at the current bid price. You would then later close the trade by buying the derivative back.

If your forecast is correct and the market decreases – meaning that you buy the derivative back at a lower amount – you’d earn a profit. Conversely, if the market price appreciates, you’d cut a loss. When going short, the difference between the opening sell price and the closing buy price is your profit or loss (excluding any costs).

However, please note that short selling is a high risk trading method because share prices can keep rising – theoretically without limit. This means that when taking a short position, you stand to incur unlimited losses. You can attach stops to your positions to protect yourself by capping your maximum potential loss.

Learn more about the differences between trading and investing

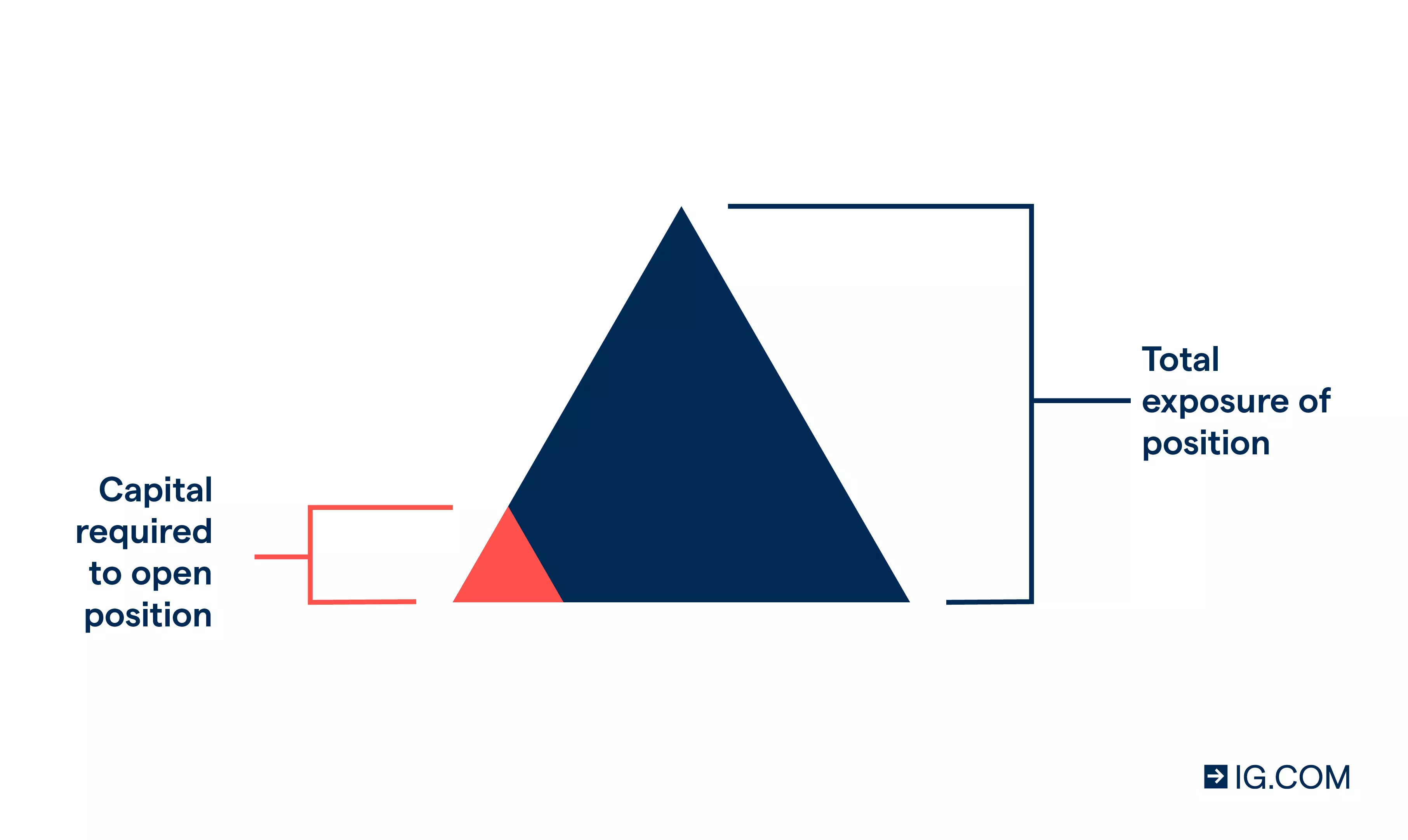

When investing – as you are buying an asset – you have to pay the full cost of the asset as an initial outlay. By contrast, when using derivatives, you can trade with leverage. Leverage enables you to open a trade by depositing a fraction of the total exposure of your position – called margin.

Say you want to open a position on Coinbase shares. If you choose to invest, you’ll have to pay the full value of the shares upfront. But, if trading with a leveraged derivative instead, you might only have to put down a deposit of 20% of your full exposure.

At a margin requirement of 20%, your leverage ratio is 1:5. This means that every 1% movement in the market price results in a 5% change in your deposit. While leverage can help to bring down your initial outlay, it will also act to amplify both your profits and your losses – so it’s vital to understand this feature of trading thoroughly before opening a position, and to take steps to manage your risk.

