UK sees the biggest drop in house prices in 14 years

The Nationwide House Index has seen prices fall by 5.3% year-over-year in August, the biggest drop since 2009.

It also fell more than expected in August, month-on-month, down 0.8%, against expectations of a 0.3% fall. It all adds up to signs that interest rate hikes are clearly talking their toll on the property sector.

(Video Transcript)

UK house prices

We've seen the biggest drop in UK house prices in 14 years according to the August report out on the Nationwide House Price Index. Let's take a look at the numbers as we saw them break this morning. In terms of the month-to-month moves, it was a 0.8% decline. We've been looking for 0.3% fall. Year-on-year though, down 5.3%. We've been looking for a drop of 3.9%.

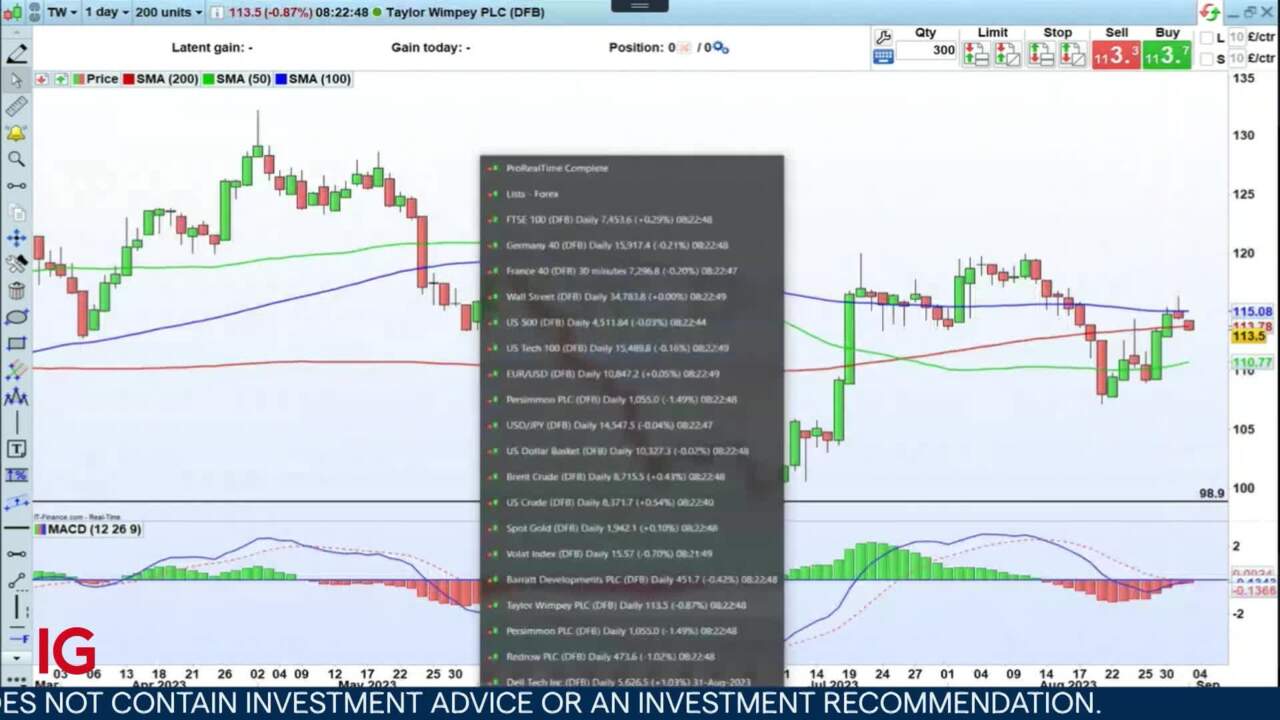

This represents a larger fall than what had been expected. A sign clearly that interest rates are taking their toll on the property sector overall. But the good news is, it hasn't really dented house prices that much in terms of share prices of those companies that actually build the products. Let's take a look at some of the charts.

Barrett Development

Barrett Development down for a second day, down by a margin today of 0.5% building on that small drop that we saw in yesterday's trade. Just a quick tour around some of the other big house builders. Taylor Wimpey, again, another one that's down for a second day in a row. Today it's down almost 0.9% of 1%. This is after 20 minutes of the session in today's trade.

Redville, another one on the way down. Persimmon, every single house builder has been affected. In fact, Persimmon over the longer term has been more affected than most on the downside. Going back to what's been happening with the likes of Barrett Developments. In fact, I think you can see here that we've been picking up a little bit recently.

Bank of England

The outlook is still very clouded, very tough. We don't know when the Bank of England is going to finish raising interest rates. It's looking like we could well get another quarter point coming through next time the Bank of England meets. Inflation is still high. That's the problem.

UK inflation

Inflation within the building sector is high, with building materials high. Inflation is high in terms of wages. With house prices dropping, it means that margins are shrinking for these big house builders.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.