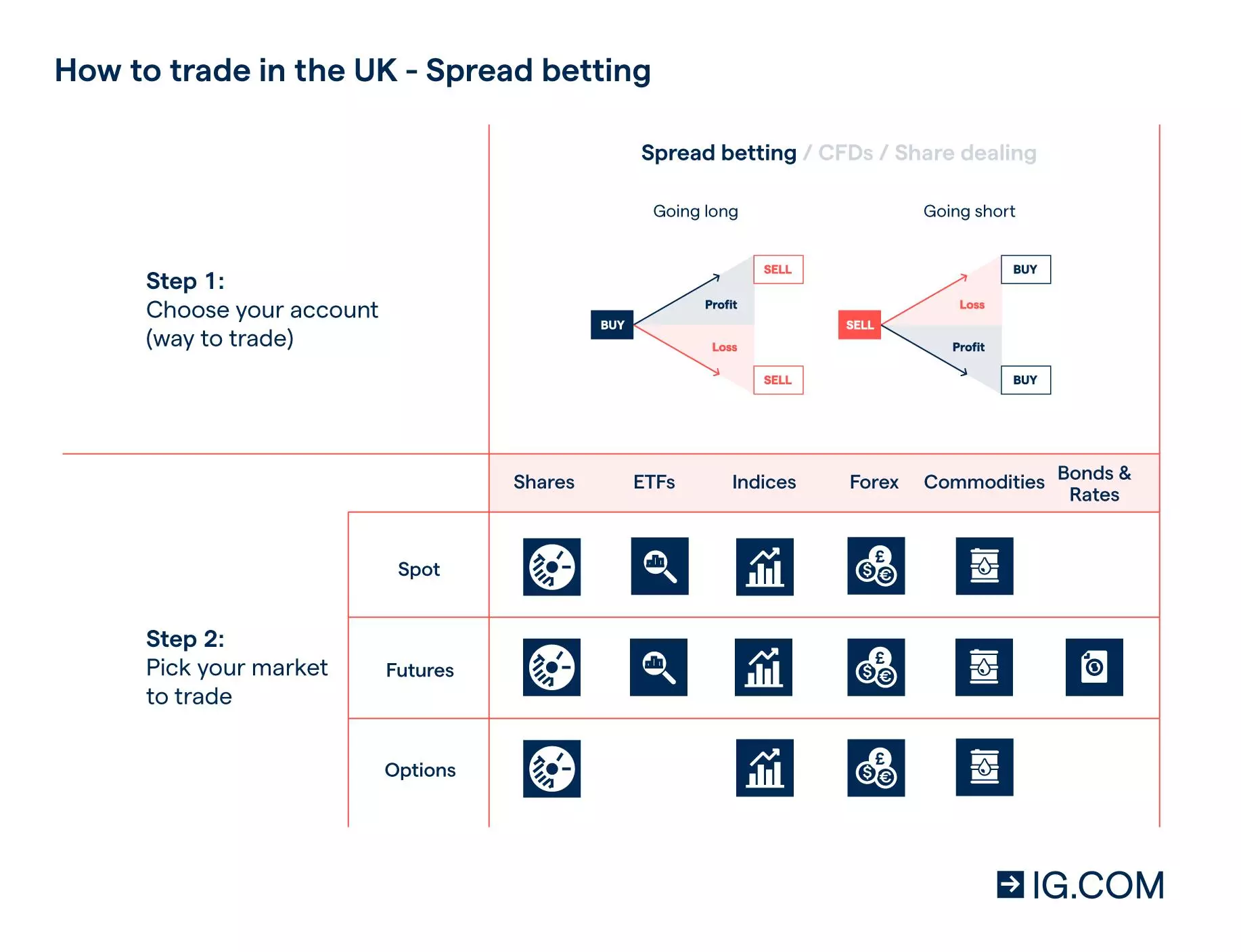

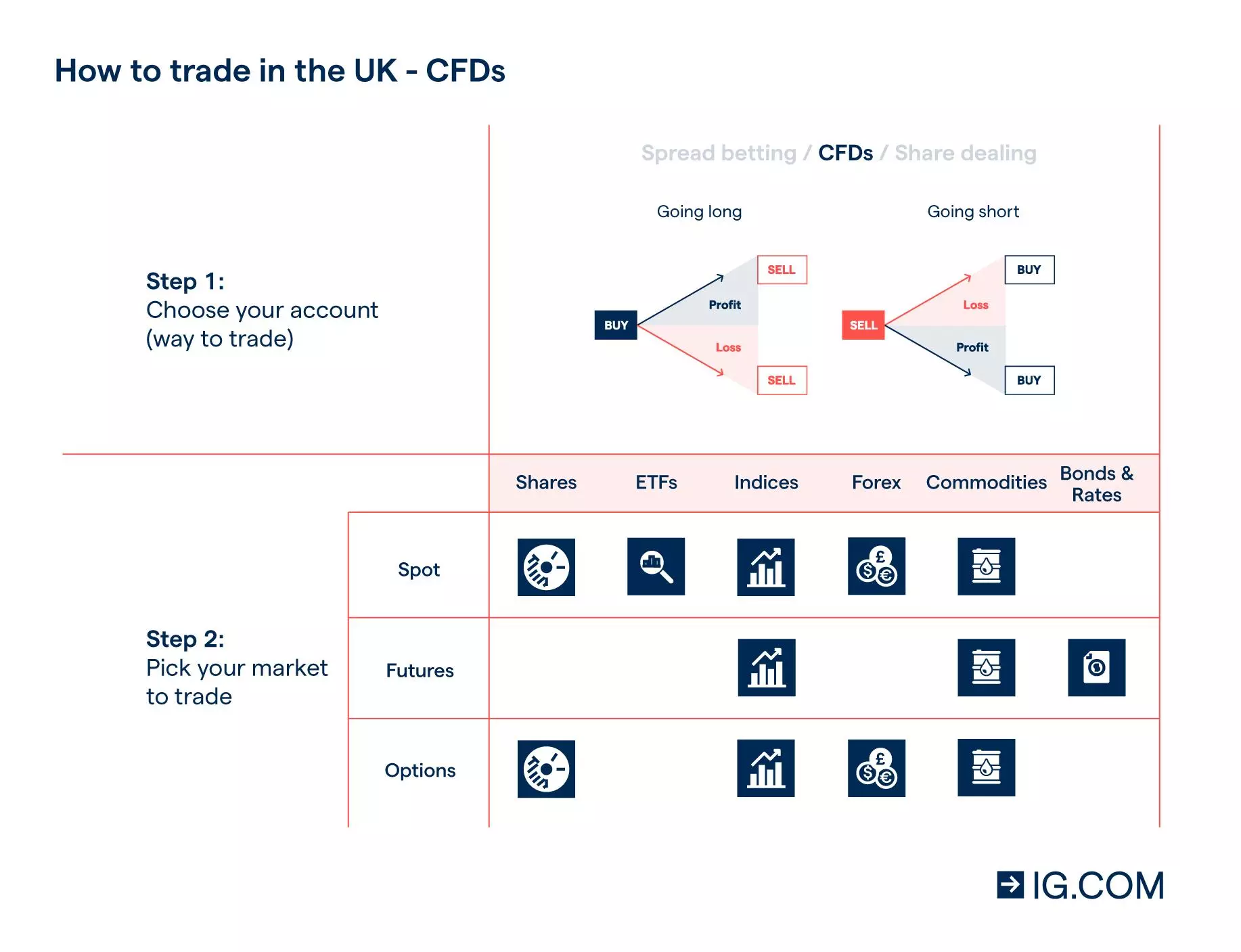

There are two main ways to trade online in the UK

With us, you’ll use spread bets and CFDs – both of which are leveraged derivatives – to access over 17,000 UK and international markets, including shares, commodities, forex, indices, ETFs and bonds.

- Spread bets

- CFDs

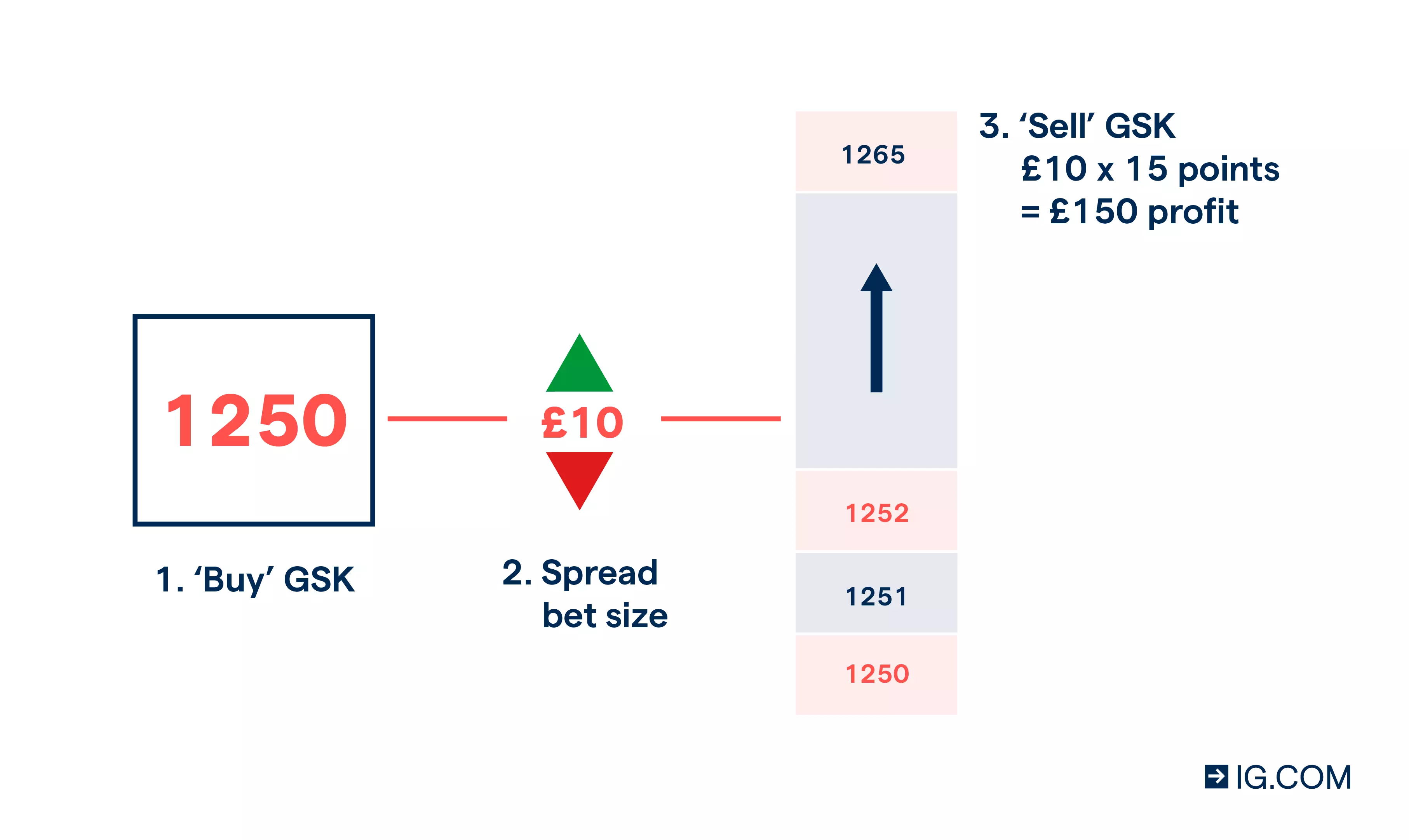

Spread bets work by tracking the value of an underlying asset so that you can take a position on changes in its market price without ever owning the asset itself. When you spread bet, you’ll be putting up a certain amount of capital per point of change. Your profit and loss is calculated by multiplying your bet size by the movement in the underlying market.

For example, after some research, you believe the share price of GlaxoSmithKline is set to rise. Consequently, you open a spread bet for £10 per point.

If you open your position by buying the stock at 1250 and close by selling at 1265, you’ll earn a profit of £150 (15 points x £10 per point). If, however, the market fell and you sold at 1240, you’d have cut a £100 loss. Possible profits and losses exclude any additional costs.

Remember that all leveraged trading puts your capital at risk, and you should always consider whether you can afford to lose more than your deposit.

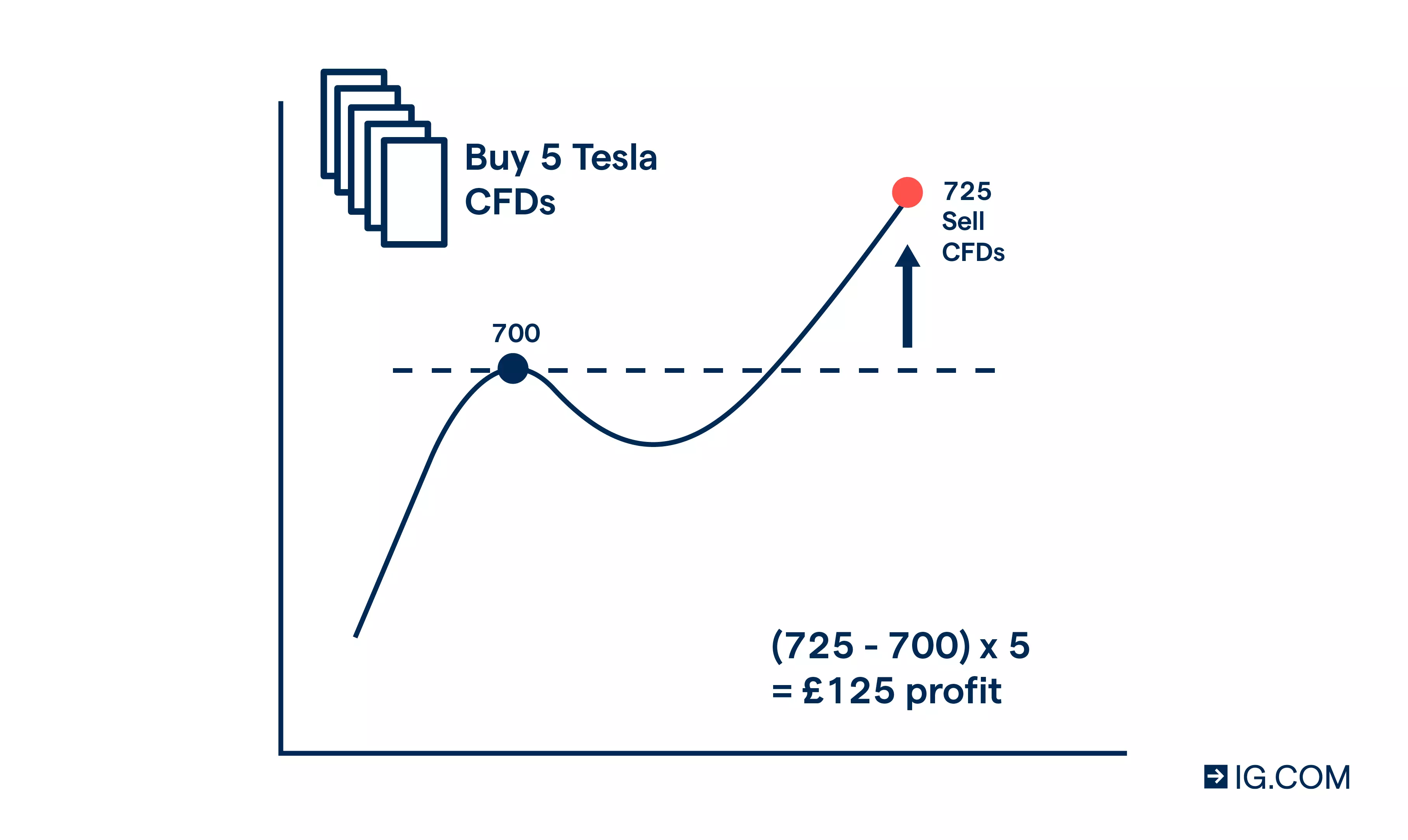

A ‘contract for difference’, or CFD, is an agreement to exchange the difference in price of an underlying asset, as measured from the time the contract is opened until the time it’s closed.

For example, you engage in analysis and believe that the price of Tesla will rise from its current level of 700. So you buy five Tesla share CFDs. Your forecast is correct, and you close your position when the market reaches a sell price of 725. The difference is £25.

Your total profits, excluding other costs, are calculated as follows: (725 – 700) x 5 CFDs = £125. If, however, the market moves against you, and you close at a level of 685, your loss would be £75.

You can trade both rising and falling markets with CFDs. To open your position, you’d buy a contract if you believe an asset’s price is set to increase, and you’d sell a contract if you think its price is going to fall.

Your profit or loss is determined by subtracting the price of the underlying at the time of buying the CFD from the price of the underlying at time of selling the CFD – no matter whether you buy or sell to open your trade.

But, please bear in mind that all leveraged derivatives are complex instruments and you could lose more than your initial deposit. All trading incurs significant risk.

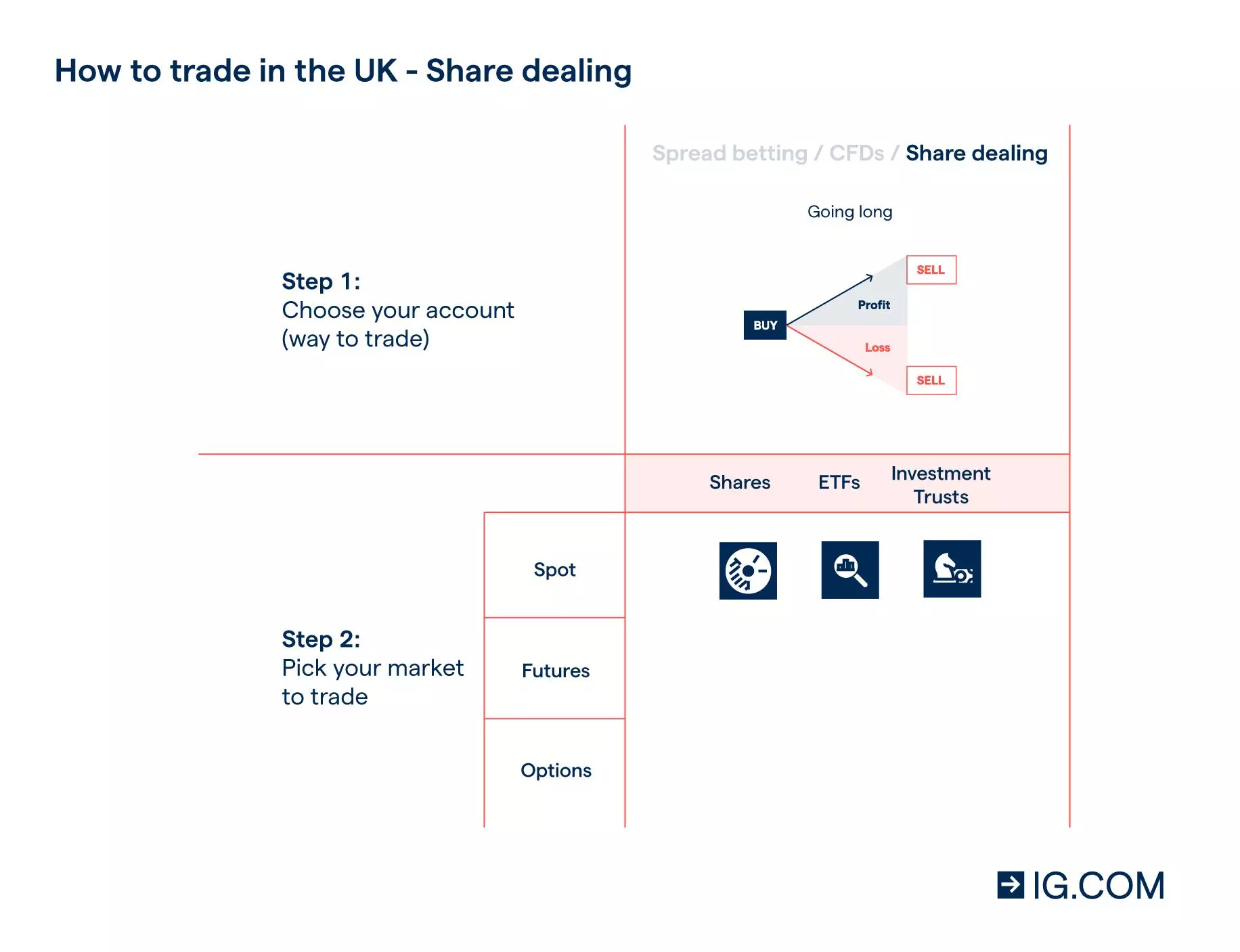

There are three main ways to invest online in the UK

If you’d prefer to opt for traditional investing over online trading, you can consider shares, exchange traded funds (ETFs) and managed portfolios:

| Shares | ETFs | Managed portfolios | |

|---|---|---|---|

| What is it? | Investing in an individual company’s shares. You might do this to benefit from long-term upward price movements, or to receive dividends and compound returns. | Investing in an ETF that tracks a group of companies. You might do this to benefit from the overall growth of an index or sector. |

Investing in a portfolio of ETFs that is built, managed and monitored for you by our in-house experts. You might do this to get access to a diversified portfolio of different ETFs. |

| What's available | 11,000 international shares |

2500 international ETFs | A bespoke portfolio of stocks and ETFs, tailored to your individual risk appetite. |

| Learn more | Learn more | Learn more |

Get a risk-free online trading account

One of the best ways to learn more about online trading is to open a risk-free demo account with us.

Our demo accounts simulate the live market environment found in our award-winning trading platform,1 giving you access to over 15,000 markets, including:

- Shares

- ETFs

- Indices

- Commodities

- Forex

Trading in a virtual market will allow you to explore, experiment and learn with confidence. Our demo accounts come with a pre-set balance of £10,000 in virtual funds. By recreating the dynamics of ‘real’ trading, you get the opportunity to see how our products and financial markets work – all without putting any capital at risk.

You’ll be able to easily toggle between your practice spread bet and CFD accounts to see which instrument is better suited to your preferences. Even experienced traders can use demo accounts to test new strategies, tools or ideas, safe in the knowledge that your experiments won’t result in any real-world losses.

We don’t offer a practice account for share dealing, but a live account can be opened for no minimum deposit.

Explore the markets you can trade online

Our online trading platform offers low spreads, exclusive opportunities to trade 24/7, out-of-hours trading on 70+ leading US shares, and gives you access to over 15,000 popular local and international markets.2

Below, you can see what markets you can trade – and whether you’ll be able to go long or short – using our spread bets and CFDs. You’ll also be able to view the same info for our share dealing offerings.

Our markets include:

- Shares

- ETFs

- Indices

- Commodities

- Currencies

- Bonds and interest rates

Shares like those of Lloyds, Apple and Tesla are a popular security to trade. As a representation of a unit of ownership in a company, shares appreciate or depreciate in value – ie in price – in step with supply and demand, often linked to a company’s performance. If market demand for a stock increases due to strong earnings, the share price will increase, and vice versa.

When trading with us, you have access to over 11,000 shares, including those of leading UK, US and international companies. Trading shares via spread bets and CFDs enjoys certain tax benefits over investment.3

For investors, we also offer over 11,000 UK and international shares from which to choose via our share dealing platform.

An exchange traded fund (ETF) tracks the overall performance of an index, economic sector or individual market. They work by either actually purchasing the basket of assets they’re tracking or by using sophisticated investment strategies to mimic the movement of the underlying market.

You can trade over 2500 international ETFs using spread bets and CFDs, including stock index ETFs, currency ETFs, sector ETFs (like energy, agriculture and healthcare) and market ETFs (like gold and commodities).

You can also invest in over 2900 leading ETFs through our share dealing platform.

An index like the FTSE 100 or S&P 500 measures the performance of a selection of the market’s most influential stocks. Indices are traded via derivatives, because there is no underlying asset to own. Similar to ETFs, indices can also track the performance of economic subsectors and individual markets.

We provide over 80 indices to trade, including more 24-hour indices than any other provider.2, 4 We’re also the only UK provider to offer spread bets and CFDs giving traders access to weekend trading on key indices.

A commodity can be defined as a raw material used in the production of goods or services. By means of spread bets and CFDs, you can speculate on the price of commodities like gold, silver, oil, wheat and sugar without ever taking delivery of a physical product.

Use spot prices, futures, options contracts, shares and ETFs to access 35 commodities. Additionally, keep your costs down with spreads from just 2.8 points on Brent Crude and 0.3 on gold.

Foreign exchange, or forex, is the world’s most-traded financial market – in fact, currency transactions worth trillions of dollars occur daily. Whereas some people exchange currency for trade and travel, forex trading is often undertaken with the aim of earning a profit.

Our forex markets offer 24-hour trading, high liquidity and a wide range of major, minor, exotic and regional pairs. You can trade forex by using spread bets and CFDs to access the spot, futures or options markets.

Use spread bets and CFDs to capitalise on the inverse relationship between bond prices and long-term interest rates with our selection of government bond futures markets. Because our contracts are off-exchange, you can deal in fractions of contracts. Our bond markets are particularly useful for hedging against the interest-rate risk incurred by assets you already own.

If, however, you’re looking to invest, we also offer bond ETFs which track government and corporate bonds.

Alternatively, take a position on the short-term (quarterly) direction of a range of global interest rates. Interest-rate spread bets and CFDs can be used to hedge against other investments affected by interest rates, such as mortgage repayments.

Get into the daily habits of a trader

In addition to using our demo account to learn more about financial markets and derivatives, ongoing and thorough research is fundamental to intelligent trading. Good trading strategies rely on understanding market dynamics and the correct interpretation of market signals – skills which can only be acquired by making use of reliable educational content – like IG Academy.

Read reliable and trustworthy sources

Like most things in life worth attaining, a bit of effort is required when trying to come to grips with the details of financial markets and financial instruments.

Learning new terms and understanding the logic underpinning their place in the world of trading and investing won’t happen overnight – so it’s important to set time aside to read, read and read some more.

While we offer a wealth of resources, including strategy and news articles, a handy glossary of trading terms, and a full educational series in the form of IG Academy, you can also look to respected industry sources for help and information. Here are some of our recommendations for experienced and beginner traders alike:

Watch and listen to content produced by knowledgeable experts

Of course, reading isn’t the only way to access quality information. Many financial experts understand the pressures of time, and have produced accessible podcasts and video content to supplement the literature available on the web. Do be careful about who you use as a trusted source, however: the internet is awash with opinions, ‘hot’ tips and – let’s face it – patently incorrect info.

For multimedia content, we recommend:

- IG Trading the Markets (Podcast)

- IG TV (available in the platform)

- IG Webinars

- Yale University Poorvu Centre for Teaching and Learning. Course: Financial Markets available on iTunes and YouTube

- MIT Sloan School of Management OpenCourseWare. Course: Finance Theory

Learn more about fundamental and technical analyses

Fundamental and technical analyses are two different ways of interpreting and forecasting markets. Traders rarely rely exclusively on one or the other, and neither can forecast market movements with absolute precision or infallibility.

Fundamental analysis

Fundamental analysis looks to a range of factors to arrive at an estimation of a share’s true or ‘intrinsic value’. This value is what the analyst believes the price of a share should be. If this price deviates from the current market price, a profit stands to be made should the market move towards this ‘true’ value.

Fundamental analysis will look to macroeconomic factors, sector performance indicators and industry news, along with information gleaned from publicly available income statements and balance sheets, to arrive at a stock valuation.

If this valuation is, for example, under the current market price – it is argued – the market price will adjust over time so that the stock is correctly valued. In this case, an astute trader could short the stock and earn a profit from the price decrease.

Technical analysis

Technical analysis adopts the point of view that markets show discernible patterns, and that these patterns can be used to predict future movements. It will look to historical data and employ a wide variety of statistical techniques to identify these patterns and forecast market trends.

Analysts using technical indicators like Bollinger Bands, the relative strength index (RSI) and the moving average convergence divergence (MACD) believe that vital market information is contained within these indicators.

Learn more about trading styles and trading strategies

What is a trading style?

Your trading style is dependent on your holding period, trading volume and risk preferences. The holding period can be for the long, medium and short term, and simply refers to the duration between opening and closing a position.

Your preferred trading volume is determined by the time you can allocate to executing trades. And, the amount of capital you risk per trade, along with the risk profile of the share or market, will also be a factor in defining your trading style.

| Trading style | Timeframe | Holding period | Trading volume | Further resources |

|---|---|---|---|---|

| Position trading | Long term | Weeks, months or years | Low | Learn more |

| Swing trading | Medium term | Days to weeks | Medium | Learn more |

| Day trading | Short term | Intraday | High | Learn more |

| Scalping | Very short term | Seconds to minutes | Very high | Learn more |

What is a trading strategy?

Closely related to trading styles, trading strategies are defined by the range of factors you look to when deciding whether to open or close a position. Many well-known strategies rely on technical analysis and use technical indicators as trading signals. A strategy is a very specific methodology for defining at which price points you will enter and exit trades.

| Trading strategy | Core characteristics | Further resources |

|---|---|---|

| Trend trading | Used for medium and long-term positions. Attempts to identify market trends (rising or falling) and adopts long or short positions. Good for position and swing trading styles. | Learn more |

| Range trading | Used for short and very short-term positions. Traders look to trade on price oscillations that occur within a range between known ‘support’ and ‘resistance’ levels. Good for day and scalping trading. | Learn more |

| Breakout trading | Used for short and medium term positions. Prices ‘breaking out’ of a normal range of fluctuations are used as signals to open positions. Good for day and swing trading. | Learn more |

| Reversal trading | Can last varying amounts of time. Based on identifying reversal points in current up or downward trends. A reversal marks a key turning point in market sentiment. Good for position and swing trading. | Learn more |

Spend a day in the life of a trader

To further your knowledge about best practices, learn how professionals approach their daily trading routine. This will offer insight into research habits, trading styles and trading strategies, general market behaviour and even personal philosophies.

Here’s a brief summary of a few key points to consider:

- Even before markets open, traders plan their day to ensure that they remain disciplined and emotionally unreactive when trading. Remaining detached allows for decisions based on solid economic rationale rather than unfounded optimism or fear. In turn, this prevents risky, impulsive or overly cautious behaviour

- Early trading – when stock markets open – is often characterised by volatility and liquidity. This is because the market opening gives investors the opportunity to act on information and news coming from international and overnight markets. Many traders use the early market as an indicator of the market sentiment to be expected later in the day

- After markets close, professionals will assess their trades and recap the day’s market behaviour. They do this to gain insight into prevailing market sentiment, volatility and liquidity, but also to review their own trades. By analysing each decision and its consequences, a trader can refine and hone their skills

- Out-of-market hours events, either occurring locally or internationally, could have profound impacts on markets when they re-open. Traders must have an awareness of market-related news at all hours

- Traders may engage in night trading to access international markets, and even work Saturdays and Sundays to gain exposure to weekend markets. Opportunities could arise at any moment, and professionals need to be agile and responsive

Practise online trading until you’re ready to open a live account

Use our demo to continue practising until you feel confident enough to engage in actual trades on our award-winning platform.1 Because the demo simulates the live environment, you’ll be familiar with the platform when you create your live account.

Note that while we don’t offer a practice account for share dealing, your live account can be opened for no minimum deposit.

FAQs

What is online trading?

Online trading is a popular way to gain exposure to the world’s leading financial markets through derivatives like spread bets and CFDs. When trading online, you’ll speculate exclusively on the price movements of an underlying asset without ever taking ownership.

This is because derivative instruments are designed to track the price of the asset on which they are based, and you can trade both rising and falling markets by ‘going long’ or ‘going short’.

What’s the difference between trading and investing?

When trading, you never take ownership of the underlying asset. Instead, you’re using derivatives like spread bets or CFDs to speculate on the underlying asset’s price movements. By using a derivative, you can profit off both rising and falling markets if your forecast about price movements is correct.

When you trade with spread bets or CFDs, you’ll be opening your positions with leverage – which grants you full market exposure for an initial deposit. While this can help to bring down your initial outlay, it can also act to amplify both your profits and your losses – so it’s important to take steps to manage your risk.

When investing, you actually buy and own the asset itself. In the case of shares, this means you’re entitled to dividends and enjoy voting rights (if applicable). However, it also means that you can only profit off price movements if you can sell the asset for more than you paid for it. So, when investing, you can only profit off rising markets.

Investing is non-leveraged, meaning you’ll need to commit the full value of the position upfront. While this can increase your initial cost, it also caps your maximum risk at what you paid to open your position. But remember that investments can rise or fall in value, and you may get back less than you initially invested.

How can I learn to trade online?

Financial markets are complex, so it takes time and effort to learn how to start trading and ultimately trade online effectively. We offer several high-quality educational resources to help you better understand the dynamics of online trading and the many risks involved.

For example, IG Academy is designed to provide traders of all levels of experience with accessible and accurate information about how financial markets work and how to trade using spread bets and CFDs.

Can I practise online trading?

Yes, you can practise trading online by signing up for a demo account. Our demo accounts simulate the live market environment found in our award-winning trading platform, giving you access to over 15,000 markets, including:

- Shares

- ETFs

- Indices

- Commodities

- Forex

Our demo accounts come with £10,000 in virtual funds, which will allow you to experiment and learn with confidence. Without putting any actual capital at risk, you can recreate the dynamics of ‘real’ trading.

How can I learn more about the ways to trade online?

You can learn more about how to trade online using spread bets and CFDs by using our website as a resource. This can be done by working through the many informative pages addressing the various must-knows of spread betting and CFD trading.

Resources for spread betting:

- What is spread betting and how does it work?

- How to spread bet

- Benefits of spread betting

- Spread betting vs share dealing

Resources for CFDs:

How can I learn more about the markets to trade online?

You can learn more about the markets to trade online by using our website as a resource. This can be done by working through the many informative pages addressing the various must-knows of the financial markets we’ve made available to traders. Read more about:

Try these next

Start trading over 70 US markets out of hours

Learn how to get exposure to IPOs and grey markets

Take a position on over 11,000 shares and ETFs

1 As awarded at the ADVFN International Financial Awards 2020 and Professional Trader Awards 2019

2 24/7 excludes the hours from 10pm Friday to 8am Saturday (UK time), and 20 minutes just before the weekday market opens on Sunday night

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK. When trading CFDs, you don’t have to pay stamp duty, but you will be liable for capital gains tax (CGT). When you spread bet, you don’t incur stamp duty and any profits are exempt from capital gains tax.

4 We offer 81 indices markets for CFD trading, and 69 indices markets for spread betting